5 Simple Steps to Create a Balance Sheet in Excel

Are you looking to master the art of creating financial statements for your business? Understanding how to craft a balance sheet is fundamental for tracking your company's financial health. This post will walk you through the 5 simple steps to create a balance sheet in Excel, ensuring you can get an accurate snapshot of your financial position at any given time.

Understanding the Balance Sheet

Before diving into the steps, it’s essential to grasp what a balance sheet represents. A balance sheet provides a snapshot of your company’s financial condition at a specific point in time. It outlines:

- Assets – What your company owns

- Liabilities – What your company owes

- Equity – The owner’s interest in the business

The fundamental accounting equation here is Assets = Liabilities + Equity.

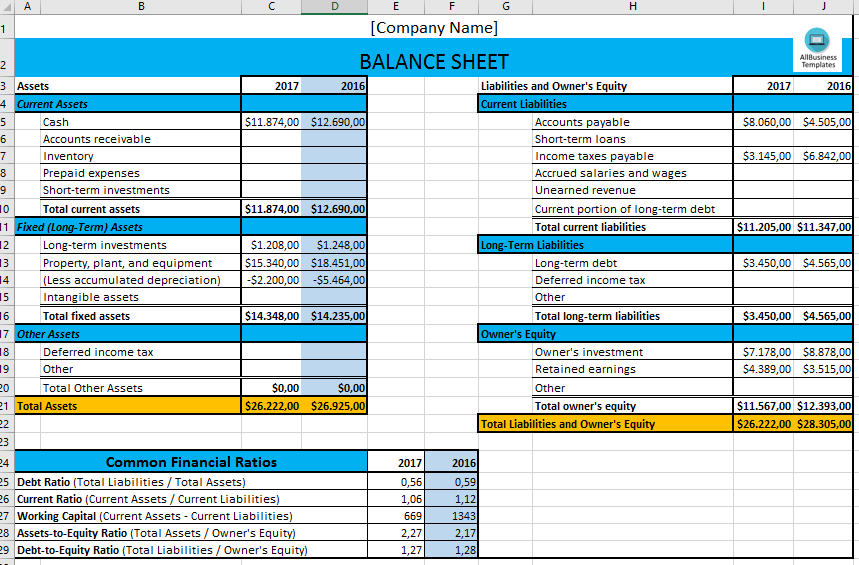

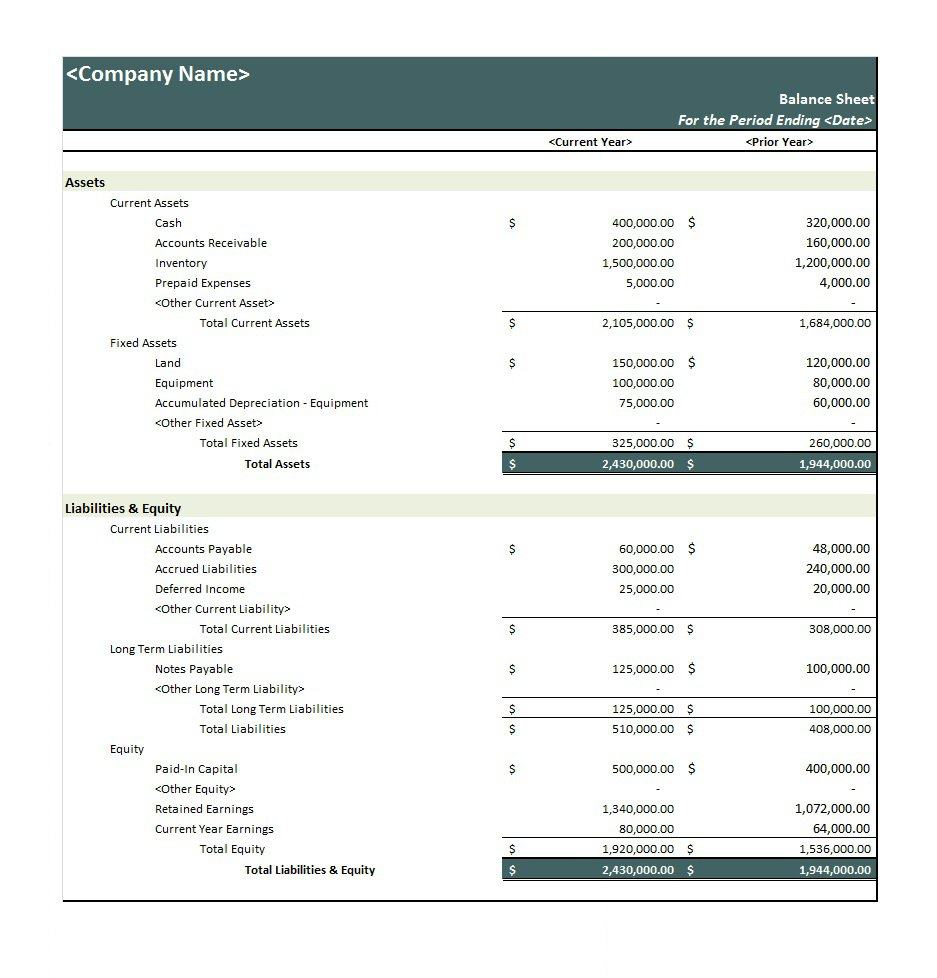

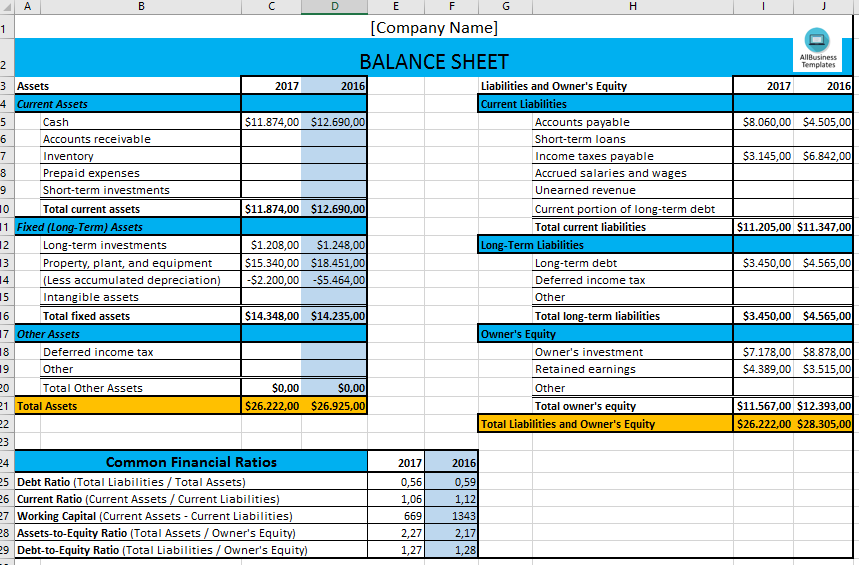

Step 1: Setting Up Your Excel Worksheet

Start by opening Microsoft Excel and creating a new worksheet. Here’s how to structure it:

- In column A, list out Assets at the top, followed by your list of assets.

- In column B, you will input the respective values.

- Below the assets, list Liabilities, again with values in column B.

- Finally, add Equity in a similar format.

You might want to use different formatting options to distinguish between sections for better readability.

Step 2: Inputting Your Financial Data

Now, let’s populate your balance sheet with real data:

- Under Assets:

- Current Assets like cash, accounts receivable, inventory.

- Non-Current Assets such as property, plant, and equipment.

- Under Liabilities:

- Current Liabilities like accounts payable, short-term debt.

- Long-Term Liabilities such as long-term debt.

- Equity would include owner’s equity, retained earnings, etc.

Make sure to format your numbers correctly to avoid errors in calculations.

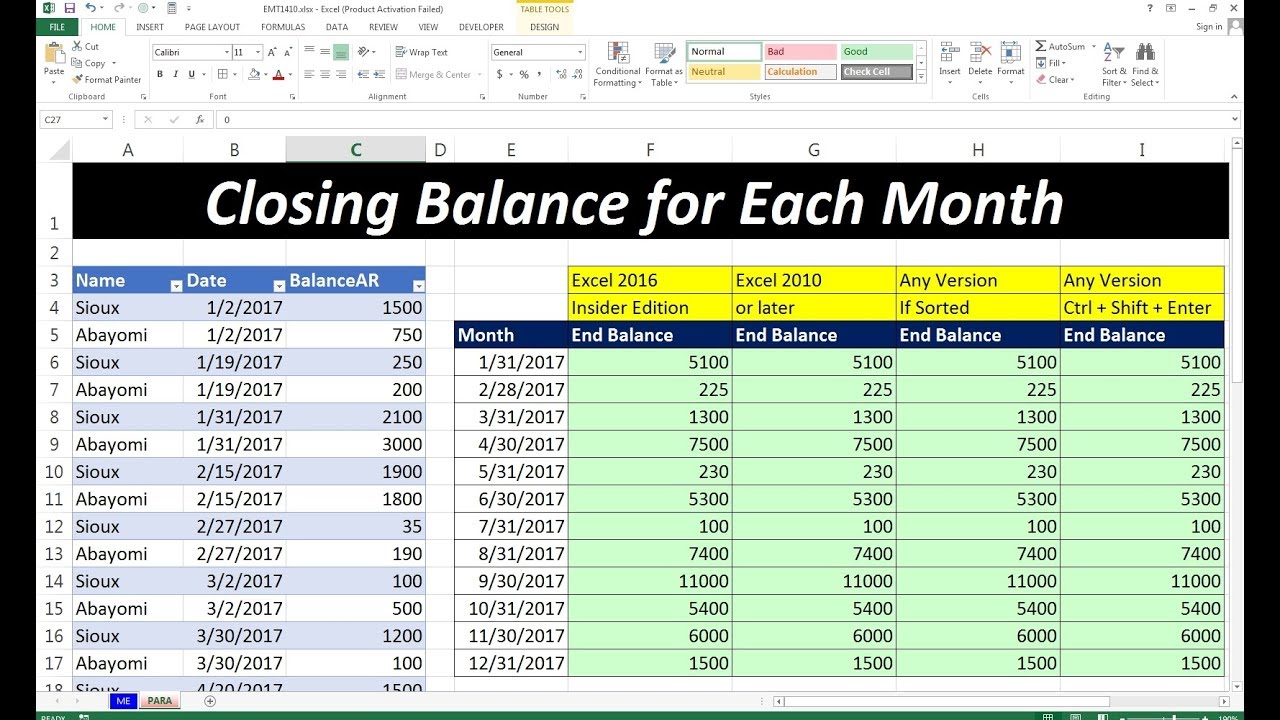

Step 3: Calculating Totals

With all your data in place, use Excel formulas to calculate the totals:

- Assets Total: Use the SUM function in a cell at the bottom of the assets section to add all the asset values.

- Liabilities Total: Similarly, sum up all liabilities.

- Equity: This can be calculated manually or derived as Total Assets - Total Liabilities.

Here’s a snippet of how you might set this up:

| Assets | Value |

| Current Assets | =SUM(B3:B5) |

| Non-Current Assets | =SUM(B6:B9) |

| Total Assets | =SUM(B3:B9) |

Step 4: Ensuring Accuracy

Check your work:

- Verify that your total assets equal the sum of liabilities and equity.

- Use Excel’s Conditional Formatting to highlight any discrepancies.

🔍 Note: Keep in mind that the balance sheet must balance. If it doesn’t, revisit your figures for any calculation errors or omitted entries.

Step 5: Final Touches and Formatting

To make your balance sheet visually appealing and professional:

- Apply formatting to separate sections clearly.

- Use bold and color to emphasize totals.

- Add borders and adjust column widths for readability.

Your journey through these steps to create a balance sheet in Excel has equipped you with the tools to monitor your business's financial health efficiently. By understanding how to organize your data, input your financials, calculate totals, ensure accuracy, and present your balance sheet, you're now set to make informed decisions based on a solid financial foundation.

Remember, the balance sheet is not just about numbers; it's about telling the story of your business's financial health. This visual representation can help stakeholders, including investors and lenders, see where your business stands. Whether for internal analysis, seeking financing, or complying with accounting standards, a well-prepared balance sheet is crucial.

What is the accounting equation?

+

The accounting equation is Assets = Liabilities + Equity. This equation must balance, ensuring that the total assets of a company are equal to the sum of what the company owes (liabilities) plus what the owners have invested (equity).

Can Excel be used for all financial statements?

+

Yes, Excel is versatile enough to create all primary financial statements including the Income Statement, Cash Flow Statement, and Balance Sheet. It provides tools for data organization, calculation, and analysis.

How often should a balance sheet be updated?

+

A balance sheet should be prepared at least annually for reporting purposes, but businesses often update it quarterly or even monthly for internal management and decision-making.