5 Easy Steps to Create a Balance Sheet in Excel

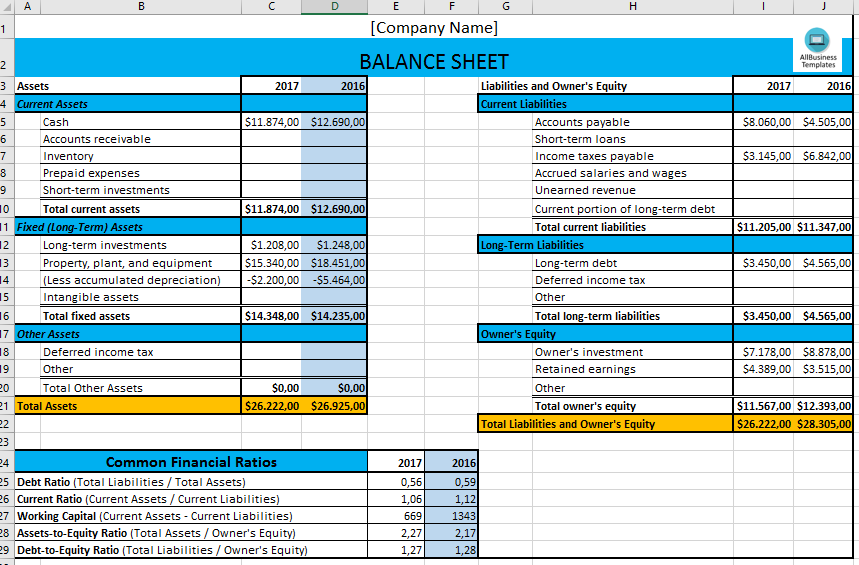

Creating a balance sheet in Microsoft Excel can be an excellent way to gain insights into your business's financial health. A balance sheet shows your company's assets, liabilities, and equity at a specific point in time, providing a snapshot that helps in decision-making processes. Here are five easy steps to create a balance sheet in Excel, which will help you get started with financial analysis efficiently.

Step 1: Set Up Your Excel Worksheet

- Open Microsoft Excel.

- Begin by formatting your sheet. In the first row, type the name of your business at the top of the sheet, center it, and make it bold.

- Below the business name, include the title “Balance Sheet,” the date, and a time frame (e.g., “For the Year Ending December 31, 2023”), also centered and formatted.

- Use columns to categorize your data. A suggested structure would be:

Column A Column B Column C Item Value Percent (%)

Step 2: List Your Assets

- In your balance sheet, assets are always listed first. They are what the company owns or controls.

- Create rows for different asset types:

- Current Assets (e.g., Cash, Accounts Receivable, Inventory, Prepaid Expenses)

- Fixed Assets (e.g., Property, Plant, Equipment)

- Intangible Assets (e.g., Goodwill, Trademarks)

- Input the value of each asset in column B.

- If you wish to track the percentage, use column C for calculations.

💡 Note: Ensure your entries for each category are clearly labeled to avoid any confusion.

Step 3: Record Liabilities and Equity

- Below the assets, list your liabilities, which are the obligations the company has to pay off.

- Subcategories might include:

- Current Liabilities (e.g., Accounts Payable, Short-Term Loans)

- Long-Term Liabilities (e.g., Bonds Payable, Mortgages)

- Equity follows liabilities, representing the owners’ stake in the company.

- Enter values for each liability and equity item in column B.

- Use formulas to total each section and ensure that the equation “Assets = Liabilities + Equity” holds true.

Step 4: Verify and Balance

- Double-check all your entries. Mistakes in financial reporting can lead to significant errors.

- Use Excel’s formulas to calculate totals for each section:

- =SUM(B10:B12) where B10 through B12 are the cells containing asset values.

- Repeat for Liabilities and Equity.

- Ensure the total of your assets equals the sum of liabilities and equity. This is the fundamental accounting equation.

💡 Note: If your balance sheet doesn’t balance, recheck all entries for accuracy.

Step 5: Format and Analyze

- Use Excel’s formatting tools to make your balance sheet visually appealing and easy to read:

- Apply borders, colors, and fonts for differentiation.

- Conditional formatting can highlight key figures or trends.

- Analyze your balance sheet:

- Look at the liquidity ratios, like the current ratio, to understand your short-term financial health.

- Assess your debt ratio to gauge the level of risk.

- Compare against previous periods to see trends in your financial stability.

- Remember that regular updates keep your balance sheet relevant and useful for decision-making.

In summary, creating a balance sheet in Excel provides valuable insights into your financial standing, helping you manage resources effectively. By following these steps, you've established a foundation for financial reporting that can be refined as your business evolves. Keep in mind the importance of accuracy and the need for updates to maintain the balance sheet's relevance.

What is the difference between assets, liabilities, and equity?

+

Assets are what your business owns or controls that have economic value, like cash, inventory, or property. Liabilities are what your business owes to others, such as loans or accounts payable. Equity represents the owners’ residual interest in the assets of the company after deducting liabilities.

How often should I update my balance sheet?

+

It’s recommended to update your balance sheet at least quarterly or with any significant business event or at the end of the fiscal year to ensure it reflects the current financial state of your company.

Can I use Excel formulas to automate calculations?

+

Yes, Excel’s formula features can be used to automate the calculation of totals, subtotals, and ratios, ensuring accuracy and saving time in the process of creating and updating your balance sheet.