5 Essential Steps for Organizing Tax Paperwork

Dealing with taxes can be a daunting task, but getting your tax paperwork organized well in advance can significantly ease the process. This post will guide you through 5 Essential Steps for Organizing Tax Paperwork to ensure you are prepared for tax season, reducing stress and potential errors. Let's dive in!

Step 1: Gather All Relevant Documents

The first step in organizing your tax paperwork is to collect all necessary documents. Here’s what you’ll need:

- Income Statements: W-2s from your employer, 1099 forms for independent contractors, and any other income-related documents.

- Expenses: Receipts, invoices, and canceled checks related to business expenses, medical bills, or charity donations.

- Deductions: Mortgage interest statements, property tax bills, educational expenses, and receipts for energy-efficient home improvements.

- Retirement Contributions: Records of contributions to retirement accounts like 401(k)s, IRAs, or HSAs.

📅 Note: Keep an eye out for documents that might arrive later, like K-1s from partnerships or S-corporations.

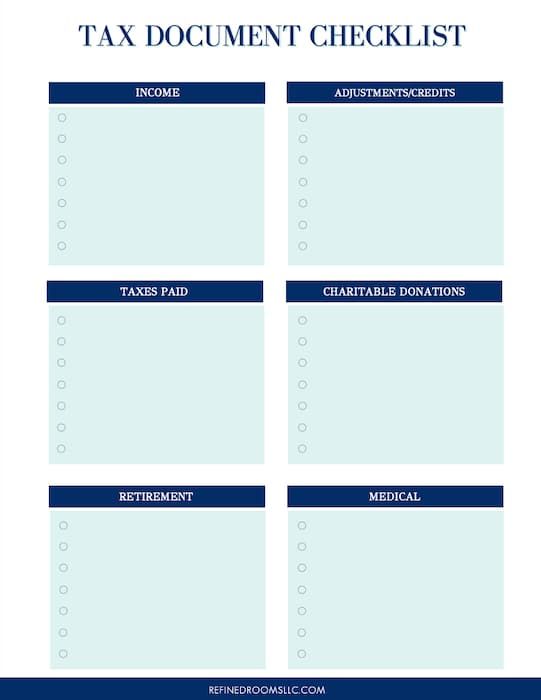

Step 2: Categorize Your Documents

After gathering your documents, categorize them for easy retrieval:

| Category | Examples |

|---|---|

| Income | W-2s, 1099s, Business Income |

| Expenses | Business Expenses, Medical, Charity |

| Deductions | Mortgage, Property Tax, Student Loan Interest |

| Retirement | 401(k), IRA, HSA contributions |

Label folders or digital files appropriately, and ensure that each document goes into its correct category.

Step 3: Digitize or Organize Physically

Whether you prefer digital or physical organization, here’s how to proceed:

- Digital: Scan or take photos of your documents, saving them in organized folders or using cloud storage solutions with tags for easy access.

- Physical: Use filing cabinets or accordion files, keeping each category in separate compartments. Make sure to backup digital copies for safety.

Step 4: Update and Verify Information

Take time to verify and update all your tax-related information:

- Check that all income numbers match what’s reported on W-2s or 1099s.

- Review expenses to ensure all deductions are legit and documented.

- Look for any changes in personal information or tax laws that could affect your return.

🧾 Note: Utilize tax software or a tax professional to help with this step, ensuring accuracy and compliance.

Step 5: Store Safely and Back Up

Once your documents are organized:

- Secure Storage: For physical documents, consider a safe or a secure file cabinet. For digital documents, use secure online storage solutions with strong password protection.

- Backup: Keep physical copies off-site or use cloud backup for digital files. This can be invaluable in case of emergencies like fires or theft.

By following these steps, you've set yourself up for a smoother tax season. Organizing your tax paperwork early allows you to review your financial situation, catch any discrepancies, and prepare for any potential audit or inquiry from the IRS. Remember, tax preparation is not just about compliance; it's about optimizing your tax situation, which requires good organization and timely action.

How long should I keep my tax records?

+

The IRS generally recommends keeping tax records for at least three years from the date you filed your return. However, keeping them for seven years is safer, especially if you claim any deductions or credits.

What if I lose some of my tax documents?

+

Request duplicates from issuers, or if you’ve been diligent with digital backups, recover them from there. For income documents, you can also contact the IRS for copies.

Can I file my taxes electronically?

+

Absolutely! Electronic filing is encouraged by the IRS for its accuracy, speed, and ease of processing refunds. Use reputable tax software or a tax professional for this.