5 Easy Steps to Create Your Excel Budget Sheet

The creation of a budget sheet in Excel is an incredibly useful exercise, whether for personal finance management or business accounting. Excel's powerful features make it a favored tool for organizing financial data, offering insights into spending patterns, savings, and financial planning. In this guide, we'll walk through five easy steps to help you set up your very own Excel budget sheet. This will equip you with the knowledge to track your finances, make informed financial decisions, and ultimately achieve your monetary goals.

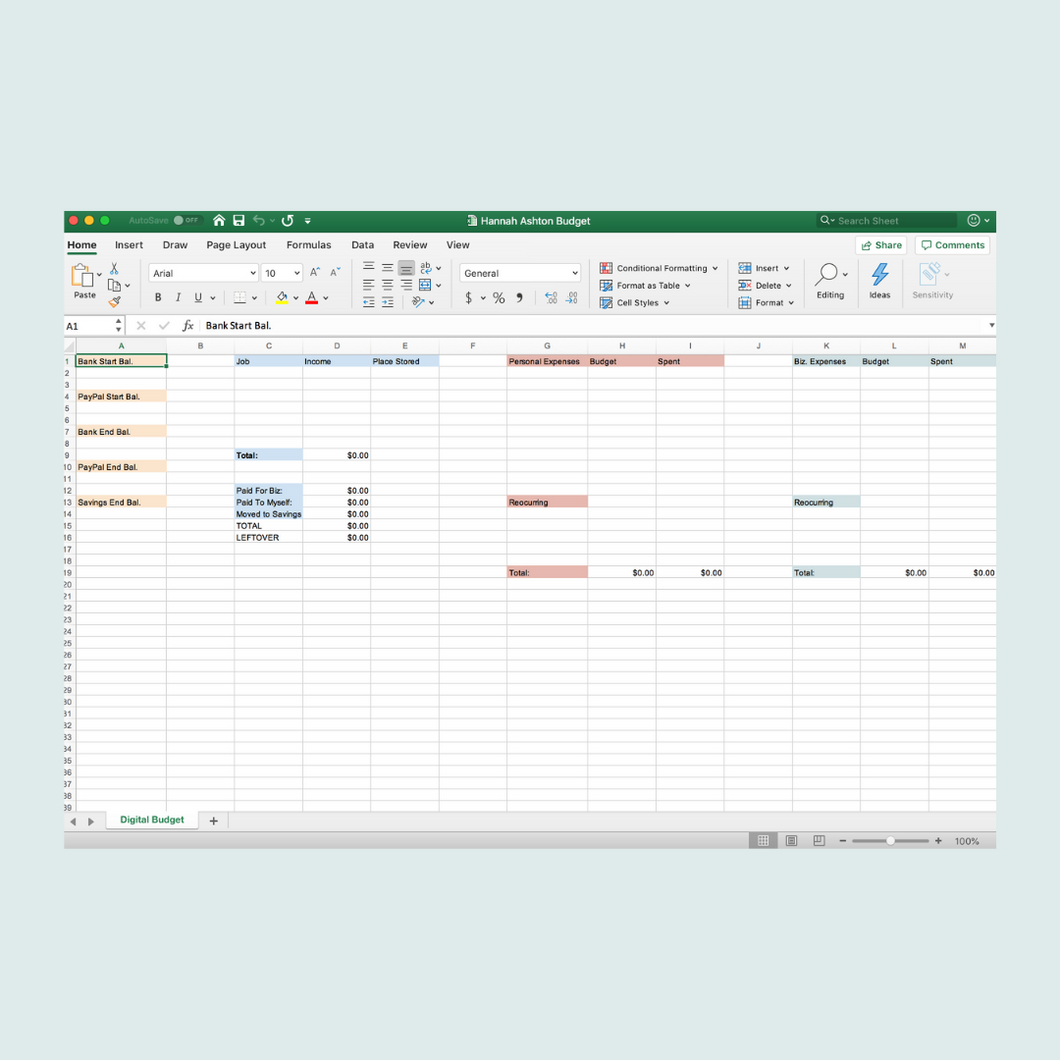

Step 1: Start with Excel’s Blank Workbook

To begin crafting your budget sheet, open Microsoft Excel. You’ll be greeted with a blank workbook by default, or you can choose a template if you’d prefer a pre-formatted structure. Here’s how to do it:

- Launch Excel from your computer’s applications menu.

- Opt for a blank workbook to start from scratch or explore templates for budgeting by selecting “File” > “New” and searching for “Budget.”

Step 2: Structure Your Budget Sheet

A well-organized budget sheet should include headers and sections to cover all financial aspects. Here’s what you should include:

- Header: Include your name or the name of the entity, date, and perhaps a title like “Monthly Budget” or “Annual Expenses.”

- Columns: Generally, you’ll need columns for:

- Category (e.g., Income, Housing, Utilities)

- Projected/Planned Amount

- Actual Amount

- Difference (Actual - Planned)

- Rows: List out your sources of income and expenses as separate rows.

Step 3: Enter Your Financial Data

Now that your budget sheet is structured, it’s time to populate it with data:

- Enter all sources of income under the Income category, like salary, freelance income, investments, etc.

- List all potential expenses under their respective categories. These might include rent/mortgage, groceries, utilities, transportation, entertainment, and savings.

- Fill in the Projected or Planned Amount for each category based on past data or expected changes.

💡 Note: Accuracy in this step is crucial. Use realistic figures to ensure your budget will reflect your actual financial situation.

Step 4: Apply Formulas for Automatic Calculations

Excel’s real power comes from its ability to perform automatic calculations. Here’s how to set up your formulas:

- For the Difference column, enter a formula like

=C2-D2if C is your Actual Amount column and D is your Planned Amount column. This will calculate the variance automatically. - At the bottom of your columns, sum up each category with the

=SUM()function, e.g.,=SUM(C2:C15)for the total actual income. - Create totals for Income and Expenses, and then calculate your Net Balance, which is your total Income minus total Expenses.

Step 5: Formatting and Analyzing Your Budget Sheet

With your data and formulas in place, now enhance readability and functionality:

- Format your headers and cells for better visual separation (bold, center, color).

- Use conditional formatting to highlight variances or areas of concern (e.g., red for negative differences).

- Create graphs or charts for visual representation. Pie charts are excellent for expense breakdown.

📊 Note: Regularly reviewing these charts can help identify trends and areas where adjustments might be needed.

Creating an Excel budget sheet isn't just about inputting numbers; it's about gaining control over your financial health. This tool empowers you to make informed decisions, understand where your money goes, and adjust your financial habits accordingly. Remember, the key to successful budgeting is consistency and accuracy. Regular updates to your sheet will provide the most current and useful financial insights, helping you to align your spending with your goals, prevent overspending, and save more effectively. Use the steps outlined here as your roadmap to fiscal freedom, and always keep in mind that your budget sheet can, and should, evolve as your financial situation changes.

Can I use an Excel budget sheet on a mobile device?

+

Yes, Excel provides apps for iOS and Android devices that allow you to view, edit, and create spreadsheets. You can sync your budget sheet via OneDrive for real-time updates across devices.

What should I do if I’m consistently going over budget in a certain category?

+

Review your spending patterns within that category. Look for discretionary expenses that you might be able to cut back on, or consider if there are cheaper alternatives. Also, adjusting your budget expectations or finding ways to increase income in that category could be beneficial.

How often should I update my budget sheet?

+

It’s best to update your budget sheet at least monthly. However, for those with variable income or expenses, weekly updates might be more suitable to keep track of cash flow and ensure timely financial decisions.