Master Excel Balance Sheets: Step-by-Step Setup Guide

Mastering Excel for financial modeling and tracking is essential for anyone in the finance or accounting sector, small business owners, or individuals keen on managing their finances. This post will guide you through the process of setting up a balance sheet in Excel, offering a step-by-step approach that ensures accuracy and efficiency.

The Importance of a Balance Sheet

Before diving into the technical setup, let's consider why balance sheets are indispensable:

- They provide a snapshot of a company's financial health at a specific point in time.

- Balance sheets show assets, liabilities, and shareholders' equity, illustrating how resources are financed.

- They are crucial for stakeholders to make informed decisions regarding investment, loans, and operational adjustments.

Excel Setup Preparations

To begin, ensure you have the following:

- Microsoft Excel (any version)

- Basic understanding of Excel's interface

Now, let's prepare the Excel environment:

- Open Excel and create a new workbook.

- Name your workbook appropriately, e.g., "Company Balance Sheet 2023"

- Adjust the spreadsheet to be larger by resizing columns A and B, and rows 1 to 5.

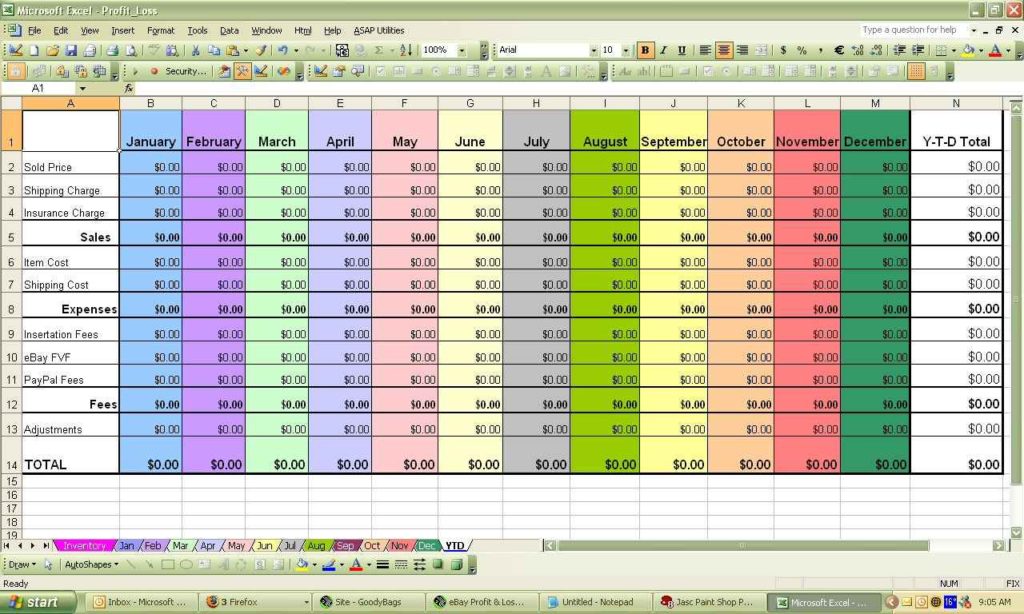

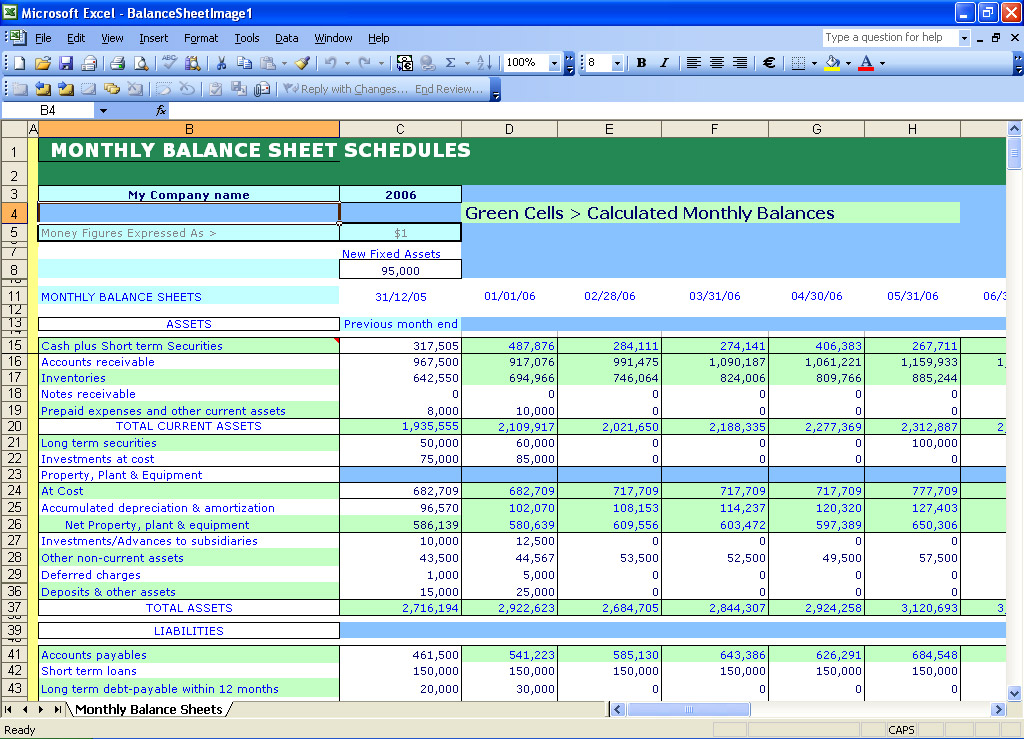

Step-by-Step Excel Setup

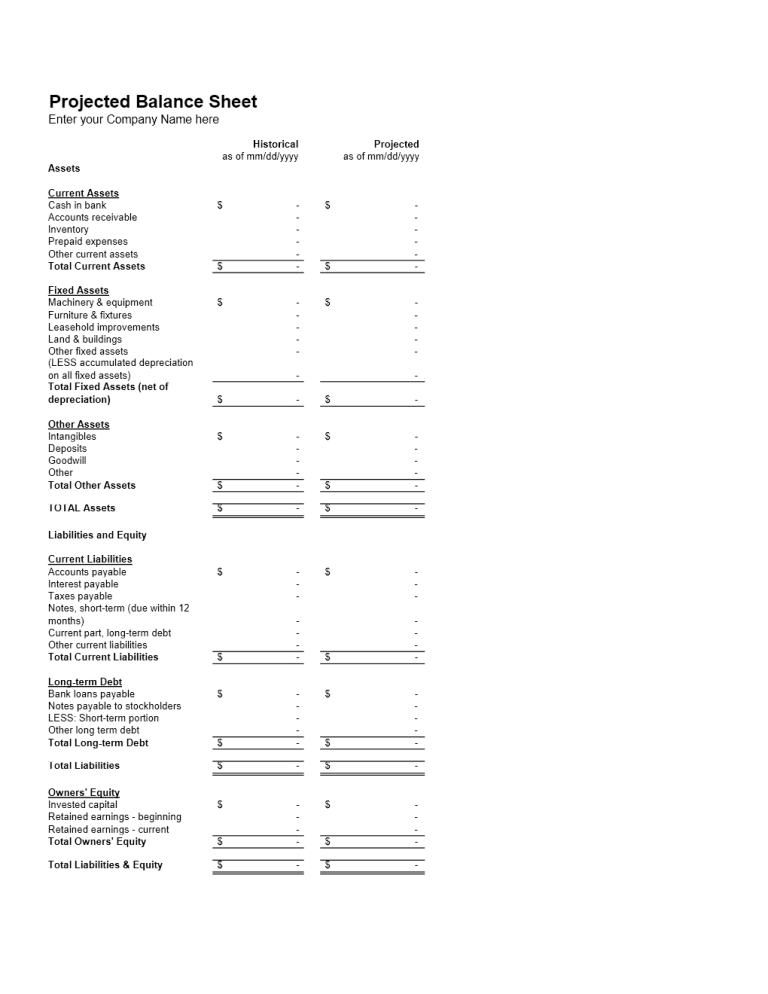

Sheet 1: Structuring the Balance Sheet

Here's how to set up the primary balance sheet:

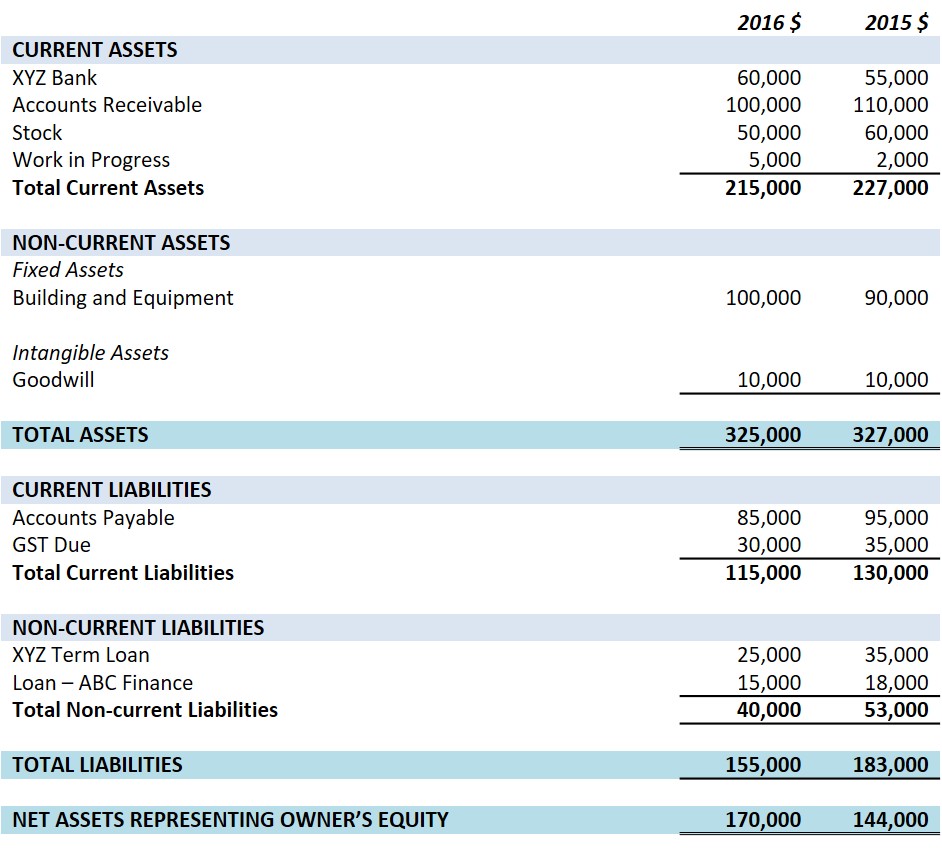

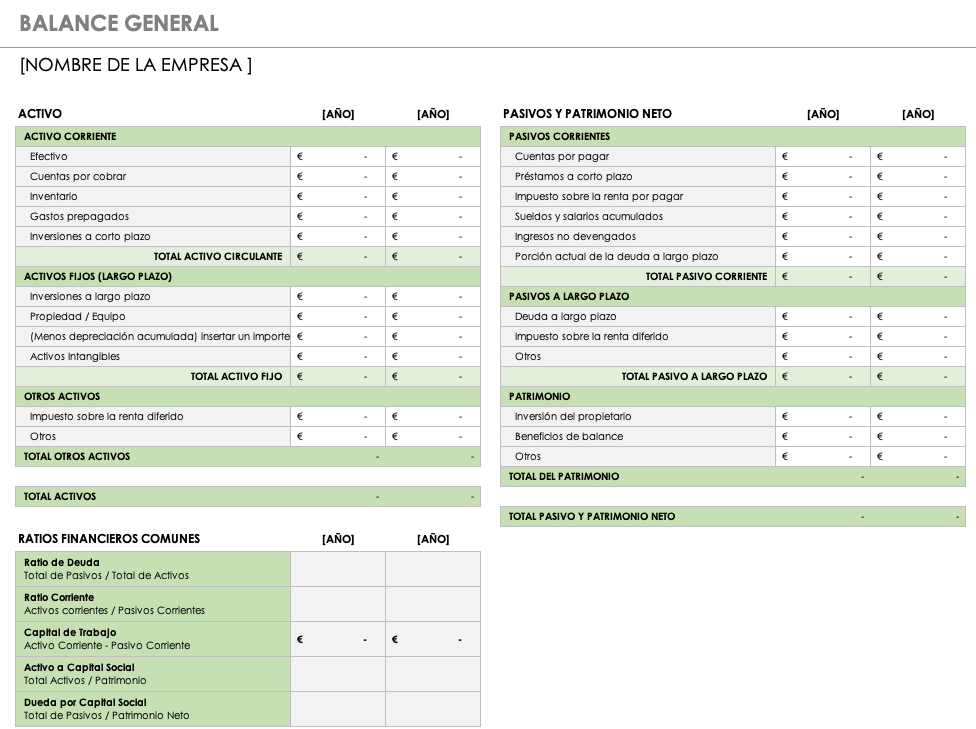

- Create three main sections on your sheet: Assets, Liabilities, and Equity.

- Set up rows for each category:

| Section | Categories |

|---|---|

| Assets | Current Assets, Non-Current Assets |

| Liabilities | Current Liabilities, Long-term Liabilities |

| Equity | Capital Stock, Retained Earnings |

Step-by-Step Entry:

- In cell A1, enter "Company Balance Sheet."

- In A2, type the date of the balance sheet.

- In A3, enter "Assets." Below, add subheadings for Current Assets and Non-Current Assets.

- Format the headers and totals with bold text and maybe even colors to distinguish sections.

Current Assets

Below "Current Assets," enter typical items like:

- Cash

- Accounts Receivable

- Inventory

- Etc.

💡 Note: Ensure that all figures are entered in the appropriate currency unit.

Non-Current Assets

Below “Non-Current Assets,” list items such as:

- Property, Plant, and Equipment (PPE)

- Intangible Assets

- Long-term Investments

Liabilities

Under “Liabilities,” detail the following:

- Accounts Payable

- Short-term Debt

- Long-term Debt

Equity

Lastly, in the “Equity” section, include:

- Capital Stock

- Retained Earnings

Automatic Calculations

Use Excel’s formula capabilities to automate calculations:

- Sum each section using the

SUM()function. - Ensure the total Assets = Total Liabilities + Total Equity. Use the formula:

=D2+D3where D2 is the sum of assets and D3 is the sum of liabilities and equity.

💡 Note: Excel formulas can change cell references if rows are inserted or deleted, so take care when modifying the sheet.

Review and Error-Checking

After setting up your balance sheet:

- Check for calculation errors.

- Validate data entry against source documents.

- Ensure formatting is consistent throughout for clarity and readability.

Having an accurate and visually appealing balance sheet in Excel can significantly streamline your financial reporting process. By following this guide, you've not only learned to set up a balance sheet from scratch but also gained insights into its importance in financial management. Now, armed with these skills, you can confidently present your company's financial status with precision and clarity.

What is the difference between an income statement and a balance sheet?

+

An income statement shows a company’s financial performance over a specific period, detailing revenues, expenses, and net income. A balance sheet, on the other hand, provides a snapshot of a company’s financial position at a specific moment, showing assets, liabilities, and equity.

Can I use this Excel balance sheet template for personal finance?

+

Yes, while the template is designed for businesses, you can adapt it for personal use by including personal assets (like savings, investments) and personal liabilities (like mortgages, loans).

How often should I update the balance sheet?

+

For businesses, updating quarterly or annually is common. However, for real-time financial tracking or for personal finance, monthly updates can be more beneficial.

Are there any legal requirements for a balance sheet?

+

Legal requirements vary by jurisdiction and the business’s legal structure, but for public companies, it’s often required to report balance sheets quarterly or annually.

What should I do if my balance sheet doesn’t balance?

+

Ensure all entries are correct, re-check calculations, and look for any missed items or errors in data entry. If the issue persists, consider having an external audit or seeking financial advice.