5 Ways to Create a Balance Sheet in Excel

Creating a balance sheet in Excel can significantly enhance your ability to manage finances, whether you're a small business owner, a financial manager, or just managing your household budget. Excel, known for its robust calculation and data management capabilities, provides several methods to produce an effective balance sheet that reflects your financial position. Here are five distinct ways to create a balance sheet in Excel, each tailored to different levels of detail and user expertise:

1. Manual Entry and Calculation

This is the most straightforward method for those who prefer a hands-on approach:

- Open Excel: Start by launching Microsoft Excel and creating a new workbook.

- Label the Sheet: Rename 'Sheet1' to something like 'Balance Sheet' for clarity.

- Set Up Headers: In the first row, enter headers such as 'Assets', 'Liabilities', 'Equity'.

- Add Categories: Under each header, list specific categories like 'Cash', 'Accounts Receivable', 'Inventory' for assets, and 'Accounts Payable', 'Loans' for liabilities.

- Input Data: Manually enter the current balances for each category.

- Total Columns: Use Excel functions like

=SUM(B3:B10)to total each category. - Calculate Equity: Equity is calculated as Assets minus Liabilities. Use a formula like

=B12-C12where B12 is total assets and C12 is total liabilities. - Formatting: Enhance readability by applying cell borders, using bold text for headers, and adjusting cell colors.

⚠️ Note: This method requires meticulous entry and might be time-consuming if there are frequent updates.

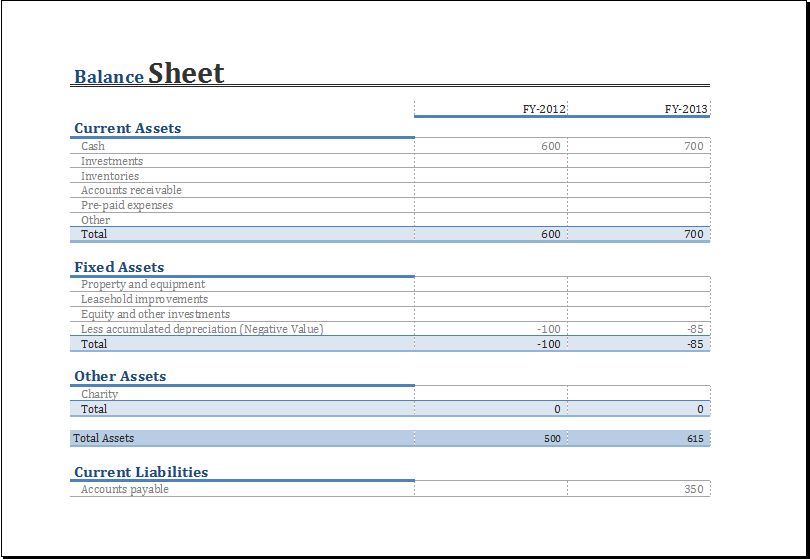

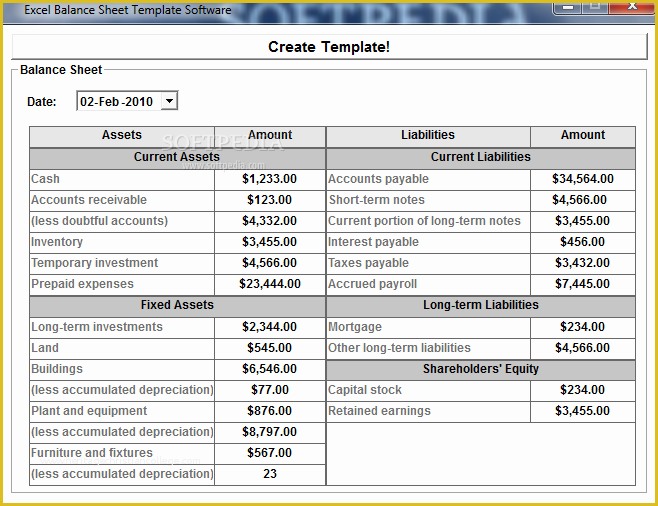

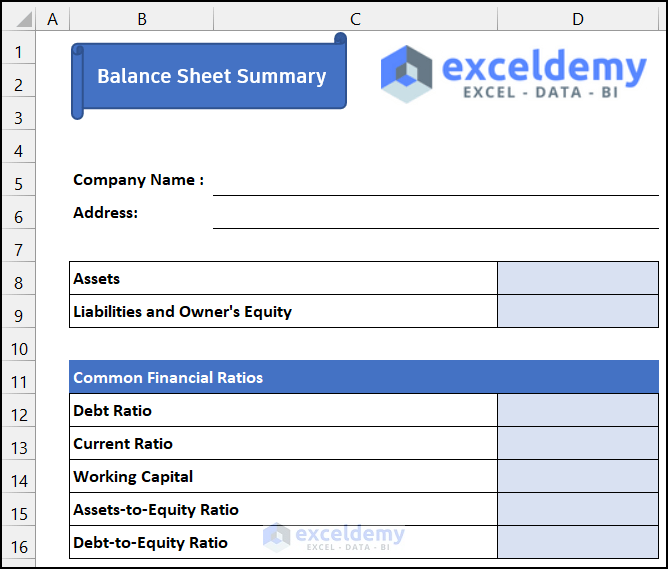

2. Using a Pre-Designed Template

Excel offers templates that can save time and ensure consistency:

- Access Templates: Go to 'File > New' and search for 'Balance Sheet'. Microsoft provides free templates you can download and customize.

- Download and Open: Click on a suitable template to download and open it in Excel.

- Input Your Data: Fill in the template with your financial data. The templates often come with pre-built formulas, so your main task is to input values accurately.

- Customize: Adjust colors, fonts, or add business information to make it your own.

Excel templates can be particularly useful for ensuring compliance with accounting standards.

3. Leveraging Excel's Advanced Features

For those familiar with Excel's more complex functions:

- Pivot Tables: Import your accounting data into Excel, then use PivotTables to summarize data into assets, liabilities, and equity categories. This provides a dynamic way to view and modify your balance sheet.

- Macro Scripts: If you frequently update balance sheets, VBA (Visual Basic for Applications) can automate repetitive tasks. Write a script to format the sheet or pull data from different sources.

- Linked Sheets: Link balance sheet data from other financial statements (like Income Statement) using formulas or external data connections.

This approach requires a deeper understanding of Excel but allows for powerful data manipulation and presentation.

4. External Data Integration

Integrate data from financial software or databases directly into Excel:

- Power Query: Use Power Query to connect to various data sources like SQL databases, cloud storage, or even web data. You can then transform and load this data into your balance sheet.

- ODBC Connections: Set up an ODBC (Open Database Connectivity) connection if you have enterprise-level financial software to pull data directly into Excel.

- Data Consolidation: If you manage multiple companies or projects, use Excel's consolidate feature to gather financial data from different workbooks or sheets.

Integration with external systems ensures real-time accuracy in your balance sheet, especially when dealing with large volumes of data or multiple entities.

5. Collaborative Balance Sheet Creation

Excel Online or OneDrive for Business provides real-time collaboration:

- Share the Workbook: Upload your balance sheet to OneDrive and share it with your team, granting editing permissions.

- Concurrent Editing: Team members can work on the sheet simultaneously, with changes reflected instantly.

- Cloud Integration: Use cloud services to store data from different sources, allowing for seamless updates across the organization.

Collaboration tools in Excel enable shared responsibility and real-time data accuracy, crucial for dynamic business environments.

Wrapping up, your method of creating a balance sheet in Excel depends greatly on your specific needs, your proficiency with Excel, and how interconnected your financial data systems are. Whether you choose to manually enter data, use templates, leverage Excel's advanced features, integrate with external data sources, or collaborate online, the key is to find a balance between functionality, ease of use, and accuracy. Remember, a well-structured balance sheet not only provides a snapshot of your financial health but also helps in decision-making and strategic planning.

Can I create a balance sheet with Excel without any accounting knowledge?

+

Yes, you can use pre-designed templates which include the basic structure of a balance sheet. However, understanding financial terms like assets, liabilities, and equity will greatly enhance the accuracy and usefulness of your balance sheet.

How do I ensure my balance sheet is compliant with accounting standards?

+

Using templates that conform to accounting standards, double-checking calculations, and possibly consulting with an accountant or using accounting software that integrates with Excel can help ensure compliance.

What are the benefits of integrating external data into my Excel balance sheet?

+

Integration allows for real-time updates, reduces manual entry errors, provides consistency in data across different financial reports, and supports scalability and detailed analysis.