5 Simple Steps to Craft a Company Balance Sheet in Excel

The balance sheet stands as a vital document for any business, presenting a clear view of its financial health at any given point in time. With Excel, businesses can construct balance sheets efficiently, ensuring accuracy and ease of updates. Here's a streamlined guide on how to craft a company balance sheet using Excel:

Step 1: Understanding the Basics

Before diving into Excel, it’s crucial to grasp what goes into a balance sheet:

- Assets: Items of value the company owns, like cash, inventory, property, equipment, and accounts receivable.

- Liabilities: Amounts owed by the company, including loans, accounts payable, and other obligations.

- Equity: Ownership interest in the business, calculated by the difference between assets and liabilities.

The equation is simple: Assets = Liabilities + Equity.

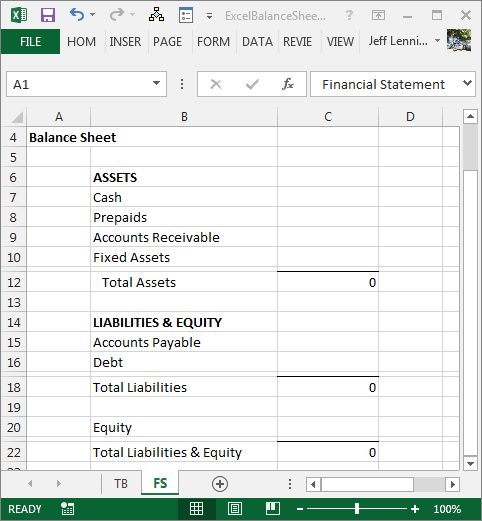

Step 2: Setting Up Your Excel Sheet

Open Excel and start with a blank workbook. Here's how to structure your sheet:

- Create three main sections by merging and centering cells over several columns for:

- Assets

- Liabilities

- Equity

- Under each section, list the respective accounts. For example:

- Assets: Cash, Accounts Receivable, Inventory, etc.

- Liabilities: Accounts Payable, Notes Payable, Accrued Expenses, etc.

- Equity: Owner's Equity, Retained Earnings, etc.

- Below each list, insert a cell for the total of each section.

Step 3: Entering Financial Data

Now, populate your balance sheet:

- Enter the figures for each asset, liability, and equity account.

- Sum the values using Excel functions like =SUM() to calculate totals for each section.

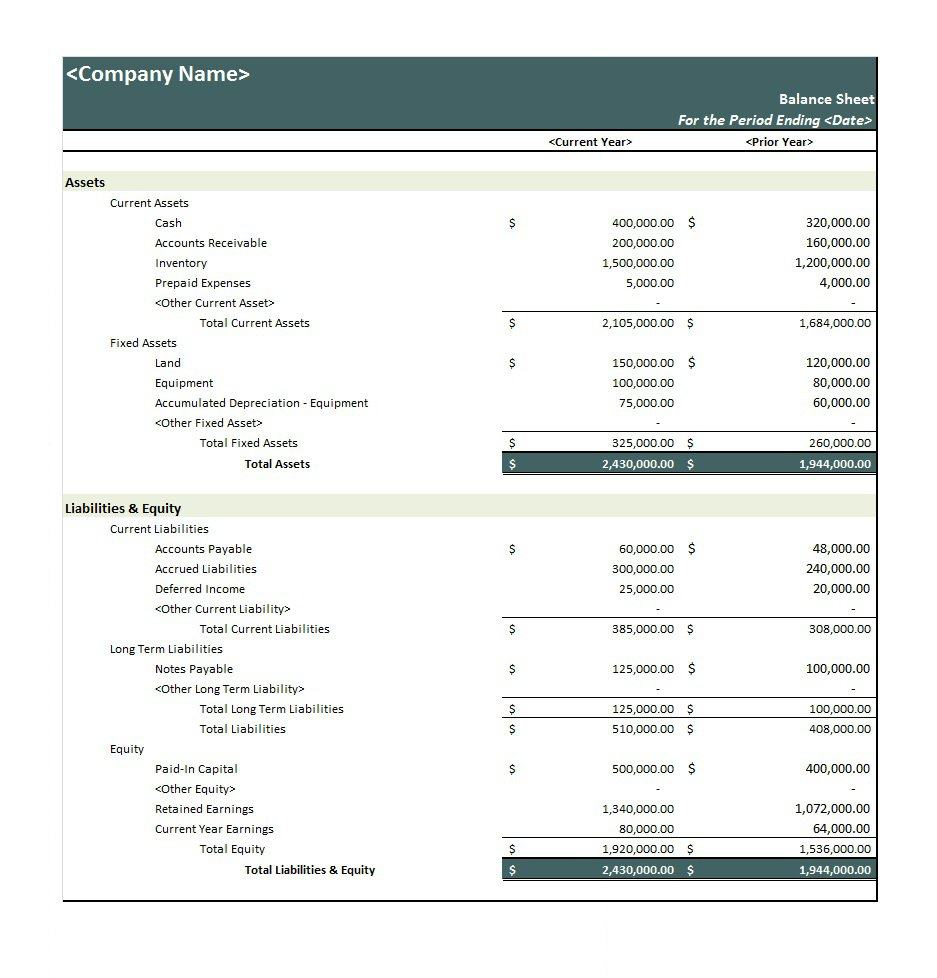

Step 4: Formatting for Clarity

To make your balance sheet readable:

- Use bold or color for section headers.

- Apply consistent number formatting (e.g., currency, no decimal points where applicable).

- Align text and figures appropriately for a neat look.

| Account | Value |

|---|---|

| Cash | $10,000 |

| Accounts Receivable | $5,000 |

| Inventory | $15,000 |

| Total Assets | $30,000 |

📝 Note: Ensure your balance sheet balances by verifying the Total Assets equals the sum of Total Liabilities and Equity.

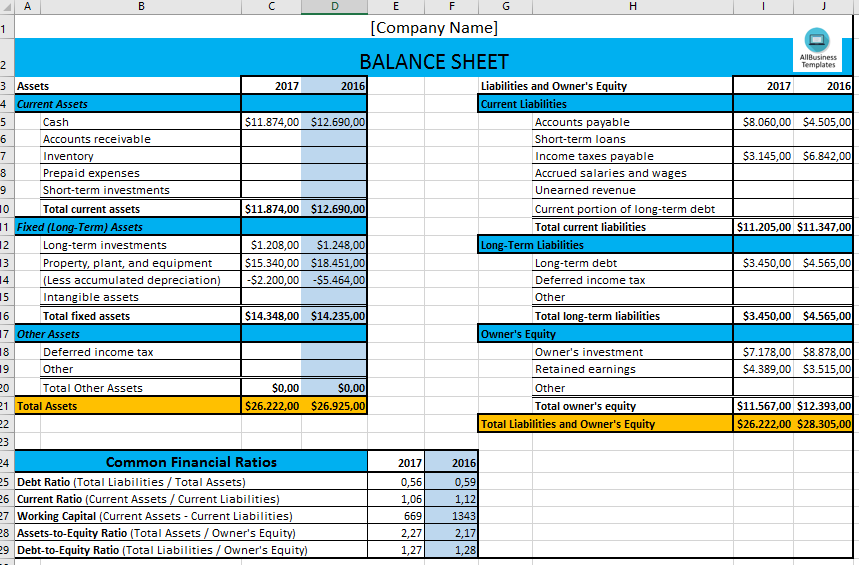

Step 5: Finalizing and Reviewing

With your data entered and formatted:

- Double-check for arithmetic errors and ensure that the balance equation holds true.

- Consider including notes or comments in Excel cells to explain unusual items or balances.

As you wrap up:

- Perform a thorough review for any discrepancies or areas that might need adjustments.

- Keep in mind that a balance sheet is not just a record; it's a tool for financial analysis, planning, and decision-making. Regular updates reflect the evolving financial state of your business, allowing for timely strategic actions.

Your crafted Excel balance sheet now serves as an insightful financial overview, highlighting the company's assets, liabilities, and equity with precision. This document becomes instrumental in tracking financial performance, aiding in strategic decisions, and fulfilling reporting requirements.

What are the main components of a balance sheet?

+

The primary components are assets (what the company owns), liabilities (what the company owes), and equity (the owner’s interest in the company).

How often should I update my balance sheet?

+

Regular updates, at least quarterly, are advisable to keep financial records current. Monthly updates can provide even better insights into the company’s financial health.

Can I use Excel for other financial statements?

+

Yes, Excel is a versatile tool for creating Income Statements, Cash Flow Statements, and more, thanks to its functionality for financial modeling and analysis.