5 Simple Steps to Create a Balance Sheet in Excel

Understanding financial health is paramount for both individuals and businesses. A balance sheet is a crucial financial statement that shows your assets, liabilities, and equity at a specific point in time. Excel, with its powerful features for calculations and data management, is an excellent tool to craft a clear and concise balance sheet. Here, we'll guide you through five straightforward steps to create your balance sheet using Excel, ensuring you grasp the essence of this financial snapshot. Whether you're a small business owner or an accountant, these steps will bolster your financial literacy and decision-making capabilities.

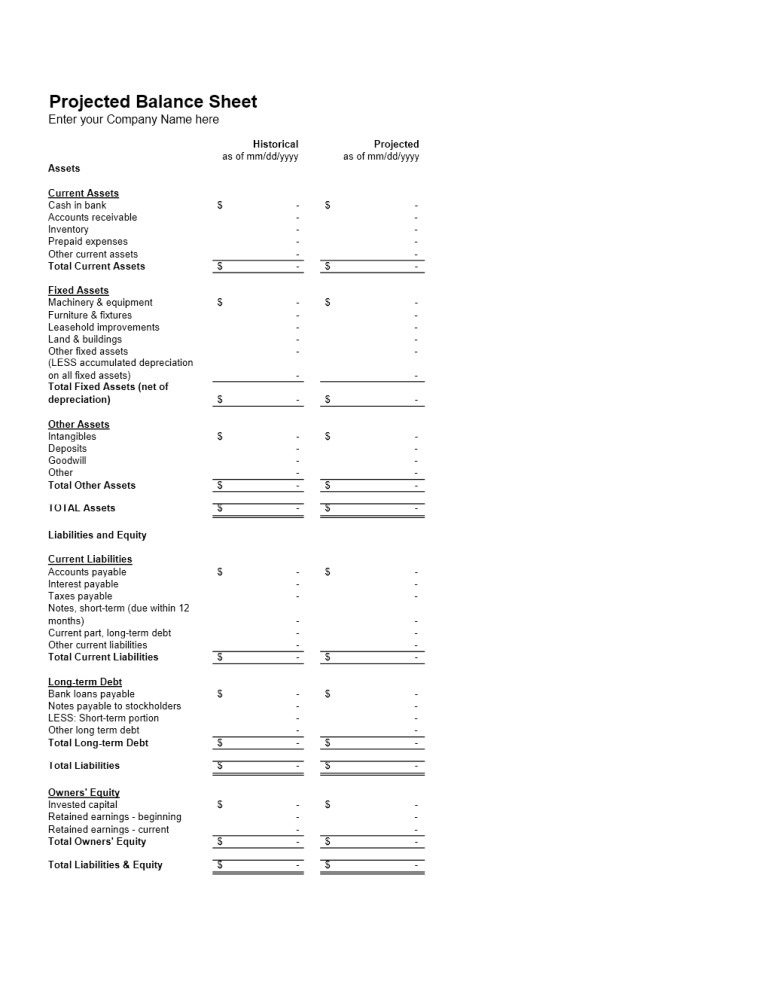

Step 1: Set Up Your Excel Sheet

Begin by opening Microsoft Excel and setting up your workbook for the balance sheet. Here’s how:

- Create a new spreadsheet or open an existing one.

- In the first row, type your business or personal name.

- Add a row for the date, so you can keep track of which balance sheet is which.

- Under the name, label columns as “Assets,” “Liabilities,” and “Equity.”

💡 Pro Tip: Freezing the top row can keep your headers visible as you scroll.

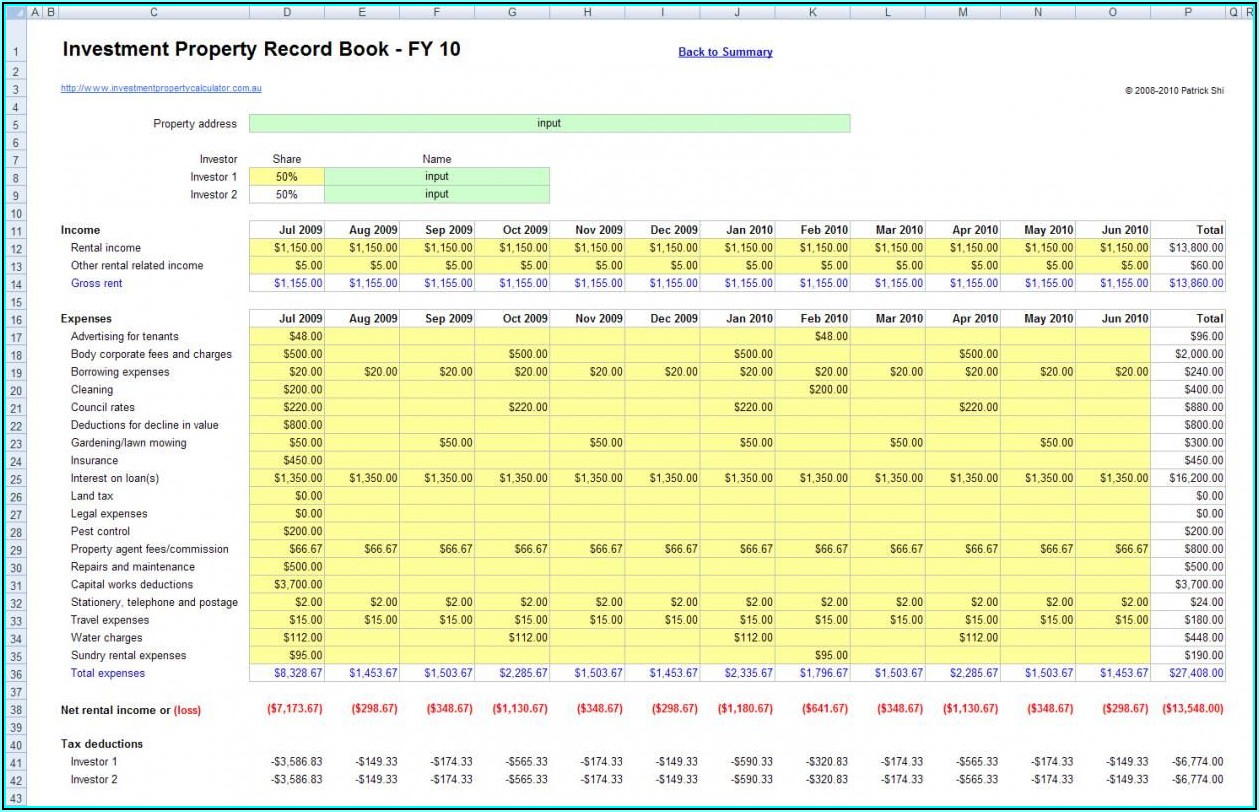

Step 2: List Your Assets

Assets are what you own or have control over. Here’s how to list them:

- Under the “Assets” column, list different categories like Cash, Accounts Receivable, Inventory, and Fixed Assets like Property or Equipment.

- Ensure each category has a row with subtotals for clarity.

- Create formulas to sum up each asset category and the total assets.

Note that assets can be tangible or intangible, so list them appropriately.

Step 3: Detail Your Liabilities

Liabilities are what you owe or what others have claims on. Follow these steps:

- Under the “Liabilities” column, categorize your debts, such as Short-Term Liabilities (e.g., Accounts Payable, Taxes), and Long-Term Liabilities (e.g., Loans, Mortgages).

- Calculate the subtotals for each liability type.

- Sum up all liabilities to find the total.

By understanding your liabilities, you can better manage your financial commitments.

Step 4: Calculate Owner’s Equity

The balance sheet must balance, hence Owner’s Equity is your formula:

- In the “Equity” column, you’ll only need one or two rows.

- The calculation for Equity is Total Assets - Total Liabilities.

- Write this formula in Excel to ensure the sheet balances.

💡 Note: Always double-check your calculations to ensure the balance sheet equals zero.

Step 5: Format and Finalize

Excel isn’t just about numbers; presentation matters. Here’s how to enhance your balance sheet:

- Adjust cell borders, colors, and fonts for readability.

- Use conditional formatting to highlight important figures or potential issues.

- Add a footer or a cell to note the creator and date.

Formatting your balance sheet not only makes it look professional but also aids in quick analysis.

By following these steps, you'll have created a functional balance sheet in Excel. Remember that a balance sheet provides a snapshot of your financial health at a specific point, so keep updating it regularly. Understanding your assets, liabilities, and equity will empower you to make informed financial decisions.

Why is it important to create a balance sheet?

+

Creating a balance sheet allows you to understand your financial position at a given point in time, providing insights into your liquidity, solvency, and financial stability. It is crucial for financial planning, decision-making, and reporting.

Can I use formulas in Excel for dynamic updates?

+

Absolutely. By using formulas, your balance sheet can automatically update when you change asset or liability values, making it easier to manage your finances.

What happens if my balance sheet doesn’t balance?

+

If your balance sheet doesn’t balance, it indicates an error in your data entry or calculations. Review all entries for accuracy, ensuring that your totals for assets, liabilities, and equity are correct.

How often should I update my balance sheet?

+

For accurate financial tracking, it’s recommended to update your balance sheet at least monthly or whenever there are significant changes in your assets or liabilities.

Can I use Excel for other financial statements?

+

Yes, Excel can be used to create other financial statements like Income Statements, Cash Flow Statements, and even complex financial models. Its versatility makes it a go-to tool for financial analysis.