Mastering Excel for P&L and Balance Sheets

Understanding the Importance of Excel in Financial Analysis

When it comes to financial management, Excel stands out as a vital tool for businesses across various industries. Its flexibility and powerful features make it indispensable for tasks like creating profit and loss (P&L) statements and balance sheets. These documents are critical for assessing a company's financial health, planning for the future, and communicating financial status to stakeholders.

Basic Excel Skills for Financial Analysis

Before delving into the specifics of P&L and balance sheets, let's establish some fundamental Excel skills:

- Cell Formatting: Formatting cells correctly for numbers, currency, and dates.

- Formulas: Understanding and using functions like SUM, AVERAGE, VLOOKUP, and IF statements.

- Data Validation: Ensuring data integrity through validation rules.

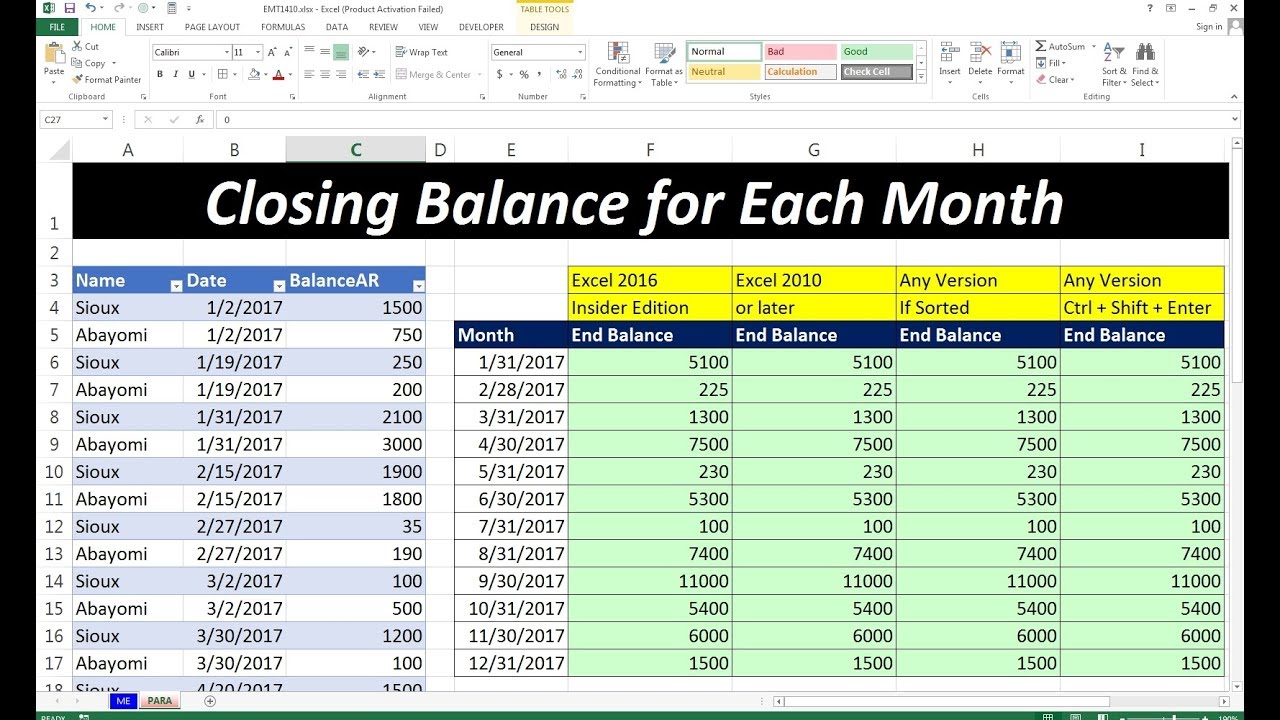

- Pivot Tables: Analyzing and summarizing large datasets.

- Charting: Visualizing data to highlight trends and anomalies.

Creating a P&L Statement in Excel

A profit and loss statement, often referred to as an income statement, provides insight into a company's revenue, expenses, and profits over a period of time. Here's how you can craft one using Excel:

Step 1: Set Up the Spreadsheet Layout

Start with a blank spreadsheet:

- Create headers for your P&L statement: Date, Revenue, Cost of Goods Sold (COGS), Gross Profit, Operating Expenses, Operating Profit, Interest, Taxes, and Net Profit.

- Format these headers using bold text and center alignment for readability.

- Add rows for individual entries and ensure you have columns for both the current and previous period if comparing.

Step 2: Input Data

Enter your financial data:

- Input actual figures for each category. For example, list all revenue streams under "Revenue."

- Ensure all expenses are categorized accurately. Use detailed subcategories if needed.

Step 3: Use Excel Formulas

Here’s how to automate your calculations:

- Calculate Gross Profit by subtracting COGS from Revenue.

- Sum up operating expenses for Operating Profit.

- Use formulas like `=SUM(Revenue Cell - Operating Expenses Cell)` for your Net Profit.

📝 Note: Regularly updating your P&L with real data ensures its accuracy for strategic planning and decision-making.

Step 4: Analyze with Charts and Visuals

Visualize trends with Excel charts:

- Insert a line chart to track revenue and expenses over time.

- Use pie or bar charts to compare different expense categories.

Creating a Balance Sheet in Excel

Unlike the P&L, which captures performance over time, a balance sheet provides a snapshot of a company's financial position at a specific point. Here's how to construct one:

Step 1: Layout

Set up your balance sheet with the following sections:

- Assets: Current Assets, Fixed Assets, Intangible Assets.

- Liabilities: Current Liabilities, Long-Term Liabilities.

- Equity: Owner's Equity, Retained Earnings.

Use similar formatting techniques as with the P&L for consistency.

Step 2: Input Data

Enter your financial data:

- Include values for cash, accounts receivable, inventory, and other assets.

- List liabilities like loans, accounts payable, and other obligations.

- Calculate equity using formulas like Total Assets minus Total Liabilities.

Step 3: Use Formulas for Calculations

Automate your balance sheet calculations:

- Sum up the total for each asset category with `=SUM(Asset Category Range)`.

- Calculate total liabilities in the same manner.

- Ensure that the accounting equation (Assets = Liabilities + Equity) balances.

Integrating P&L and Balance Sheets for Financial Health

The real power of Excel for financial analysis comes from integrating your P&L with your balance sheet:

Creating a Dashboard

Construct a dashboard:

- Use a summary table to consolidate key metrics from both documents.

- Employ pivot tables to dynamically change data views and analyses.

Data Validation and Quality

Ensure data accuracy:

- Set up data validation rules to restrict input types for each cell.

- Regularly check for errors using Excel’s error checking tool or formula auditing.

🔎 Note: Validating data prevents errors that could skew financial reports, ensuring stakeholders receive reliable information.

Wrapping Up

Excel's versatility in financial analysis cannot be overstated. From creating detailed P&L statements to building balance sheets, the software helps businesses track, analyze, and present financial information with efficiency and accuracy. By mastering these tools, finance professionals can not only streamline their workflow but also provide deeper insights into the company's financial trajectory, fostering informed decision-making for growth and sustainability.

Can Excel handle complex financial statements for large corporations?

+Yes, Excel can handle complex financial statements, though for very large datasets, tools like Power BI might be more efficient for data management and analysis.

What’s the difference between a P&L and a balance sheet?

+A P&L statement shows revenue, expenses, and net profit or loss over a period, while a balance sheet provides a snapshot of a company’s financial position at a specific point in time, detailing assets, liabilities, and equity.

How often should a balance sheet be updated?

+Balance sheets are typically updated at least quarterly, but businesses might opt for monthly updates for more granular analysis, especially during periods of significant financial activity.