Create a Salary Sheet in Excel 2007 PDF

Managing employee payroll is a critical task for any business. Not only does it require accuracy, but it also demands efficiency to ensure timely payments. Excel 2007, despite being an older version, remains a powerful tool for creating salary sheets due to its flexibility and familiar interface. In this blog post, we will delve into how you can create a comprehensive salary sheet using Excel 2007, including practical tips for automation and customization.

Starting with Excel 2007

Open Excel 2007. If you’re familiar with newer versions, you might notice a slightly different layout, but the basic functionalities remain similar.

- Create a New Workbook: Go to File > New > Blank Workbook.

- Name Your Sheet: Double-click on the 'Sheet1' tab at the bottom and rename it to 'Salary Sheet' for better organization.

Setting Up the Basic Structure

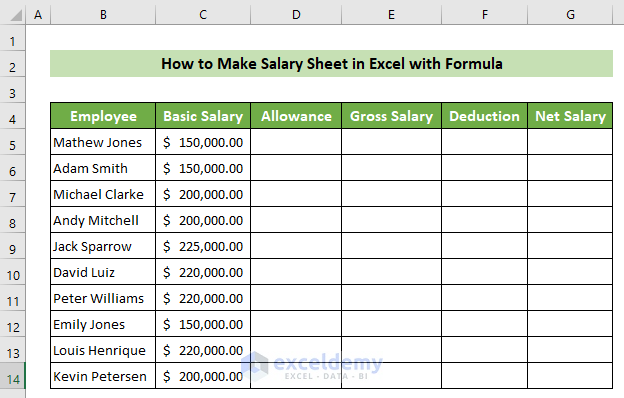

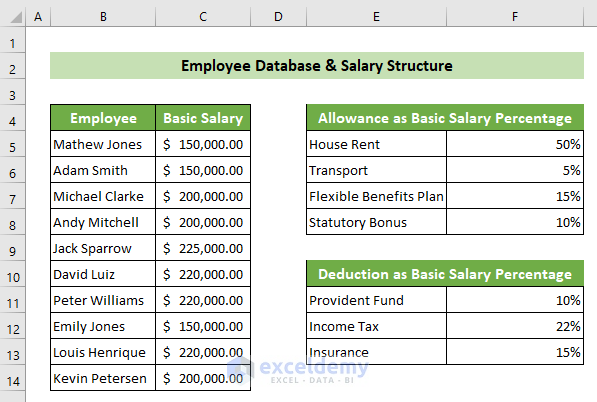

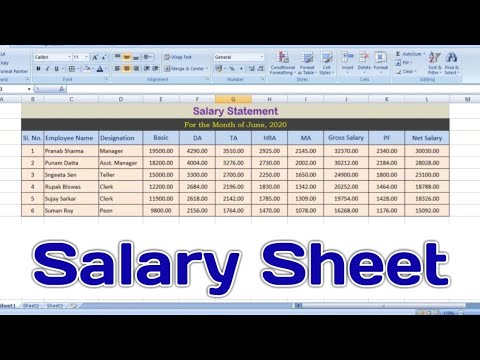

Your salary sheet will typically include various columns for different components of the salary. Here’s what you might need:

| Column A | Column B | Column C | Column D | Column E | Column F | Column G | Column H |

|---|---|---|---|---|---|---|---|

| Employee ID | Name | Basic Salary | Allowances | Deductions | Gross Salary | Net Salary | Remarks |

💡 Note: The above structure is basic; you might add or remove columns based on your organization's policies.

Entering Data

Begin filling in employee details row by row:

- Employee ID: Unique identifier for each employee.

- Name: Full name of the employee.

- Basic Salary: This is the core salary before any allowances or deductions.

- Allowances: Add allowances like travel, housing, etc., if applicable.

- Deductions: Include items like tax, provident fund, etc.

- Gross Salary: Basic Salary + Allowances.

- Net Salary: Gross Salary - Deductions.

- Remarks: Any notes or comments regarding the salary calculation.

Using Formulas

Formulas are the backbone of automation in Excel:

- Gross Salary Calculation: In Column F (Gross Salary), you can use =C2+D2 for each employee row.

- Net Salary Calculation: In Column G, use =F2-E2.

These formulas will automatically update whenever you change the values in the Basic Salary, Allowances, or Deductions columns.

💡 Note: Always double-check your formulas for accuracy. A single error can lead to significant discrepancies in payroll calculations.

Formatting for Better Readability

Enhance your sheet:

- Highlight Rows: Use conditional formatting to highlight rows based on criteria like payment status, salary range, etc.

- Freeze Panes: Freeze the header row to keep it visible while scrolling through employee data.

- Use Data Validation: Set up dropdown lists for columns like 'Remarks' to standardize entries.

Protecting Sensitive Data

Since salary data is sensitive:

- Password Protection: Go to Review > Protect Sheet. Set a password to lock the sheet.

- Hide Formulas: If you've used complex formulas, you can hide them to prevent employees from viewing calculation logic.

Exporting to PDF

Once your salary sheet is complete:

- Save as PDF: Click File > Save As. Choose PDF from the 'Save as type' dropdown. Ensure that you're saving only the necessary data to avoid including unwanted sheets or hidden cells.

- Name Your File: Give it a meaningful name like "Payroll_March2023.pdf".

To sum up, creating a salary sheet in Excel 2007 involves meticulous data entry, formula usage for automation, and careful formatting for clarity and security. This method not only streamlines the payroll process but also provides a transparent record that can be easily accessed and archived in PDF format, ensuring both privacy and convenience for future reference.

Can I automate salary calculations in Excel 2007?

+

Yes, by using formulas, you can automate the calculation of gross and net salaries based on changes in allowances and deductions.

How do I protect the Excel salary sheet?

+

Go to the ‘Review’ tab, select ‘Protect Sheet,’ and set a password to prevent unauthorized edits.

What if the PDF contains errors or requires changes?

+

Changes cannot be made directly to a PDF file. You would need to go back to the Excel file, make the corrections, and export the PDF again.