5 Steps to Create a Dynamic Balance Sheet in Excel

A dynamic balance sheet in Excel not only helps in tracking financial health but also makes financial reporting more efficient. Whether you're managing a small business or a large corporation, having a tool that updates financial data automatically can save time and reduce errors. Here's a comprehensive guide to creating a dynamic balance sheet in Excel.

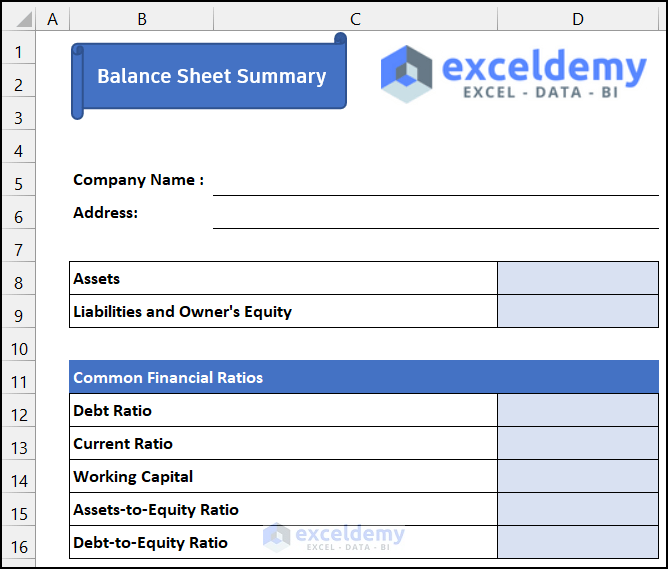

1. Setting Up Your Excel Worksheet

Before diving into complex formulas or features, let’s set up our Excel worksheet:

- Open a New Excel Workbook: This will be our starting point for creating the balance sheet.

- Label Columns: Name the columns appropriately. Common headers include Date, Assets, Liabilities, and Equity.

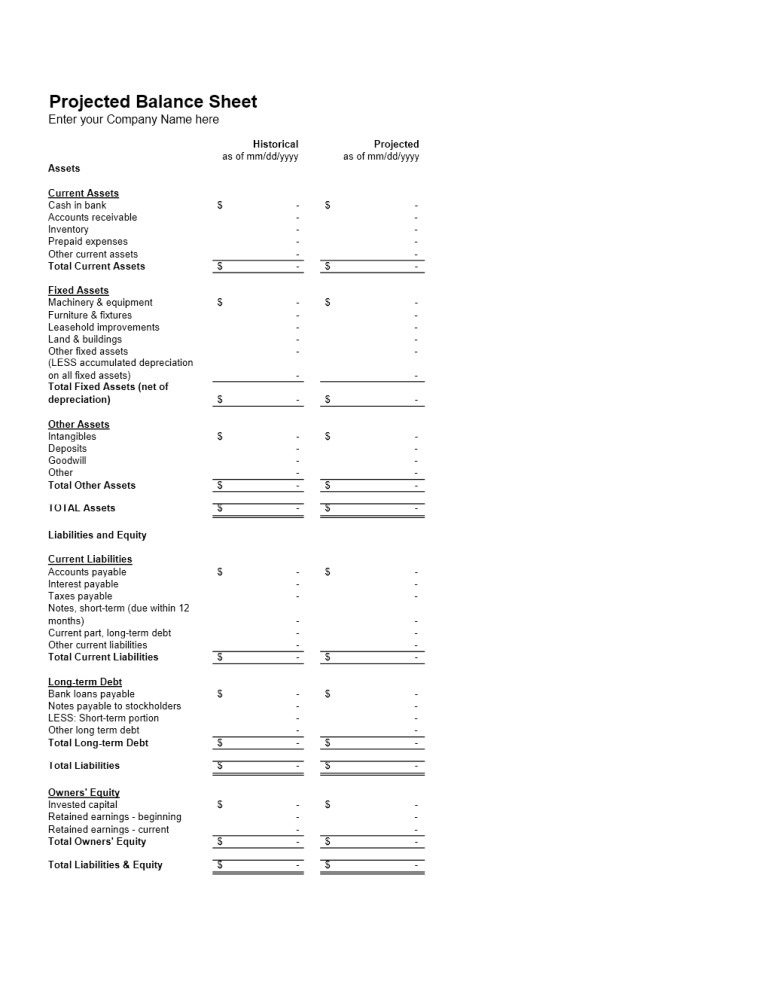

- Structure the Sheet: Divide your sheet into sections like Current Assets, Fixed Assets, Current Liabilities, Long-Term Liabilities, and Shareholders’ Equity.

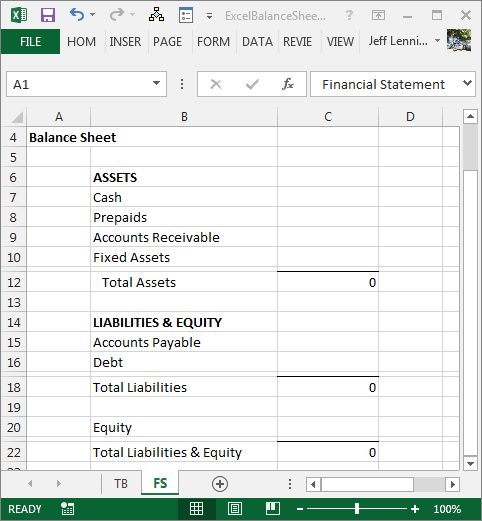

2. Entering Initial Data

Input the initial figures for each category:

- Assets:

- Current Assets: Cash, Accounts Receivable, Inventory, etc.

- Fixed Assets: Property, Plant, and Equipment, Investments, etc.

- Liabilities:

- Current Liabilities: Accounts Payable, Short-term Loans, etc.

- Long-Term Liabilities: Bonds Payable, Long-term Loans, etc.

- Equity:

- Retained Earnings, Common Stock, Additional Paid-In Capital, etc.

3. Using Formulas for Dynamic Updates

The power of Excel lies in its ability to automatically update figures:

- Total Assets Formula: In the cell where you want the Total Assets to be displayed, use =SUM(Current Assets range:Fixed Assets range).

- Total Liabilities Formula: Similarly, for Total Liabilities, use =SUM(Current Liabilities range:Long-term Liabilities range).

- Equity Calculation: Equity should balance with Total Assets minus Total Liabilities.

- Dynamic Fields: Use formulas like VLOOKUP, SUMIF, or SUMPRODUCT for more complex calculations where data might change based on various conditions.

💡 Note: Always check the references in your formulas to ensure they are correct and dynamic as intended.

4. Automating with Macros and VBA

To further automate your balance sheet:

- Create macros that can:

- Automatically fetch data from different sheets or external files.

- Generate reports or update values based on certain conditions.

- Handle monthly or yearly rollovers of data.

- Use VBA for custom functions or to automate more complex tasks like data formatting or error checking.

💡 Note: VBA scripting can be complex; make sure to back up your work before testing new scripts.

5. Validating and Protecting Your Balance Sheet

Ensure the integrity of your financial data:

- Data Validation: Set up rules to check that entries are in the correct format or within reasonable limits.

- Protection: Lock cells to prevent accidental changes. Allow only authorized users to edit certain areas of the sheet.

- Error Checking: Use Excel’s error checking tools or custom VBA to detect discrepancies or errors in formulas.

The creation of a dynamic balance sheet in Excel represents a significant step towards efficient financial management. By following these steps, you ensure that your financial reports are accurate, up-to-date, and easily accessible. This process not only helps in visualizing the financial health of a business at a glance but also simplifies the audit trail and compliance processes. Embracing such tools can lead to more informed decision-making, enabling business owners and financial managers to react swiftly to changing financial conditions. Additionally, the automation reduces manual entry errors, enhancing the reliability of the financial data. Remember to keep updating and refining your Excel model as your business grows or as accounting standards evolve, ensuring that your balance sheet remains a robust tool for financial analysis.

How often should I update my balance sheet in Excel?

+

It’s best to update your balance sheet at least monthly or upon significant financial events to keep it current and useful for decision-making.

Can Excel handle large financial data sets for balance sheets?

+

Yes, Excel can manage substantial amounts of financial data. For large sets, consider optimizing your worksheet with features like data tables, pivot tables, or external data connections for better performance.

What if I make a mistake in my dynamic balance sheet?

+

Excel offers features like undo history, version history in shared workbooks, and error checking tools to help rectify mistakes. Regular backups also ensure you can recover from errors.