5 Essential Tips for Crafting a Balance Sheet in Excel

Understanding and effectively managing your business finances is crucial to its success. One of the most critical financial tools at your disposal is the balance sheet, which provides a snapshot of your company's financial health at a particular point in time. Crafting an accurate balance sheet in Excel can seem daunting, especially with the intricacies of financial data. However, with the right approach and these essential tips, you'll be able to create a comprehensive and functional balance sheet that not only helps in understanding your business's current financial position but also aids in forecasting and planning.

The Importance of an Accurate Balance Sheet

Before diving into how to create one, let’s briefly touch on why a balance sheet is so vital:

- Financial Insight: It reveals the financial health of your business, showing what your company owns (assets), what it owes (liabilities), and the owner’s equity.

- Credit Assessment: Lenders and investors often look at your balance sheet to assess your ability to take on additional debt or investments.

- Strategic Planning: It helps in making informed decisions by providing a clear picture of your financial resources and obligations.

Tip 1: Organize Your Data Before Starting

Begin by gathering all the necessary financial data. This includes:

- Assets: Cash, inventory, accounts receivable, property, and equipment.

- Liabilities: Accounts payable, loans, taxes due, and other obligations.

- Equity: Owner’s investment, retained earnings, and any other owner’s equity accounts.

Organize this data into categories to make the input process into Excel more straightforward. Use an external tool or sheet to list out each category and ensure all your financial statements are up to date.

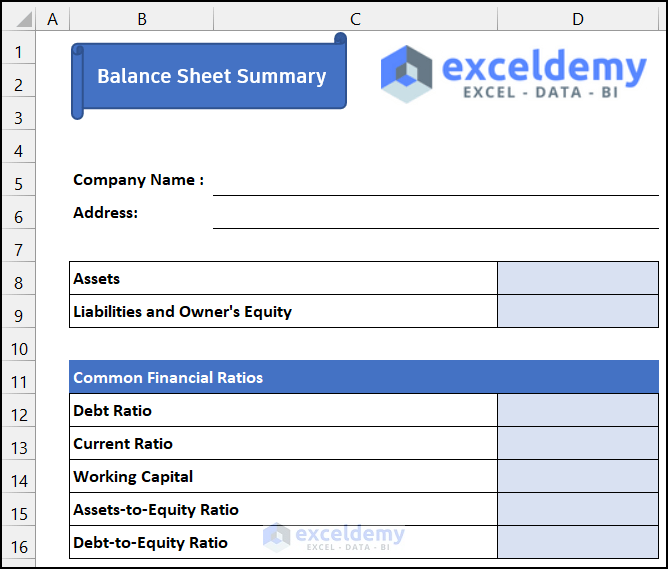

Tip 2: Use Excel Templates or Build Your Own

If you’re new to creating balance sheets in Excel:

- Template: Start with an Excel template designed for financial statements. Microsoft Excel offers a variety of templates that can be tailored to your specific needs.

- Customize: If you prefer to build your own, here’s how to set it up:

| Excel Section | Description | Formula |

|---|---|---|

| Assets | All assets should be listed and summed up here. | =SUM(Cells containing Asset values) |

| Liabilities | List all your business’s liabilities, ensuring they are correctly categorized. | =SUM(Cells containing Liability values) |

| Equity | This is what is left after liabilities are subtracted from assets. It should match the equity on your balance sheet. | =Assets - Liabilities |

| Total | The balance sheet should balance, so Total Assets should equal Total Liabilities and Equity. | =Assets=Liabilities+Equity |

📝 Note: Always ensure that your balance sheet balances. If it doesn’t, review the values for potential errors or discrepancies.

Tip 3: Use Formatting to Enhance Readability

Formatting in Excel can significantly improve readability and make your balance sheet more user-friendly:

- Bold and italicize headings and important figures to stand out.

- Use different colors for different sections like assets, liabilities, and equity.

- Adjust font size and style for better hierarchy and visual appeal.

Example: Use a bolder font for titles like “Total Assets” and a different color or shading for each major section.

Tip 4: Ensure Accuracy with Double-Entry

The principle of double-entry accounting ensures that for every transaction, there are two corresponding entries:

- Debit: An increase in assets or decrease in liabilities/equity.

- Credit: An increase in liabilities/equity or decrease in assets.

When entering data into your Excel balance sheet:

- Double-check each transaction to ensure it correctly reflects these principles.

- Use Excel functions to validate data automatically, like conditional formatting to highlight anomalies or discrepancies.

Tip 5: Automate as Much as Possible

Excel can automate many aspects of balance sheet creation:

- Formulas: Use formulas to automatically calculate sums and totals, reducing manual entry errors.

- Conditional Formatting: Set conditions to highlight negative values, zero values, or important milestones in your financials.

- Data Validation: Use Excel’s data validation feature to ensure only appropriate data types or ranges are entered into specific cells.

- Macros: For advanced users, writing VBA macros can streamline repetitive tasks like formatting or data input.

By automating these tasks, you not only save time but also reduce the chances of making calculation errors that could distort your financial picture.

In summary, crafting an accurate balance sheet in Excel requires a systematic approach to data organization, the use of templates or careful custom setup, formatting for clarity, adherence to double-entry accounting principles, and automation where possible. Ensuring that your balance sheet balances and that the data is presented in a clear, readable format will not only help in day-to-day financial management but also in strategic business planning and analysis. As you refine your skills in Excel and financial analysis, remember that these tools are there to serve your business's financial needs, helping you make informed decisions that drive growth and stability.

What should I do if my balance sheet does not balance?

+

Check for data entry errors, ensure that all transactions are recorded correctly using the double-entry principle, and verify the integrity of your data. If issues persist, consider reviewing your chart of accounts or consulting with a financial advisor.

Can I use Excel for other financial statements besides the balance sheet?

+

Yes, Excel is very versatile. You can use it to create Income Statements, Cash Flow Statements, and other financial analyses. It supports dynamic data linking, pivot tables, and many other tools for comprehensive financial reporting.

How often should I update my balance sheet?

+

Ideally, balance sheets should be updated at least monthly for internal purposes. However, external reporting and auditing might require annual or semi-annual balance sheets. Regular updates help in tracking the financial health of the business in real time.