5 Easy Steps to Create a Balance Sheet in Excel

Introduction to Excel for Financial Statements

Excel has become an indispensable tool for accountants, business owners, and financial analysts due to its versatility in handling various financial statements. Among these statements, the balance sheet stands out as a critical document that provides a snapshot of a company’s financial health at any given point in time. In this comprehensive guide, we’ll walk through 5 easy steps to create a balance sheet in Excel, making it accessible for beginners to experts alike.

Excel has become an indispensable tool for accountants, business owners, and financial analysts due to its versatility in handling various financial statements. Among these statements, the balance sheet stands out as a critical document that provides a snapshot of a company’s financial health at any given point in time. In this comprehensive guide, we’ll walk through 5 easy steps to create a balance sheet in Excel, making it accessible for beginners to experts alike.

Understanding the Balance Sheet

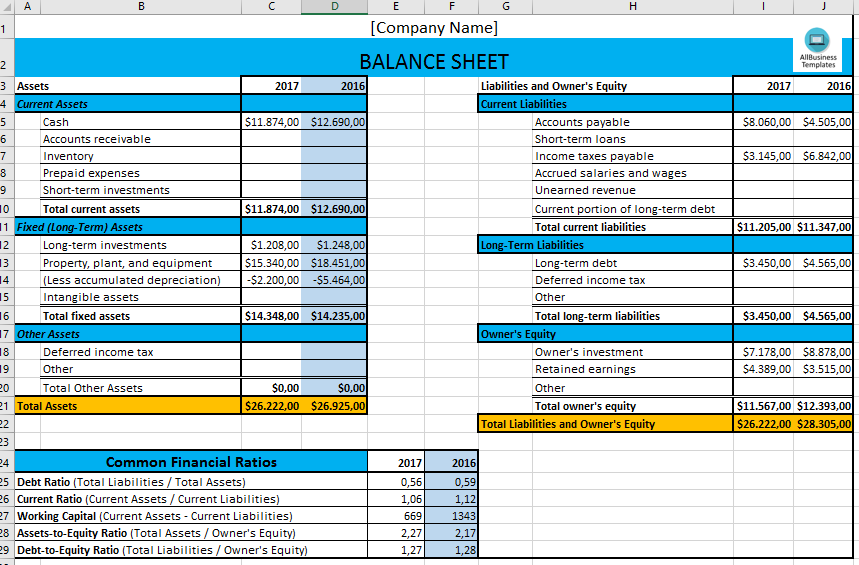

Before diving into the technical aspect of creating a balance sheet, it’s essential to understand its components and purpose. A balance sheet is divided into three main sections:

- Assets: Everything the company owns that has monetary value.

- Liabilities: All the company’s debts and obligations.

- Equity: The residual interest in the assets of the enterprise after deducting liabilities.

Step 1: Setting Up Your Excel Workbook

- Open Microsoft Excel: Start by opening a new Excel workbook.

- Name the Sheet: Rename the tab at the bottom to something like “Balance Sheet” for clarity.

- Define Your Structure: Your balance sheet should follow a standard format with columns for Assets, Liabilities, and Equity. Here’s a basic layout:

| Item | Value |

|---|---|

| Assets | |

| ...Current Assets... | |

| ...Fixed Assets... | |

| Liabilities | |

| ...Current Liabilities... | |

| ...Long-Term Liabilities... | |

| Equity | |

| ...Equity... |

🔍 Note: For a more detailed breakdown, you might want to add subcategories under each main category.

Step 2: Inputting Your Data

Once you have your structure, follow these steps to input your financial data:

- Assets: Start with listing all your current and fixed assets. For example:

- Cash and equivalents

- Accounts receivable

- Inventory

- Property, Plant, and Equipment (PPE)

- Liabilities: List all debts and obligations:

- Accounts payable

- Short-term debt

- Long-term debt

- Accrued expenses

- Equity: Here you will include:

- Owner’s capital

- Retained earnings

💡 Note: Ensure the numbers you input are as accurate as possible for an effective balance sheet.

Step 3: Applying Formulas for Automatic Calculations

Excel’s real power comes from its ability to perform automatic calculations:

- Total Assets: Sum all the entries under your Assets category using the formula

=SUM(A1:A10), where A1:A10 represent your asset values. - Total Liabilities: Use the same formula for Liabilities.

- Equity: This can be calculated as

Total Assets - Total Liabilities, or you can add individual equity components directly.

Step 4: Formatting for Clarity

Formatting your balance sheet for easy reading is crucial:

- Use bold text for headings.

- Highlight or italicize totals for emphasis.

- Use borders or shading to separate different sections.

- Consider using conditional formatting to highlight anomalies or important numbers.

Step 5: Validation and Verification

Your balance sheet must be accurate, so:

- Double-Check Your Numbers: Ensure all figures are entered correctly.

- Validate Totals: Make sure Assets equal Liabilities plus Equity.

- Use Excel’s Error Checking Tools: Excel offers features like error checking to help find discrepancies.

To finalize your balance sheet:

- Balance Check: Ensure that Assets balance with the sum of Liabilities and Equity.

- Formatting Review: Check that all formatting is consistent and enhances readability.

In this detailed guide, we've covered the essentials of creating a balance sheet in Excel, from setting up your worksheet to ensuring accuracy through validation. This process not only helps in understanding your company's financial standing but also serves as an excellent practice for financial modeling and analysis. By following these steps, you'll be equipped to produce a clear, accurate, and insightful balance sheet, beneficial for decision-making and financial reporting.

Can I automate the data entry in my balance sheet?

+

Yes, you can automate data entry by linking Excel to data sources like accounting software or by using macros to input data from predefined templates or forms. Automation reduces manual errors and saves time.

What should I do if my balance sheet doesn’t balance?

+

If your balance sheet doesn’t balance, recheck your entries for errors, ensure all transactions are correctly categorized, and verify that no double-entry or omissions have occurred. Use Excel’s error checking or create an audit trail to find discrepancies.

How often should a balance sheet be updated?

+

Balance sheets are typically prepared monthly, quarterly, or annually for internal use. For external reporting like financial statements, they are commonly updated at the end of each fiscal year.