5 Easy Steps to Create a Provisional Balance Sheet in Excel

The balance sheet, one of the fundamental financial statements, provides a snapshot of a company's financial health by detailing its assets, liabilities, and equity at a specific point in time. For small businesses, startups, or those managing their finances without an accounting background, creating a provisional balance sheet in Excel can be an empowering step towards better financial management. Here's how you can easily set up a provisional balance sheet, along with tips for ensuring accuracy and efficiency.

Step 1: Understand the Components

Before diving into Excel, it’s crucial to grasp what goes into a balance sheet:

- Assets: Everything the company owns that has value, including cash, inventory, accounts receivable, and property.

- Liabilities: Obligations or debts the company owes, like accounts payable, loans, and taxes.

- Equity: Ownership interest in the company, which includes invested capital by owners and retained earnings.

Step 2: Set Up Your Excel Spreadsheet

Here’s how to organize your Excel workbook:

| Section | Column Headers |

|---|---|

| Assets | Account Name, Current Value |

| Liabilities | Account Name, Current Value |

| Equity | Account Name, Current Value |

| Total | Total Assets, Total Liabilities, Total Equity |

⚠️ Note: Keep your data organized to prevent errors in calculations.

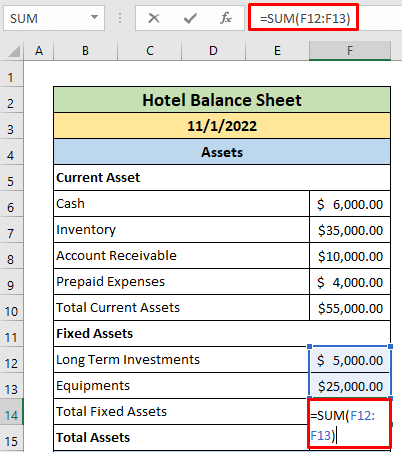

Step 3: Enter Your Financial Data

Start entering your financial data:

- List all assets in the assets section, ensuring to categorize them as current or non-current assets.

- Enter liabilities similarly, separating them into current and long-term liabilities.

- For equity, include owner’s investment, retained earnings, and any other applicable equity categories.

Step 4: Use Formulas for Calculations

Excel’s formulas can automate the math involved in your balance sheet:

- Use SUM formulas to calculate totals for each section. For example, to sum up all current assets, you could use “=SUM(A2:A10)”.

- Ensure the balance sheet balances by confirming that Assets = Liabilities + Equity. You can achieve this by subtracting Total Liabilities from Total Assets with a formula like “=B13-B14”.

Step 5: Format for Clarity and Professionalism

Finalize your provisional balance sheet:

- Use conditional formatting to highlight cells that might require attention, like negative values or high balances.

- Apply consistent styles for headings, subtotals, and main totals to enhance readability.

- Add a date to your balance sheet to reflect the financial position at a specific time.

Creating a balance sheet in Excel not only helps you understand your company’s financial standing but also prepares you for potential audits, banking relations, and strategic planning. By following these steps, you equip yourself with a valuable tool to manage and analyze your financial health effectively.

In closing, a well-prepared provisional balance sheet in Excel serves as a critical component for financial decision-making. Remember, this is a snapshot, and regular updates will provide insights into trends and changes over time, aiding in strategic financial management.

Why is a balance sheet important for a business?

+

A balance sheet helps stakeholders understand the company’s financial health, assess its liquidity, leverage, and solvency, and make informed decisions regarding investments, loans, and operations.

What’s the difference between current and non-current assets?

+

Current assets are resources that can be converted into cash within one year (e.g., inventory, accounts receivable), while non-current assets are long-term investments or resources that are not easily liquidated (e.g., property, plant, and equipment).

How often should a provisional balance sheet be updated?

+

Updating can be done monthly, quarterly, or annually, depending on the business’s needs for financial reporting and management. Small businesses might update quarterly to align with tax filing.