5 Easy Steps to Create a Company Expenses Sheet in Excel

Introduction

Managing company expenses efficiently is crucial for any business, small or large. A well-organized company expenses sheet not only helps in tracking costs but also in financial planning, budgeting, and tax preparation. Excel, with its versatility and widespread use, is an excellent tool for creating such a document. Here are five easy steps to create a comprehensive company expenses sheet in Excel, ensuring you keep your finances in check with minimal effort.

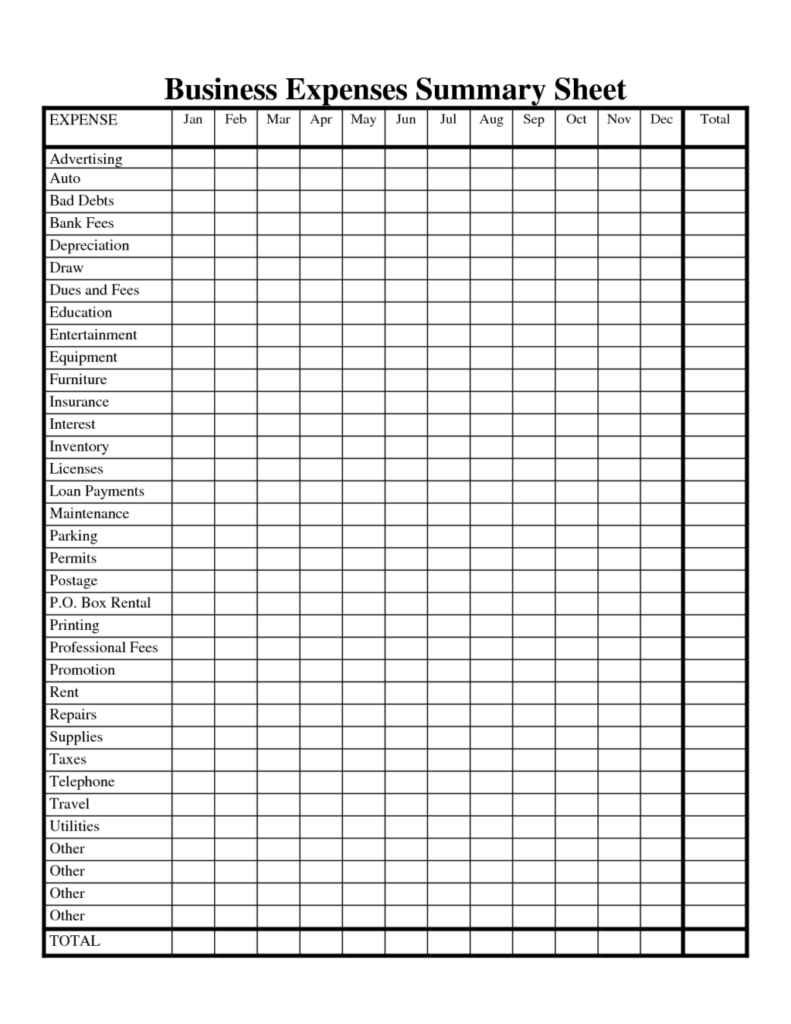

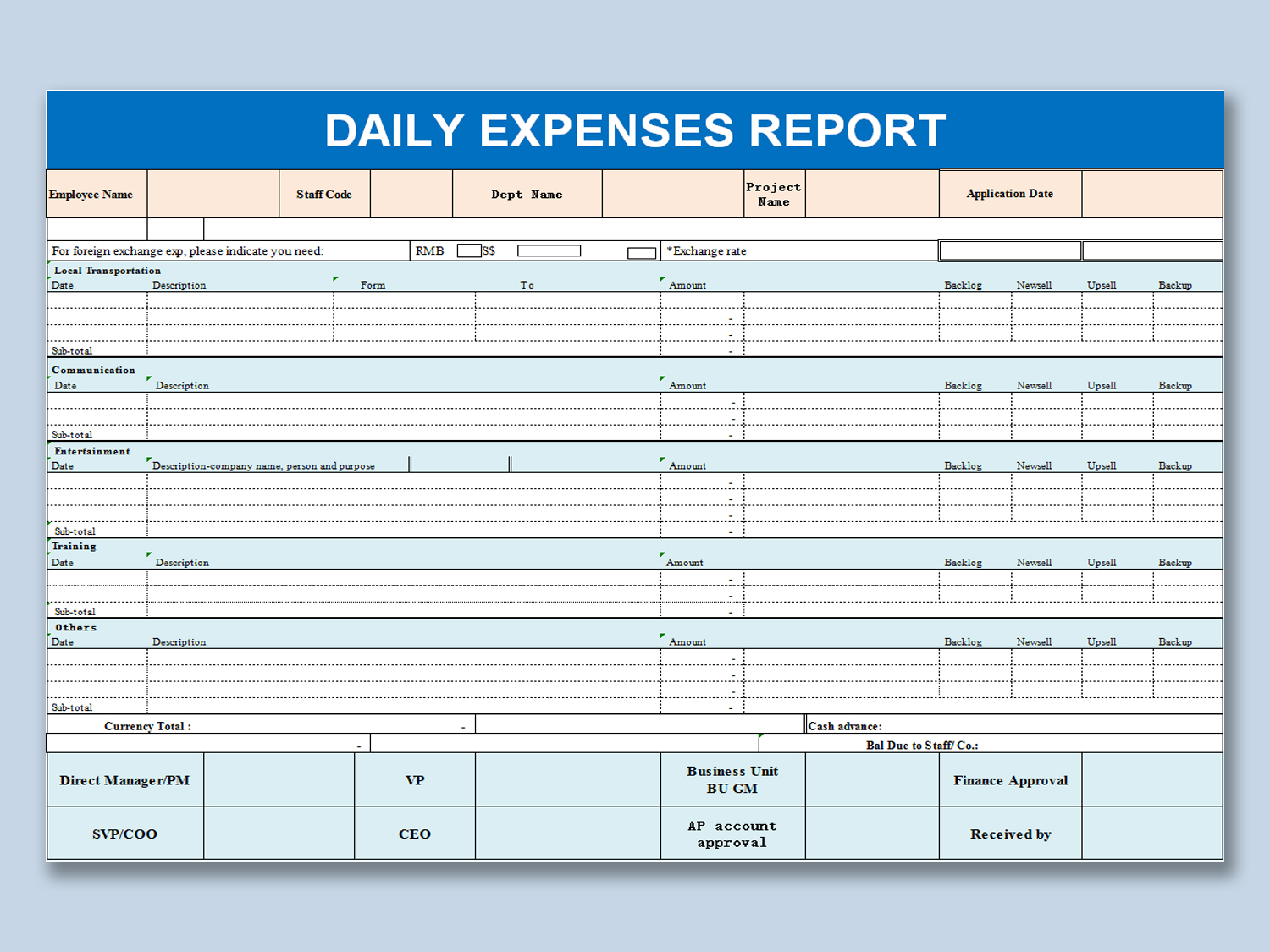

Step 1: Plan Your Expense Categories

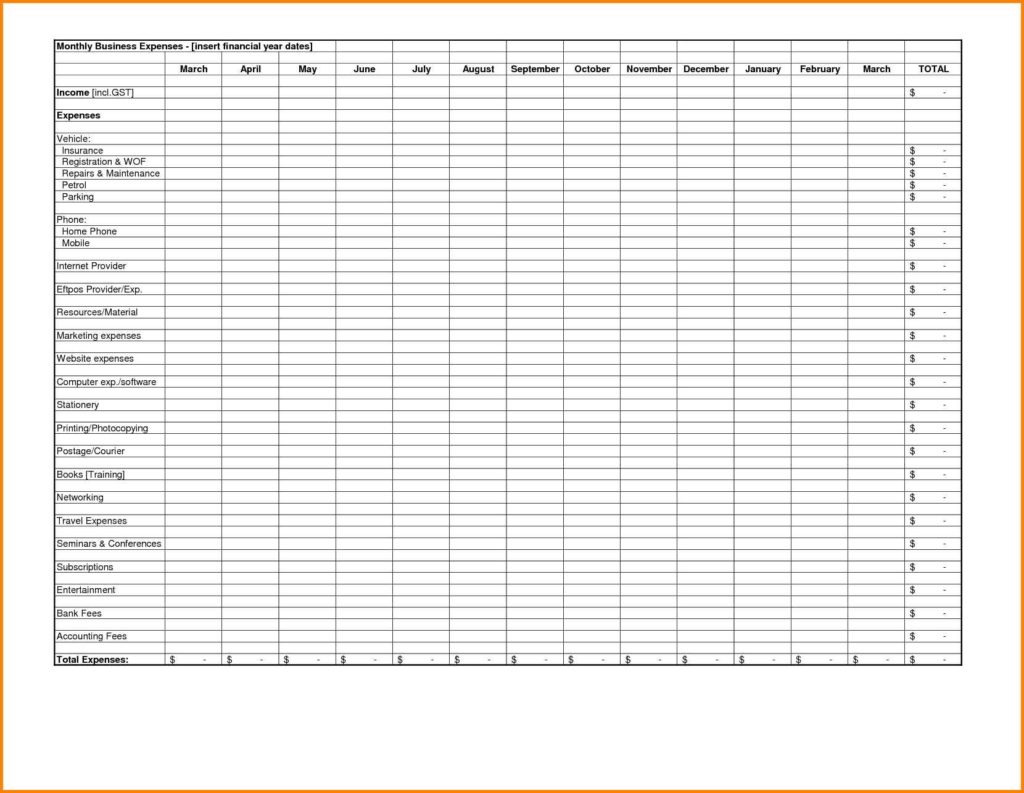

Before opening Excel, it’s beneficial to plan out the categories of expenses you typically encounter. This preliminary step will structure your spreadsheet effectively, making data entry and analysis easier. Here’s what you should consider:

- Fixed Expenses: Rent, utilities, insurance, salaries, etc.

- Variable Expenses: Travel, marketing, office supplies, etc.

- Capital Expenses: Equipment, furniture, vehicles, etc.

- Miscellaneous: Any other expenses that don't fit neatly into the above categories.

📝 Note: Identifying and categorizing your expenses will provide clarity on where your money is going, aiding in financial decision-making.

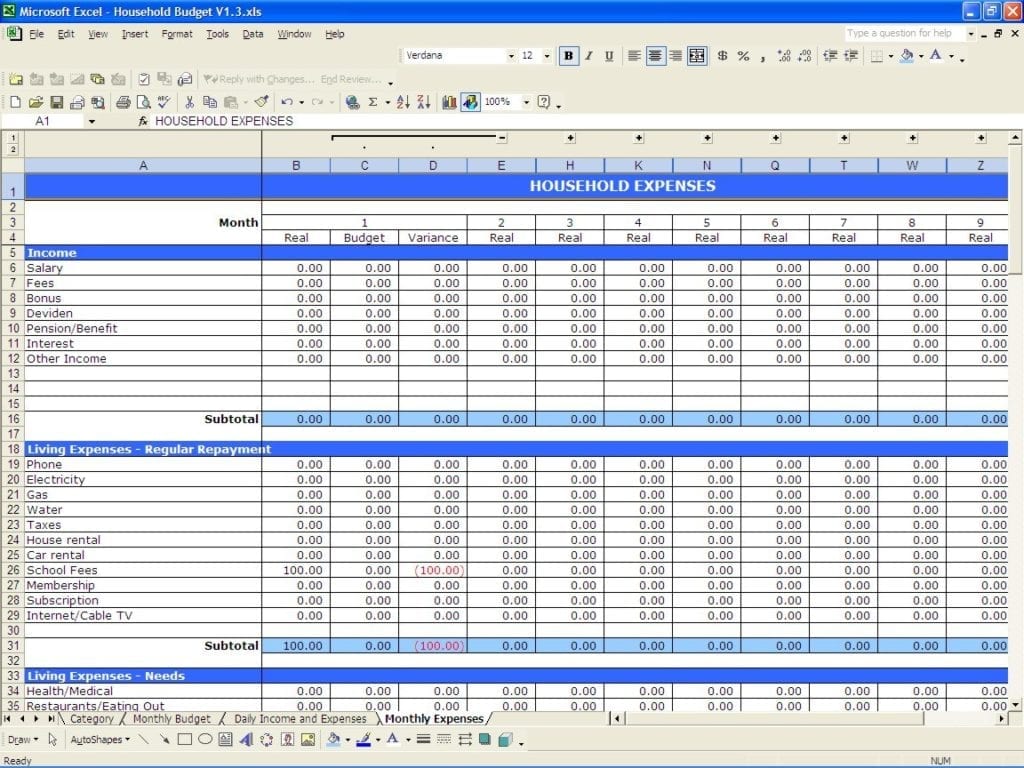

Step 2: Open Excel and Set Up Your Sheet

Once your categories are decided:

- Open Excel and create a new workbook.

- Label your worksheet appropriately; for example, "2023 Company Expenses."

- At the top, add headers in row 1 for:

- Date

- Category

- Description

- Amount

- Payment Method

- Use the following format:

Date Category Description Amount Payment Method [cell for date] [dropdown for category] [description] [amount] [payment method]

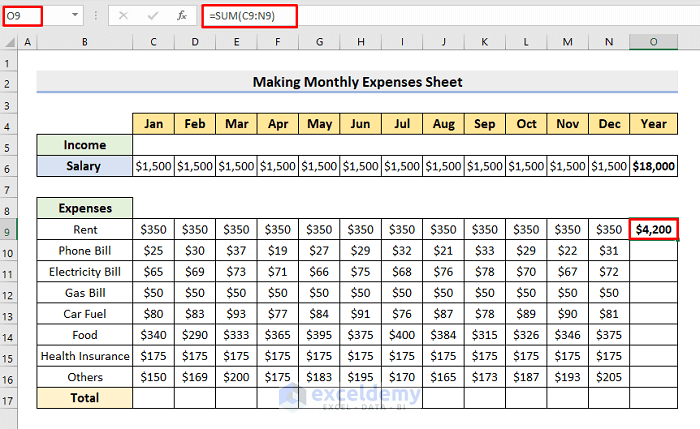

Step 3: Automate With Formulas

Excel’s power lies in its formulas, allowing you to automate calculations:

- Sum Formula: Use

=SUM(range)to calculate the total expenses for a period. - Conditional Sum: With

=SUMIF()or=SUMIFS(), you can sum expenses by category or other criteria. - Date Functions: Use

=EOMONTH(start_date, months)to automatically list the end of the month, or=DATE()to create dynamic date entries.

⚠️ Note: Test your formulas regularly to ensure they give accurate results. Incorrect formulas can lead to financial miscalculations.

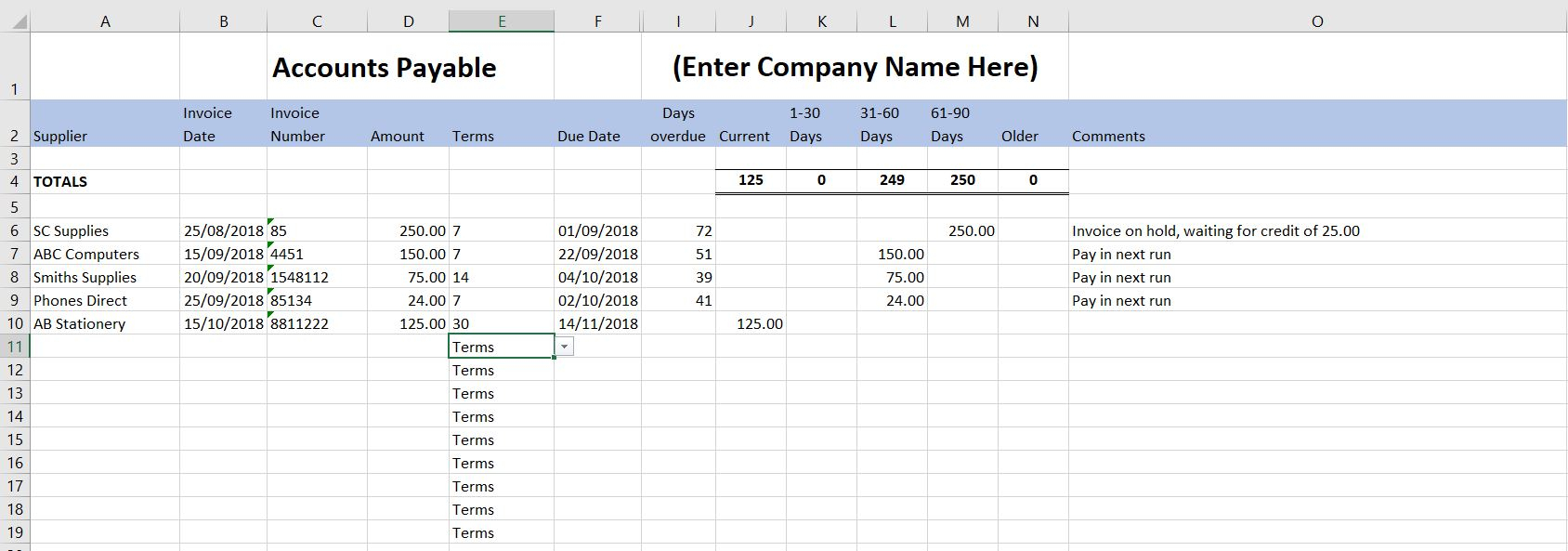

Step 4: Utilize Data Validation and Dropdowns

To make data entry smoother and more accurate:

- Select the cells where you want a dropdown list (e.g., Category column).

- Go to Data > Data Validation.

- Set Allow to "List," and in Source, type your categories: Fixed, Variable, Capital, Miscellaneous.

This will create a dropdown menu making data entry less prone to errors.

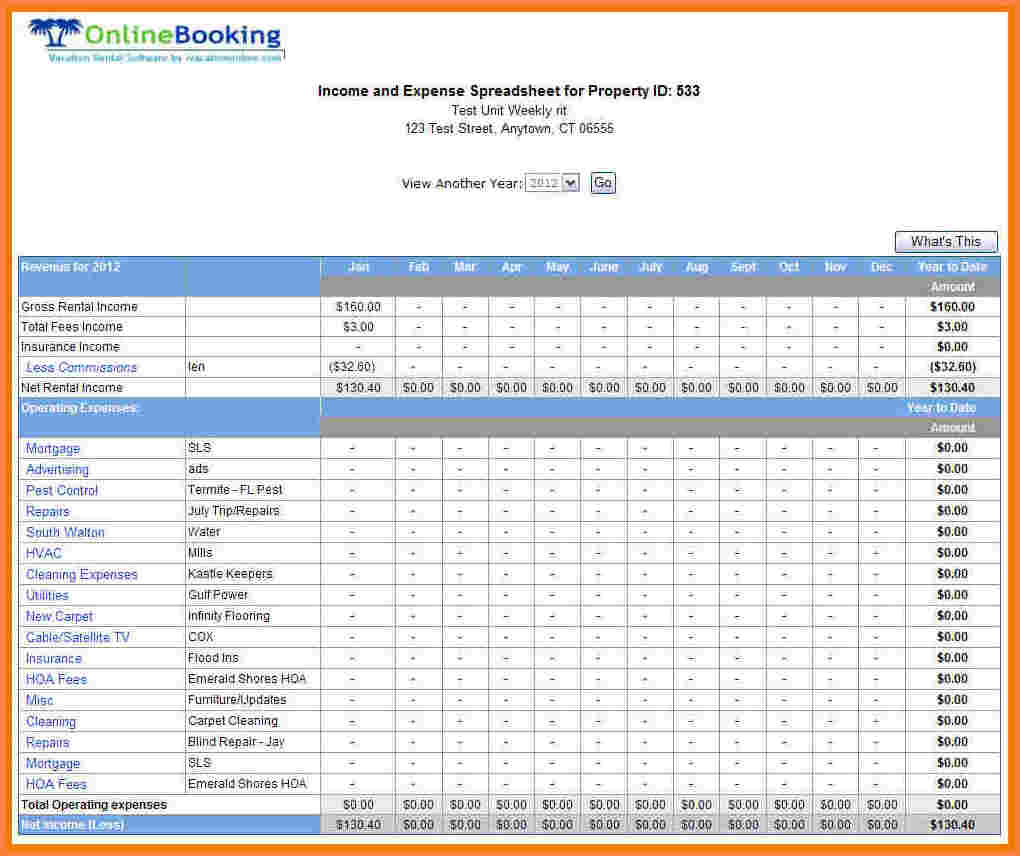

Step 5: Analyze Your Data With Charts and Tables

After setting up your sheet:

- Pivot Tables: Summarize your expenses by category, time period, or other parameters.

- Charts: Visualize trends in your expenses. Line, pie, and bar charts can be particularly useful.

🔎 Note: Regularly analyze your data to identify spending patterns or areas for cost reduction.

Wrapping Up

By following these five steps, you’ve created a dynamic and robust tool for managing your company’s expenses. This Excel sheet will help you track costs, plan your finances, prepare for tax seasons, and make informed financial decisions. Remember to keep your sheet regularly updated and periodically review your data to ensure you’re staying within budget and identifying cost-saving opportunities.

What are the benefits of using Excel for managing expenses?

+

Excel offers customization, automation through formulas, and powerful data analysis tools, making it an ideal choice for expense tracking and analysis.

How often should I update my expenses sheet?

+

Weekly or monthly updates are common. Choose a frequency that suits your business operations and financial cycle.

Can Excel replace accounting software for expense management?

+

Excel is versatile but might not replace dedicated accounting software for businesses with complex financial operations. It can complement existing software for smaller tasks or businesses.

How secure is my financial data in an Excel file?

+

Excel files can be password-protected for security, but for enhanced security, consider using cloud storage with access controls or specialized financial software.

What if I need to include more categories later?

+

Excel allows you to easily add new categories to your data validation list or formulas by updating the source list in Data Validation.