5 Steps to Craft a Simple Balance Sheet in Excel

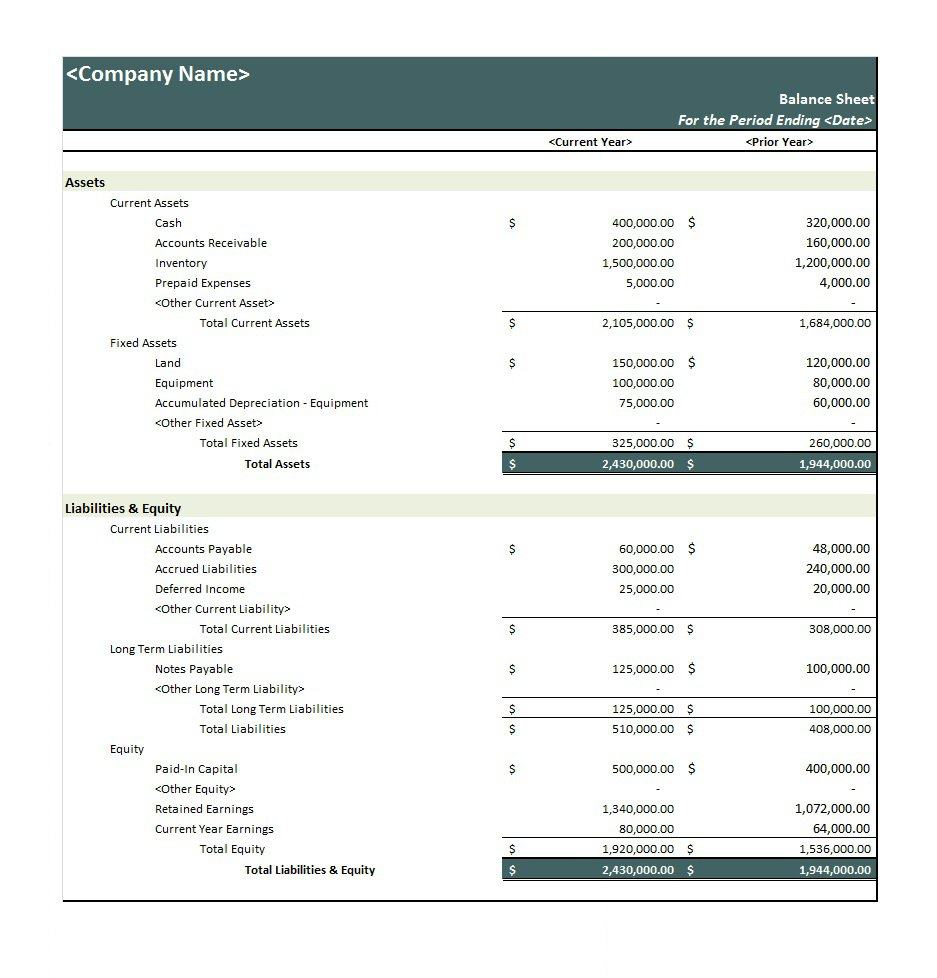

Welcome to our comprehensive guide on crafting a simple balance sheet in Excel! Whether you're a small business owner, a student learning finance, or someone looking to understand your personal finances better, mastering the balance sheet is crucial. This document provides a snapshot of your financial health at a specific point in time, detailing what you own (assets), what you owe (liabilities), and the net worth of your entity or personal finances. Here's how you can create one using Excel.

Step 1: Set Up Your Spreadsheet

Before diving into the numbers, you need to organize your Excel spreadsheet to ensure that all information is clearly presented and easy to understand.

- Open Excel and create a new workbook.

- Label the first row with your balance sheet title and date, for example: Balance Sheet as of December 31, 2023

- In the second row, name three columns: Assets, Liabilities, and Owner’s Equity

Step 2: List Your Assets

Assets are everything of value you or your company owns that can be converted into cash. Here are the steps to list them:

- Current Assets: Include cash, inventory, accounts receivable, etc.

- Fixed Assets: These are long-term assets like property, plant, and equipment.

- Other Assets: This might include intangible assets, prepaid expenses, etc.

Enter these categories under the “Assets” column, then input specific items beneath each category with their corresponding value.

| Assets | Current | Fixed | Other |

|---|---|---|---|

| Cash | $10,000 | ||

| Accounts Receivable | $2,000 | ||

| Inventory | $5,000 | ||

| Property | $150,000 |

💡 Note: If you have a significant number of assets, consider using subtotals within categories for better readability.

Step 3: Enumerate Your Liabilities

Liabilities represent what you owe. Just like assets, these are listed under their respective categories:

- Current Liabilities: Short-term financial obligations like accounts payable, short-term loans, etc.

- Long-Term Liabilities: Loans, mortgages, or bonds payable that are due over a longer period.

- Other Liabilities: Miscellaneous debts or deferred revenue.

List these under the “Liabilities” column, detailing each item with its amount.

| Liabilities | Current | Long-Term | Other |

|---|---|---|---|

| Accounts Payable | $3,000 | ||

| Short-term Loans | $1,000 | ||

| Mortgage | $100,000 |

Step 4: Calculate Owner’s Equity

Owner’s equity or shareholders’ equity is what’s left after subtracting liabilities from assets. This section is crucial for understanding the financial health and ownership value:

- Start with the capital contributed by the owner(s).

- Add in retained earnings from previous years.

- Include any additional investments or donations by the owner.

- Subtract any owner’s withdrawals or distributions.

- Sum these up under “Owner’s Equity”.

👉 Note: The formula for calculating Owner’s Equity is: Assets - Liabilities = Owner’s Equity

Step 5: Verify Your Balance Sheet

Finally, you need to ensure your balance sheet balances:

- Sum up the total of assets, total liabilities, and owner’s equity.

- Apply the accounting equation: Assets = Liabilities + Owner’s Equity

- If they don’t equal, review your data for errors or omissions.

Once verified, save your balance sheet for record-keeping or for further analysis.

Creating a balance sheet in Excel might seem daunting initially, but it becomes straightforward with practice. It not only helps in understanding your financial position but also serves as an essential tool for business management, investors, and financial analysts. Remember, the key to a useful balance sheet is accurate data entry, regular updates, and meticulous attention to ensuring that it balances. This financial statement can guide your future financial decisions, provide insight into financial stability, and assist in strategic planning.

Why is it important to balance a balance sheet?

+

A balance sheet that balances ensures that the accounting equation holds true (Assets = Liabilities + Owner’s Equity). This balance reflects the principle of double-entry bookkeeping, showing that all financial transactions have been recorded accurately.

Can I include depreciation in a simple balance sheet?

+

Yes, you can include depreciation in your balance sheet by reducing the book value of your fixed assets. However, in a simple balance sheet, you might not detail this calculation, but it’s implicitly considered when listing the value of fixed assets.

What should I do if my balance sheet doesn’t balance?

+

If your balance sheet doesn’t balance, you should review your entries for arithmetic errors, ensure all transactions are recorded correctly, and recheck any manual calculations. Often, a minor error in data entry can throw off the entire balance.