Create Your Perfect Budget Excel Sheet Easily

Why Budgeting is Essential

Budgeting is often regarded as the backbone of personal finance management. Whether you're aiming to save for a major purchase, reduce debt, or simply gain control over your spending, having a well-structured budget is the key to achieving these financial goals. In this comprehensive guide, we will explore how you can create your perfect budget using Excel, one of the most versatile and widely used tools for financial planning.

Understanding Your Financial Flow

Before you start crafting your budget, it's imperative to have a clear picture of your financial inflows and outflows:

- Income: This includes your salary, freelance earnings, investment income, or any other sources of regular money coming in.

- Expenses: Track all your expenditures, from fixed costs like rent and utilities to variable expenses such as groceries, entertainment, and spontaneous purchases.

Setting Up Your Excel Sheet

Excel is an excellent tool for budgeting due to its robust calculation capabilities, graphical representation features, and ability to update in real-time. Here's how you can set up your own budget:

Creating Categories

Begin by dividing your expenditures into logical categories:

- Fixed Expenses: Rent, mortgage, insurance, subscriptions

- Variable Expenses: Food, transport, entertainment, clothing

- Savings: Emergency funds, retirement, investments

- Debt: Credit cards, student loans, personal loans

Formatting Your Excel Sheet

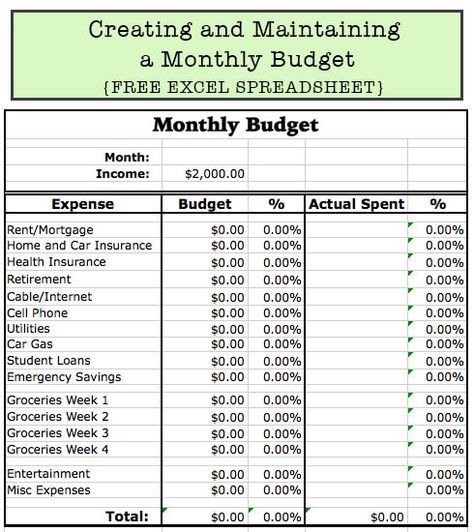

Here is a simple layout to get you started:

| Category | Estimated | Actual | Difference |

|---|---|---|---|

| Rent/Mortgage | |||

| Utilities | |||

| Groceries | |||

| Entertainment |

Fill in the estimated and actual expenses each month. The difference column can automatically calculate how much you're over or under your budget.

Using Formulas for Calculations

To automate your calculations:

- Use the SUM function to total your expenses.

- Subtract your total expenses from your total income to see your net balance.

- Apply conditional formatting to highlight when you go over budget in any category.

💡 Note: Utilize Excel’s formulas like SUMIF and VLOOKUP to manage and track specific categories or expenses more dynamically.

Visualizing Your Budget

A visual representation of your budget can make the abstract numbers more tangible. Here are a couple of ideas:

- Pie Charts: Show proportions of different expense categories.

- Line Graphs: Track your savings growth or debt reduction over time.

- Bar Charts: Compare estimated vs. actual expenses for each category.

Regular Updates and Review

To make your budget work:

- Update your sheet regularly; daily for variable expenses, weekly for fixed costs.

- Review your budget at the end of each month to adjust your estimations and set new goals.

📝 Note: Regular updates not only keep your budget current but also provide valuable insights into your spending habits.

Making Adjustments and Financial Goals

Your financial situation evolves, and so should your budget:

- Adjust categories based on lifestyle changes or new financial goals.

- Incorporate new income streams or recurring expenses as they arise.

As you get more comfortable with Excel, you can enhance your budget with features like:

- Macros: Automate repetitive tasks like monthly updates.

- Pivot Tables: Analyze your financial data from different perspectives.

💻 Note: Explore online resources or take an Excel course to master advanced features for more sophisticated budgeting.

Summarizing the journey we've taken, budgeting with Excel is not just about tracking numbers; it's about gaining control over your finances and setting the foundation for a financially secure future. By implementing a well-thought-out budget, you can visualize your financial flow, set realistic goals, and make informed decisions that pave the way towards financial independence and peace of mind.

How often should I update my budget?

+

Update your budget daily for variable expenses, weekly for fixed costs, and conduct a thorough review at the end of each month.

Can I track non-monthly expenses?

+

Absolutely, set up categories for annual, bi-annual, or one-time expenses and allocate funds accordingly throughout the year.

What if my income varies each month?

+

Estimate your average income over several months and create a buffer category for income fluctuations. Adjust your expenses to match your lowest income expectations.