Creating a Balance Sheet in Excel PDF Easily

When it comes to managing financial information for your business or personal finances, a balance sheet is an invaluable tool. It provides a snapshot of your financial condition at any given time, showing assets, liabilities, and equity. Here, we'll explore how to create a balance sheet in Excel and save it as a PDF, ensuring you have a durable record of your financial health.

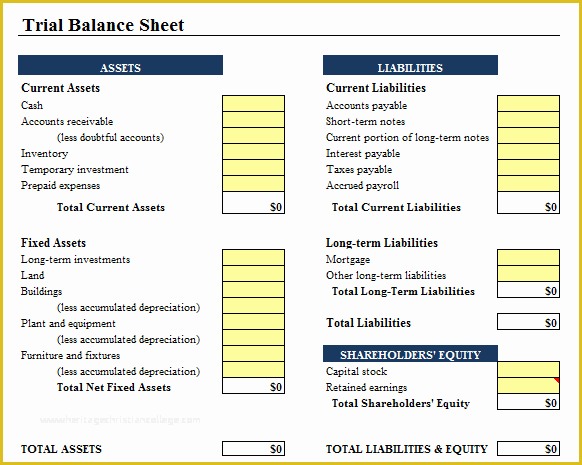

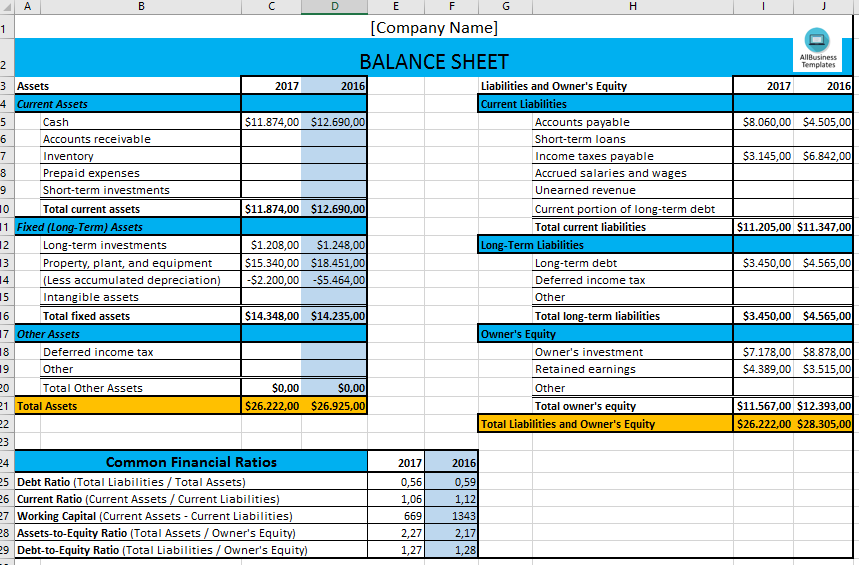

Understanding the Components of a Balance Sheet

A balance sheet consists of three main parts:

- Assets: What you own, including cash, investments, accounts receivable, inventory, and fixed assets like property or equipment.

- Liabilities: What you owe, which can include loans, accounts payable, mortgages, or any other debts.

- Equity: What is left over after liabilities are subtracted from assets, also known as net worth or shareholders’ equity.

Setting Up Your Excel Sheet

Let’s begin with setting up your Excel spreadsheet for a balance sheet:

- Open a new Excel workbook.

- In cell A1, type the title: “Balance Sheet as of [Date]”. Adjust the date to reflect the period ending.

- In cell A3, type Assets, A15 for Liabilities, and A25 for Owner’s/Shareholders’ Equity.

Entering Data into Your Balance Sheet

Now you’ll enter data into each category:

Assets

- In the row below “Assets”, list items like Cash, Accounts Receivable, Inventory, etc.

- Enter values for each asset in column B. You might want to add intermediate calculations or totals where necessary.

Liabilities

- Under “Liabilities”, enter accounts like Accounts Payable, Notes Payable, Accrued Liabilities, etc.

- Enter the corresponding values in column B.

Equity

- For equity, you’ll generally just need to list total equity and enter the value in column B. If detailed, break down into Owner’s Investment, Retained Earnings, etc.

Calculations and Totals

To ensure your balance sheet balances:

- Add totals for each section. For Assets, sum the values in column B below the last asset entry. Use =SUM(B4:B12).

- For Liabilities, sum below the last entry in column B.

- For Equity, sum the values if applicable or just enter the total value.

- Confirm that the Total Assets equal Total Liabilities plus Total Equity.

🔎 Note: Use formulas for automatic updates. If you change any values, the totals will adjust accordingly.

Formatting Your Balance Sheet

Here’s how to make your balance sheet visually appealing and professional:

- Merge cells A1 and B1 for the title and center it.

- Apply bold formatting to section headings (Assets, Liabilities, Equity) and center align them.

- Use borders and shading to visually distinguish different sections or highlight key figures.

- Format monetary values to show currency symbols.

| Item | Amount |

|---|---|

| Cash | $25,000 |

| Accounts Receivable | $12,500 |

| Inventory | $15,000 |

| Total Assets | $52,500 |

Saving Your Balance Sheet as a PDF

Once your balance sheet is ready:

- Click on File > Save As.

- Choose a location to save your file.

- In the “Save as type” dropdown, select PDF (*.pdf).

- Click Save. Your balance sheet is now a PDF, preserving the layout and data for sharing or record-keeping.

💡 Note: To save multiple sheets in a single PDF, hold down Shift while selecting multiple sheets before saving.

To conclude, creating a balance sheet in Excel and converting it to a PDF is an excellent way to keep track of your financial status. The steps above outline how to setup, populate, and format your balance sheet, ensuring it looks professional and is easy to read. By following these instructions, you'll have a comprehensive tool at your fingertips to monitor and manage your finances effectively.

Why do I need to balance the balance sheet?

+

A balance sheet must balance because it represents the fundamental accounting equation: Assets = Liabilities + Equity. If it doesn’t balance, there might be errors in data entry or calculation.

Can I automate my balance sheet updates in Excel?

+

Yes, using formulas and Excel’s linking capabilities, you can link your balance sheet to other sheets or sources where your data is updated, making the balance sheet self-updating.

What should I do if my balance sheet doesn’t balance?

+

Check for mathematical errors, ensure all items are categorized correctly, and verify that all figures are inputted accurately. If you’re still having trouble, consider consulting with an accountant or financial advisor.