Create Your Expense Sheet in Excel Easily

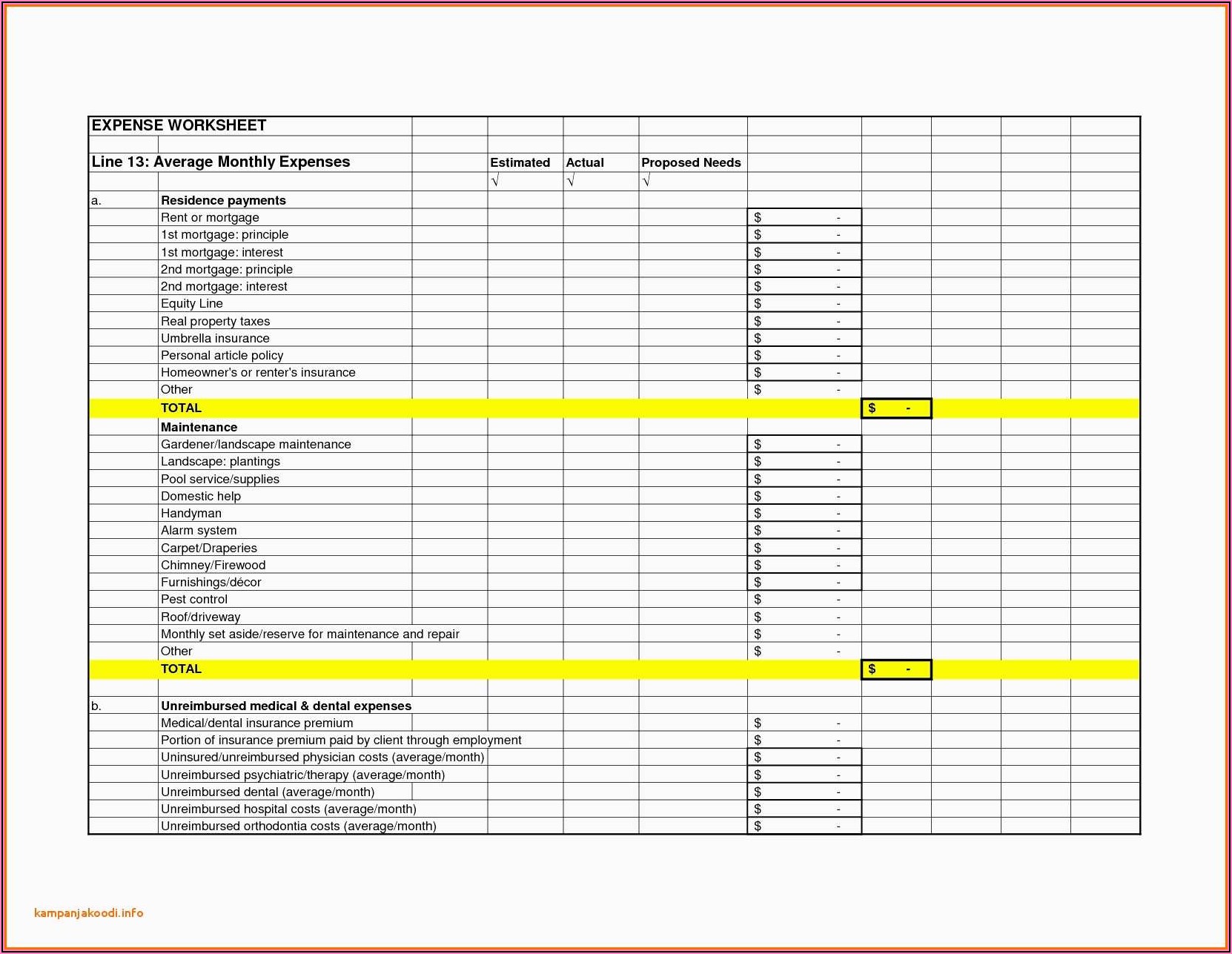

Managing personal or business finances can often feel like a daunting task, especially with the myriad of expenses to keep track of daily. Whether you're budgeting for household expenses, planning a trip, or overseeing financials for a small business, an organized approach to managing expenditures is crucial. One of the most effective tools for this purpose is Microsoft Excel, which provides a flexible platform for creating detailed and dynamic expense sheets. Here's how you can set up your own expense sheet in Excel with ease:

Setting Up Your Spreadsheet

Begin by opening Microsoft Excel. Here’s a step-by-step guide:

- Create a New Workbook: Click on ‘File’ and then ‘New’. Choose a blank workbook.

- Name the Sheet: Rename the first sheet to something like “Monthly Expenses” or “Project Expenses”.

- Setup Columns: Use the first row for headers. Common headers could include Date, Category, Description, Amount, and Payment Method.

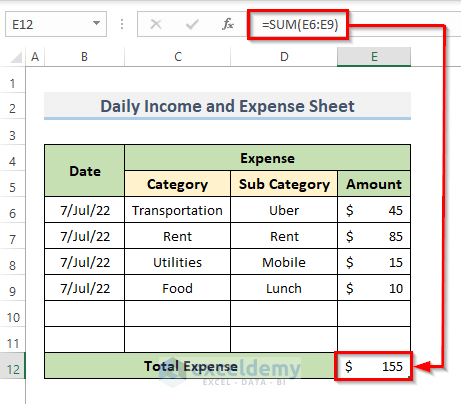

Data Entry

With your template ready, you can start entering your financial data:

- Under the “Date” column, input the date of each expense. You can format this column to display dates in any standard format you prefer.

- In the “Category” column, list out different expense categories like groceries, utilities, transport, etc. This helps in categorizing and analyzing where money is being spent.

- “Description” should contain a brief explanation of the expense. For example, “Electricity bill for May” or “Dinner at Italian restaurant”.

- Enter the amount spent under “Amount” in the currency you’re using.

- “Payment Method” can detail how the payment was made, whether by cash, credit card, bank transfer, etc.

💡 Note: Keep your entries consistent to ensure accurate data analysis and reporting.

Using Excel Functions for Automation

Excel comes with built-in functions that can automate much of the data processing:

- SUM: Add a row at the bottom of your expense list to calculate the total amount spent using

=SUM(D2:D100), where D is the column for amounts. - PIVOT Tables: Use Pivot Tables to analyze expenses by category or date. Go to ‘Insert’ > ‘PivotTable’ to start creating one.

- Conditional Formatting: To highlight categories or dates where expenses are unusually high, use conditional formatting. Select the range, go to ‘Home’ > ‘Conditional Formatting’, and choose the rules that fit your needs.

Adding Dynamic Elements

To make your spreadsheet more interactive:

- Data Validation: Limit entries in specific columns (like Category) to a predefined list to maintain data integrity.

- Drop Down Lists: Create drop-down lists for categories or payment methods to reduce data entry errors. Go to ‘Data’ > ‘Data Validation’, select ‘List’, and define your list.

- Charts: Add visual representations of your spending. Use ‘Insert’ > ‘Chart’ to select a chart type that fits your data visualization needs.

| Category | January | February | March |

|---|---|---|---|

| Utilities | 120</td> <td>125 | 130</td> </tr> <tr> <td>Groceries</td> <td>450 | 500</td> <td>470 |

| Travel | 80</td> <td>100 | $0 |

The journey towards efficient expense tracking in Excel starts with setting up a simple yet functional spreadsheet. By organizing your data clearly, automating calculations, and using dynamic elements, you can transform the mundane task of expense tracking into a streamlined process. This not only saves time but also provides a clear picture of your financial habits, allowing for better planning and potential savings.

This proactive approach to managing expenses in Excel can reveal spending patterns, highlight areas where you might cut back, and ensure that all your financial dealings are documented in a way that's easy to analyze. With practice, your Excel expense sheet will become an invaluable tool for both personal and business financial management.

Can I share my Excel expense sheet?

+

Yes, Excel allows you to share spreadsheets through OneDrive, SharePoint, or even email, where you can provide editing or viewing permissions to others.

What if I don’t know Excel well?

+

Begin with simple functions like SUM, then gradually explore features like pivot tables or conditional formatting as you get more comfortable with Excel. There are plenty of online tutorials and help guides available.

How can I ensure data accuracy?

+

Use Excel’s data validation rules to restrict input to specific formats or values, reducing errors in data entry. Regularly reconcile your entries with bank statements or receipts.