Mastering Excel: Create a Trial Balance Sheet Easily

Excel, an indispensable tool for accountants and finance professionals, offers robust features for financial analysis and reporting. Among these, generating a trial balance sheet efficiently showcases Excel's power in simplifying complex tasks. This guide will walk you through the steps to create a trial balance sheet in Excel, ensuring your financial data is not only well-organized but also easily analyzable.

Understanding Trial Balance Sheet

Before diving into Excel functionalities, it's essential to grasp the purpose of a trial balance sheet:

- Verification Tool: It helps in verifying the ledger accounts' mathematical accuracy by listing all accounts' debit and credit balances.

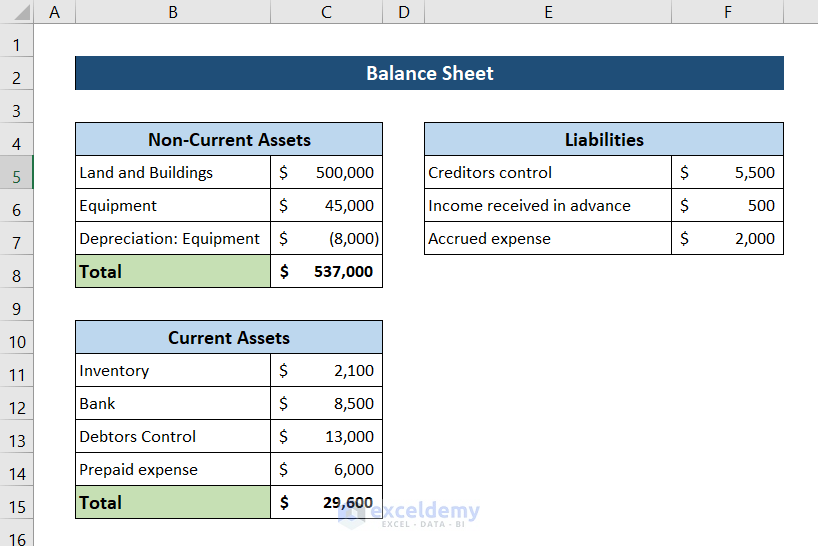

- Precursor to Financial Statements: It's the first step in preparing income statements, balance sheets, and cash flow statements.

- Highlighting Discrepancies: The trial balance can quickly expose any discrepancies or errors in ledger entries.

Preparation Before Using Excel

Here are the steps to prepare before jumping into Excel:

- Organize Your Data: Gather all ledger accounts and their respective balances.

- Understand Account Types: Be familiar with account classifications - Assets, Liabilities, Equity, Revenue, and Expenses.

- Data Integrity: Ensure your entries are error-free; any mistake in data entry will lead to an incorrect trial balance.

Setting Up Excel for Trial Balance

Let's now delve into setting up Excel for a trial balance:

Data Entry

- Enter your account names, types, and balances into separate columns. Here's how to format this:

Column A Column B Column C Column D Account Name Account Type Debit Balance Credit Balance

- Ensure accurate account classification and leave debit or credit fields blank if the balance is zero.

Formatting Tips

- Header Formatting: Use merged cells for column headers to make them stand out.

- Conditional Formatting: Apply it to highlight discrepancies or accounts with zero balances.

- Data Validation: Implement data validation for account types to avoid typos or misclassifications.

Creating the Trial Balance

Using Formulas

Excel’s formulas simplify the trial balance creation process:

- To sum debit balances:

=SUM(C2:C10) - Similarly, for credits:

=SUM(D2:D10) - Calculate the total (ensure it’s zero):

=SUBTOTAL(9, C2:D10)

✅ Note: Ensure that your formula range includes only the data cells to avoid including the headers or totals in your calculations.

Formatting Your Trial Balance

- Column Adjustments: Auto-fit columns to make the data legible.

- Cell Borders: Apply borders for clarity.

- Number Formatting: Format numeric cells to display as currency or with two decimal points for consistency.

Summarizing Your Findings

Once your trial balance is complete, ensure:

- The total debit balance equals the total credit balance, indicating an arithmetically balanced ledger.

- There are no discrepancies or errors, which could require you to re-check your ledger entries.

- You can proceed with preparing other financial statements based on this balanced sheet.

Final Touches and Analysis

Finalize your trial balance by:

- Checking for any anomalies or accounts with unusual balances.

- Adding comments or notes for auditors or colleagues for clarity.

- Utilizing conditional formatting for easy data interpretation, such as highlighting net balances.

Creating a trial balance sheet in Excel isn't merely about data entry; it's about ensuring the accuracy of your financial reporting. By following the outlined steps, you've not only mastered the creation process but also ensured that your financial data is well-organized, understandable, and ready for further financial analysis or statement preparation. Remember, the key lies in meticulous data entry, the appropriate use of Excel features, and a thorough review process. With this knowledge in hand, you can confidently navigate through financial reporting, enhance your Excel skills, and make data-driven decisions with ease.

What if my trial balance doesn’t balance?

+

If your trial balance doesn’t balance, check for common errors like transposition errors in account balances, ensuring all transactions are recorded, and double-checking the account classifications. If discrepancies persist, review your ledger entries thoroughly.

Can I use Excel for more complex financial statements?

+

Yes, Excel is versatile enough to create various financial statements like income statements, balance sheets, and even cash flow statements. It’s a powerful tool for financial modeling and analysis.

How often should I update my trial balance?

+

Depending on your reporting needs, monthly updates are common. However, for internal control or audit purposes, you might update it more frequently or at the close of each accounting period.