Projected Balance Sheet: Easy Excel Guide

The projected balance sheet is a vital financial tool that offers a glimpse into a company's future financial health. When meticulously crafted, it serves as a cornerstone for financial planning and analysis, allowing businesses to forecast their financial position and make informed decisions. This guide explores the ins and outs of creating a projected balance sheet using Microsoft Excel, ensuring your projections are both accurate and insightful.

Understanding the Basics of a Projected Balance Sheet

Before diving into the mechanics of creating one in Excel, it’s important to understand what a projected balance sheet entails. It’s essentially a pro forma financial statement that projects the company’s financial position at a future date, based on assumptions about future business operations. This includes anticipated assets, liabilities, and equity.

Setting Up Your Excel Workbook

- Open a new Excel Workbook: Start with a clean slate, which allows for easy data entry and manipulation.

- Name Sheets Appropriately: For instance, label sheets as “Income Statement”, “Cash Flow Statement”, and “Balance Sheet” for clarity.

- Input Historical Data: If available, input last year’s balance sheet data to serve as a starting point for your projections.

Inputting Assumptions

To create a projection, assumptions must be made about future growth, revenue, expenses, and other financial variables:

- Revenue Growth: Estimate the annual percentage increase or decrease in sales.

- Expense Assumptions: Predict changes in cost of goods sold, operating expenses, and other costs.

- Asset Assumptions: Make educated guesses on the purchase or sale of fixed assets, depreciation, and changes in inventory.

- Liability and Equity Assumptions: Consider debt repayment schedules, new borrowings, or equity financing.

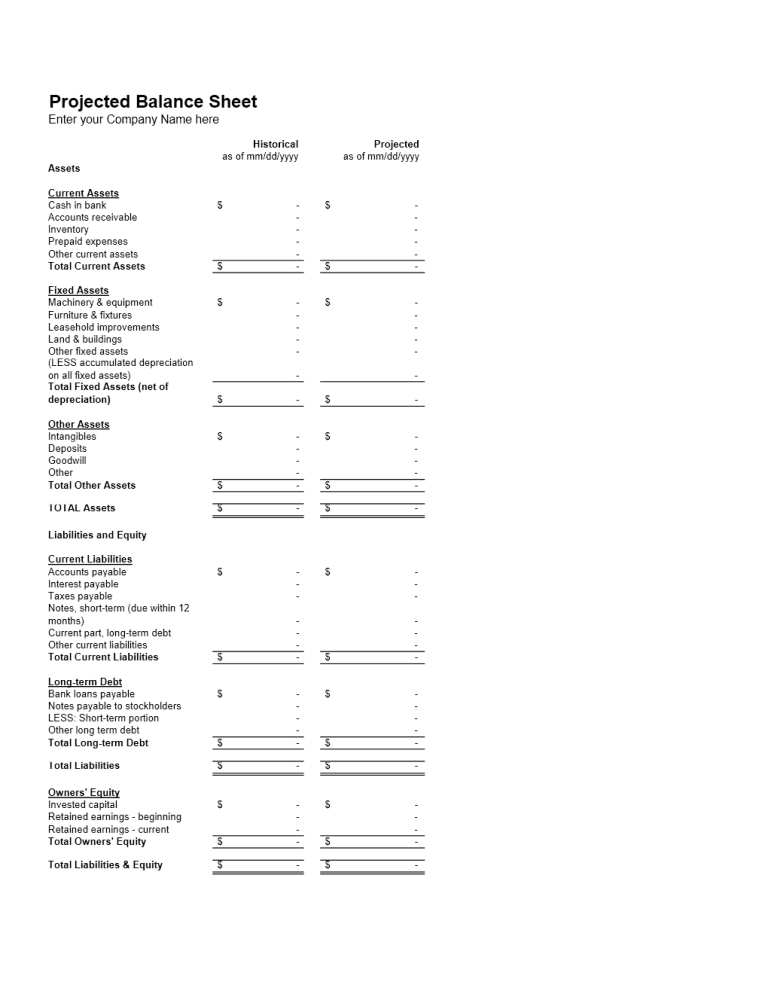

Constructing the Projected Balance Sheet

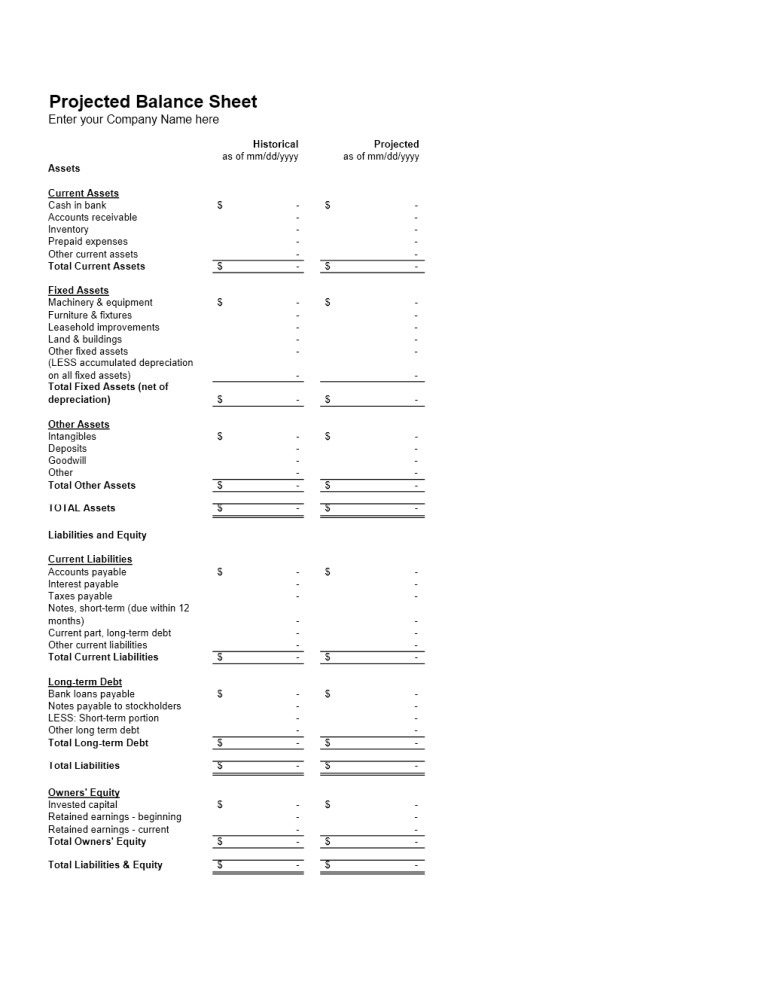

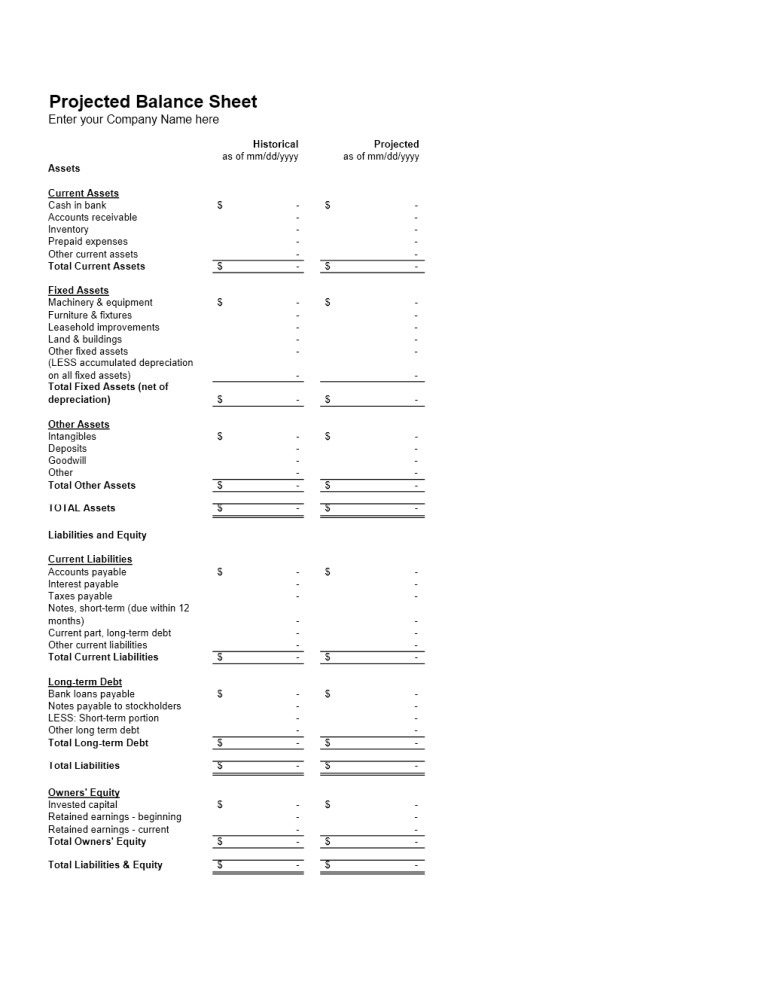

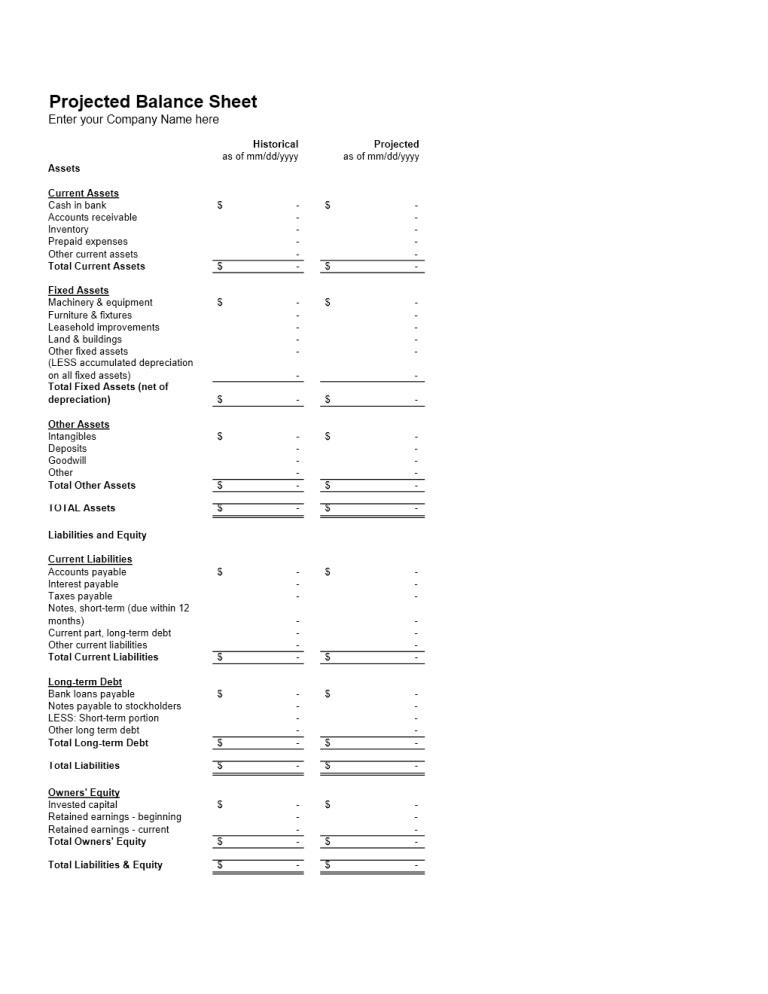

1. Assets

- Insert columns for each period you want to project (e.g., monthly, quarterly).

- Start with Current Assets, including cash, accounts receivable, inventory, and other short-term investments. For each asset, apply growth rates or assumptions to project future values.

- For Fixed Assets, apply depreciation schedules, and add new capital expenditures.

| Asset Type | Last Year's Value | Growth Rate | Projected Value |

|---|---|---|---|

| Cash | 100,000 | 10% | 110,000 |

| Accounts Receivable | 150,000 | 15% | 172,500 |

| Inventory | 200,000 | 8% | 216,000 |

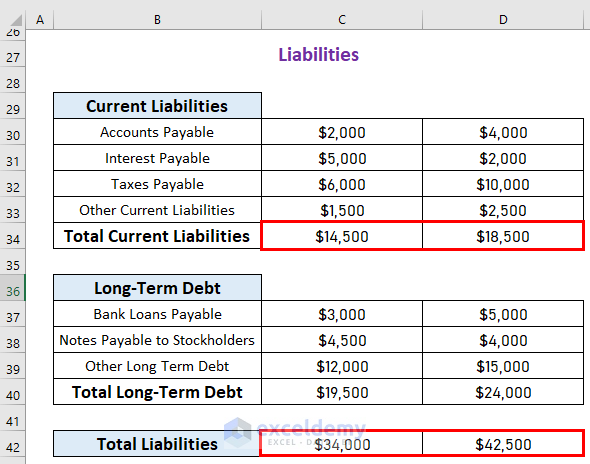

2. Liabilities and Equity

- Use historical data to determine current liabilities, such as accounts payable, short-term debt, and accrued expenses.

- For long-term liabilities, input principal repayments and interest expense projections.

- Equity projections might include retained earnings, common stock, and additional paid-in capital.

📝 Note: Ensure all inputs and calculations are thoroughly cross-checked for consistency and logic.

3. Balancing the Sheet

The sum of your assets must equal the sum of liabilities and equity at all times. If they do not, your projections might need adjustments:

- Check for errors in your formulas or data input.

- Adjust your assumptions or reconcile discrepancies.

- Ensure that changes in one part of the sheet logically affect the others.

Finalizing and Reviewing Your Projections

Once your projected balance sheet is complete:

- Perform a Sensitivity Analysis: Test your model by changing key assumptions to see how sensitive your projections are to changes.

- Peer Review: Have someone else review your work for potential errors or overlooked assumptions.

- Iterate: Refine your projections based on feedback and new data as it becomes available.

In summary, creating a projected balance sheet in Excel involves a meticulous blend of data entry, formula application, and logical thinking. This process not only helps in understanding your company's financial future but also aids in strategic decision-making. By following these steps and ensuring accuracy, your projections will serve as a valuable tool for financial planning.

What is the purpose of creating a projected balance sheet?

+

A projected balance sheet helps businesses forecast future financial conditions, aiding in strategic planning, budgeting, and investment decisions. It provides a snapshot of what the company’s financial position might look like at a future date based on current trends and assumptions.

How often should I update my projected balance sheet?

+

It is advisable to update your projected balance sheet at least quarterly or whenever there are significant changes in your business operations, financial structure, or economic conditions.

Can Excel handle all my financial projections?

+

Yes, Excel is versatile enough to handle basic to complex financial projections. However, for very large datasets or complex modeling, specialized financial software might offer additional functionality and robustness.