Create a Simple Invoice in Excel: Step-by-Step Guide

In today's fast-paced business environment, creating an invoice swiftly and efficiently is crucial for managing cash flow and maintaining professionalism. Excel, being one of the most versatile tools available, simplifies this task by allowing you to create a customizable invoice template that can be adapted for various types of businesses. This step-by-step guide will walk you through the process of making a simple invoice in Excel.

Setting Up Your Workbook

Begin by opening Microsoft Excel and creating a new blank workbook. Here’s how to set up the basic structure of your invoice:

- Enter company information at the top

- Create sections for Invoice Details, Bill To, and Line Items

- Summarize financial totals at the bottom

Company Information

Start by entering your business details:

- Business Name

- Address

- Phone Number

- Email Address

- Tax ID (if applicable)

Invoice Details

Include key invoice identifiers:

- Invoice Number

- Invoice Date

- Due Date

- Client Name

- Client Address

- Payment Terms

Bill To Section

Here you’ll specify:

- Client’s Company Name

- Contact Person

- Client’s Address

- Client’s Phone Number

- Email Address

Line Items

This section will detail the goods or services provided:

| Description | Quantity | Unit Price | Amount |

|---|---|---|---|

| Product/Service 1 | 2 | 50</td> <td>100 | |

| Product/Service 2 | 3 | 30</td> <td>90 |

Financial Totals

Summarize your invoice with:

- Subtotal

- Discounts or Tax (if applicable)

- Total Due

Formatting Your Invoice

Enhance readability and professionalism with Excel’s formatting features:

- Apply cell borders to create a structured layout

- Use bold and larger fonts for headers and titles

- Adjust column widths for readability

- Merge cells where necessary for titles

- Use text alignment to center or left-align information

- Add a color scheme for visual appeal

💡 Note: When merging cells, ensure that the merged cell can accommodate all text while maintaining visual appeal.

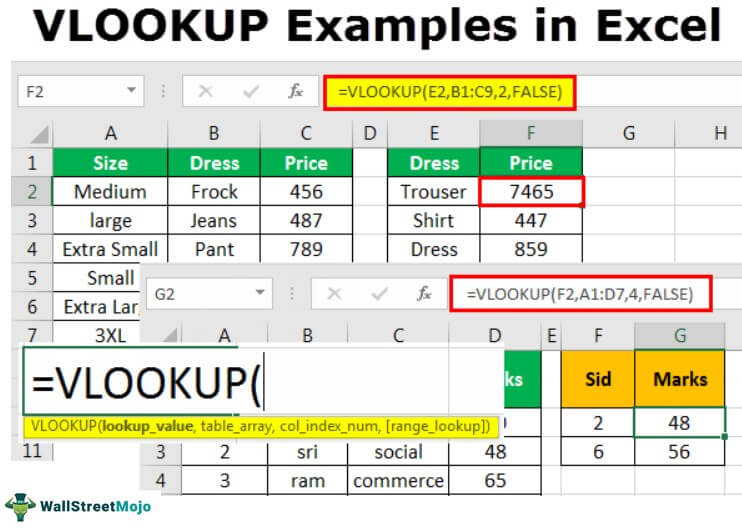

Automating Calculations

Excel’s calculation capabilities can automate your invoice calculations:

- Use SUM for the subtotal of the ‘Amount’ column

- Add conditional formulas for discounts or taxes

- Calculate the Total Due by summing up all relevant totals

💡 Note: Excel's formulas can auto-update when changes are made, ensuring accuracy in your invoices.

Final Touches and Review

Before sharing or sending the invoice, review these steps:

- Ensure all details are correctly entered

- Check for formula errors by validating cells with formulas

- Add a professional signature or logo if needed

- Protect the worksheet to prevent unauthorized changes

💡 Note: When protecting the worksheet, make sure to allow necessary cells for editing, like the line item details.

With this guide, you have now learned to create a simple yet functional invoice in Microsoft Excel. By following these steps, you can generate professional, accurate, and customized invoices that meet your business's needs. Remember to keep your invoice template updated with any changes in business details or tax laws to ensure compliance and professionalism.

Can I customize the layout further?

+

Absolutely! Excel allows for extensive customization. You can adjust cell colors, change fonts, add your company logo, or even include additional sections tailored to your business’s needs.

How do I update the invoice for recurring clients?

+

For recurring clients, save a copy of the invoice and simply update the invoice date, line items, and totals. Keep a master template with placeholders for regular updates.

Is there a way to automate my invoices in Excel?

+

Yes, Excel has functionalities like macros and formulas that can be set up to automate repetitive tasks, though more complex setups might require Excel VBA programming skills.

How can I ensure my invoice is legally compliant?

+

Make sure to include mandatory elements like business name, tax ID, date, due date, and a detailed description of services or goods. Compliance rules can vary by country or state, so check local regulations.

Can I use this invoice template for international clients?

+

Yes, but ensure to convert currency correctly and include any required international payment details. Also, consider adding a section for international tax considerations if applicable.