5 Essential Tips for Setting Up an Excel Sheet for Buying a Car

Purchasing a car is a significant decision, involving both substantial financial commitment and the promise of convenience and pleasure. To ensure you make an informed choice without getting overwhelmed by numbers, setting up an Excel sheet can be your key to clarity. Here are five essential tips to structure your Excel sheet for buying a car, simplifying your decision-making process:

1. List Your Requirements and Priorities

Start with what you want:

- What type of car are you looking for? (Sedan, SUV, hatchback, etc.)

- Do you prefer new, certified pre-owned, or used cars?

- What are your must-have features (like sunroof, navigation, adaptive cruise control)?

- Are there any deal-breakers you want to avoid?

Using an Excel sheet, create columns for each priority:

| Feature | Must-Have | Desired | Not Necessary |

|---|---|---|---|

| Sunroof | X | ||

| Apple CarPlay | X |

By listing your priorities, you can quickly compare car models to see which aligns with your needs.

💡 Note: Use conditional formatting to highlight must-haves for quick reference.

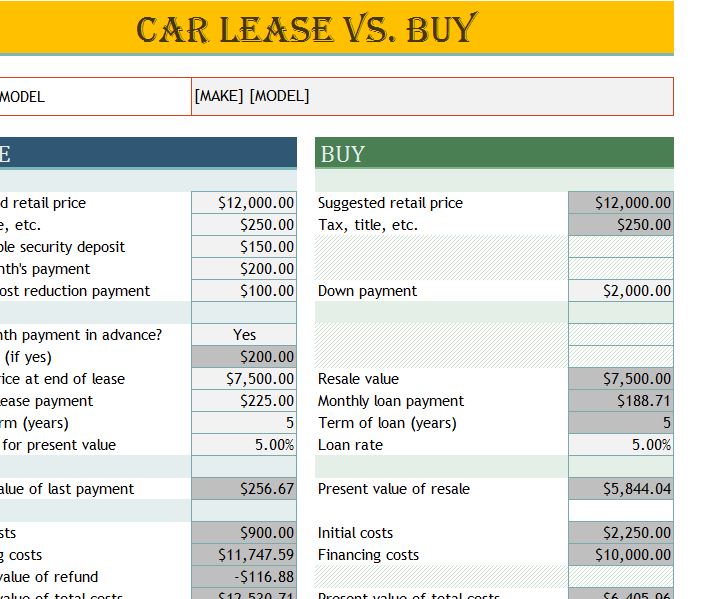

2. Organize Financial Considerations

Your budget is crucial when buying a car:

- Estimate your down payment, loan amount, interest rate, and loan term.

- Include rows for potential additional costs like tax, title, license fees, and insurance.

Here’s a suggested layout for your financial section:

| Description | Estimated Cost | Actual Cost |

|---|---|---|

| Car Purchase Price | 25,000</td><td>25,500 | |

| Down Payment | 5,000</td><td>5,000 | |

| Loan Amount | 20,000</td><td>20,500 | |

| Interest Rate | 4% | 4.25% |

Ensure your Excel sheet calculates the total cost of ownership, including monthly payments, insurance, and estimated maintenance over time.

💡 Note: Utilize Excel’s financial functions like PMT to calculate your monthly car payment.

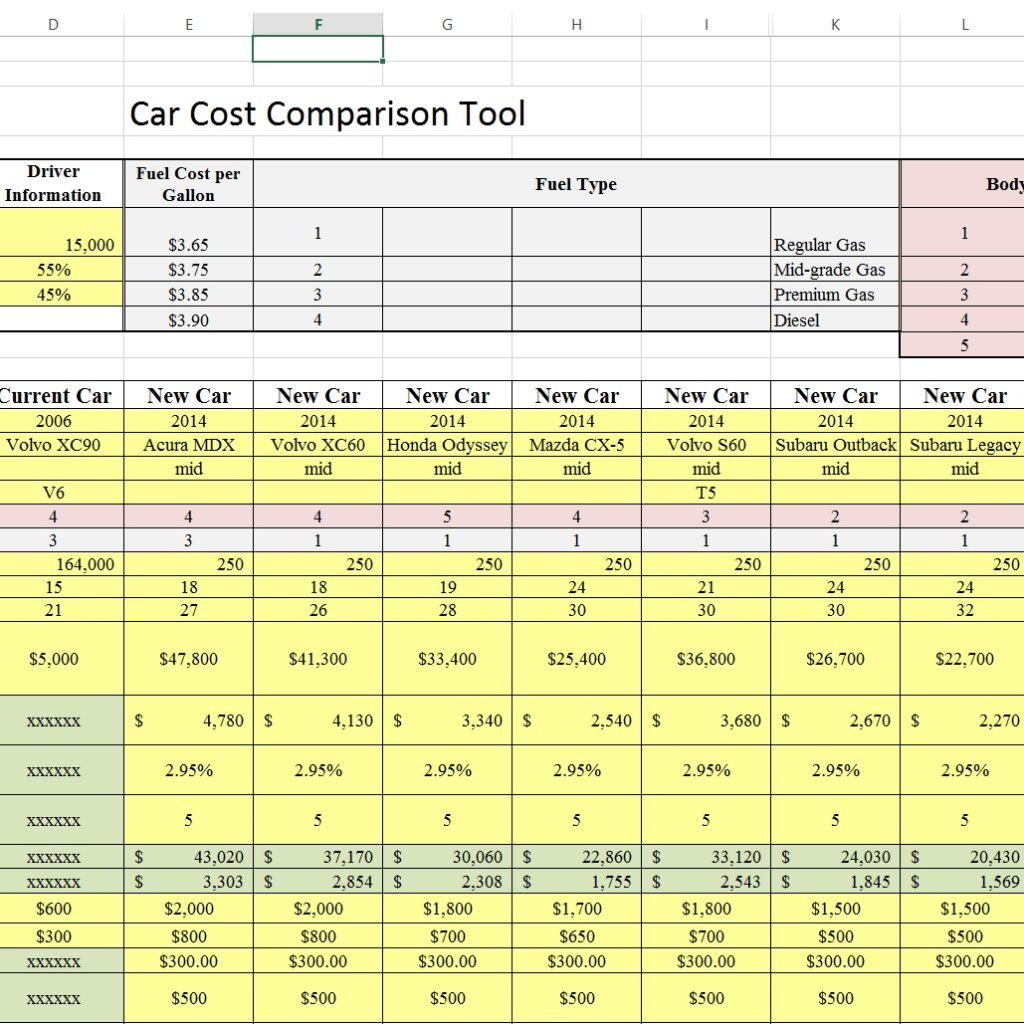

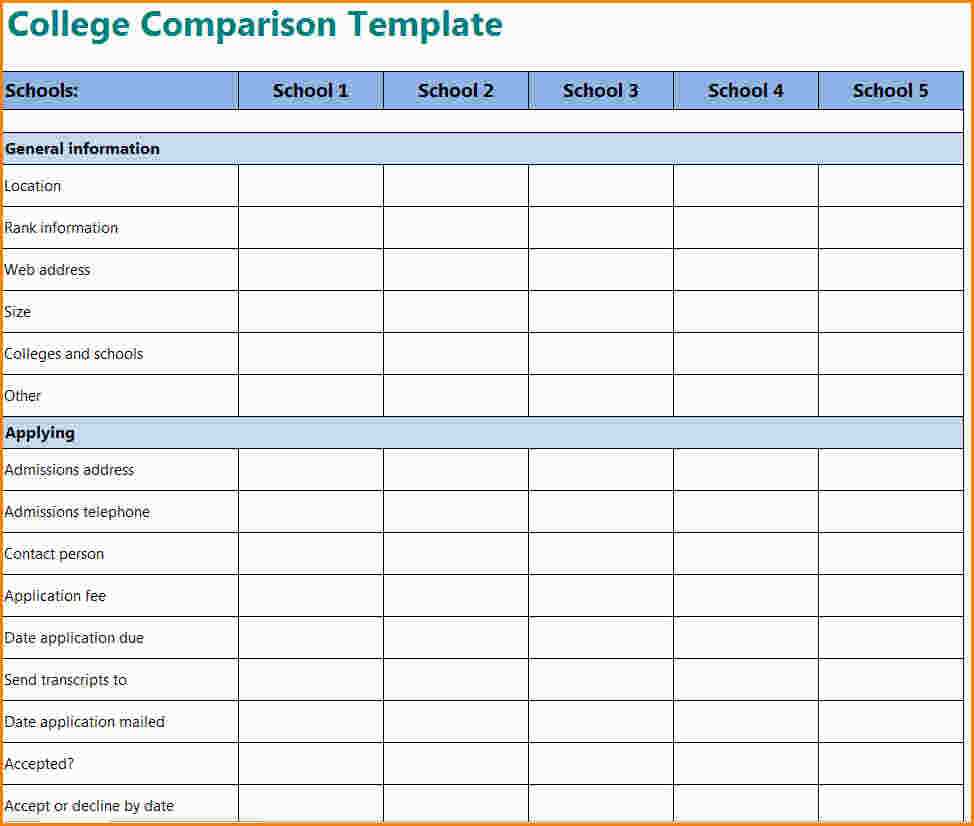

3. Comparative Analysis of Car Models

To make an informed decision, you need to compare cars:

- Create columns for make, model, year, features, price, safety ratings, and reviews.

- Use filters and sorting features to organize and compare the data.

Set up your comparative analysis sheet as follows:

| Make | Model | Year | Price | Fuel Efficiency (mpg) | Reliability Rating |

|---|---|---|---|---|---|

| Honda | Civic | 2023 | 22,000</td><td>32</td><td>8.5</td></tr> <tr><td>Toyota</td><td>Corolla</td><td>2023</td><td>21,500 | 33 | 8.6 |

This comparative approach lets you weigh pros and cons quickly, tailoring your choice to what truly matters to you.

💡 Note: Look for online tools or databases to autofill some car details directly into your Excel sheet.

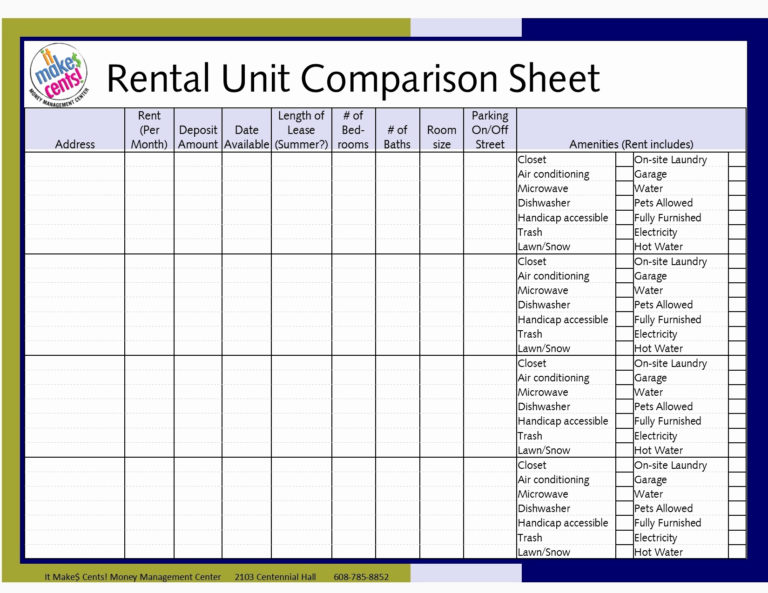

4. Track Test Drives and Dealer Visits

Visiting dealerships and test driving cars is a crucial step:

- Record date, location, sales rep, notes on the driving experience, and your impressions.

- Consider adding columns for sales offers, incentives, and any additional value provided by the dealer.

Here’s how you might structure this part:

| Dealer Name | Date Visited | Car Model | Test Drive Notes | Offer |

|---|---|---|---|---|

| ABC Motors | 15/05/2023 | Honda Civic | Smooth ride, responsive steering | 21,800 with 0% financing</td></tr> <tr><td>XYZ Auto</td><td>17/05/2023</td><td>Toyota Corolla</td><td>Good handling, slightly noisy engine</td><td>21,000 + $1000 rebate |

Keeping track of these details helps in negotiating later and remembering your driving experiences.

5. Decision Making and Post-Purchase Planning

After all the data gathering, here’s how to wrap it up:

- Summarize pros and cons, maintenance costs, fuel efficiency, and total cost of ownership.

- Create a timeline for your purchase and post-purchase activities like insurance setup, registration, and warranty review.

Your decision-making section could look like:

| Car Model | Pros | Cons | Final Cost | Decision |

|---|---|---|---|---|

| Honda Civic | Better handling, safety ratings | Higher upfront cost | 25,500</td><td>Selected</td></tr> <tr><td>Toyota Corolla</td><td>Fuel efficiency, lower price</td><td>Engine noise</td><td>22,000 | Not selected |

Your Excel sheet is now a powerful decision-making tool, providing a comprehensive overview of your car buying journey.

In this detailed exploration, setting up an Excel sheet for buying a car transforms the complex task into a structured, data-driven process. By listing your requirements, organizing financial considerations, comparing car models, tracking test drives, and planning post-purchase activities, you turn potential overwhelm into an exercise of informed decision-making. As you input data, the car buying journey becomes transparent, allowing you to compare offers, negotiate with confidence, and choose the best vehicle tailored to your needs.

How often should I update my Excel sheet?

+

It’s beneficial to update your Excel sheet after each car review, test drive, or when new financing options are considered to reflect current market conditions and your evolving preferences.

Can I use Excel to estimate future car value?

+

Yes, by researching historical depreciation rates and applying them to your car models, you can estimate future value with formulas like the one for straight-line depreciation.

What should I do if my budget changes during the process?

+

Revise your Excel sheet to reflect your new budget. This might involve adjusting columns for down payment, loan terms, or even reconsidering the car models you are looking at.