Create a Simple Balance Sheet in Excel 2016 Easily

Why Use Excel for a Balance Sheet?

Excel is a powerful tool that many businesses and individuals rely on for financial management. Here's why Excel is ideal for creating a balance sheet:

- Customization: Excel allows you to tailor your balance sheet to your specific needs, adjusting column widths, formatting cells, and applying different styles.

- Calculation Efficiency: With built-in formulas and functions, Excel performs calculations automatically, reducing the chance of human error.

- Data Integrity: Excel ensures that the data is organized and protected with features like data validation, conditional formatting, and password protection.

- Easy to Use: Even those with minimal experience can navigate Excel's interface, making it accessible for creating financial documents.

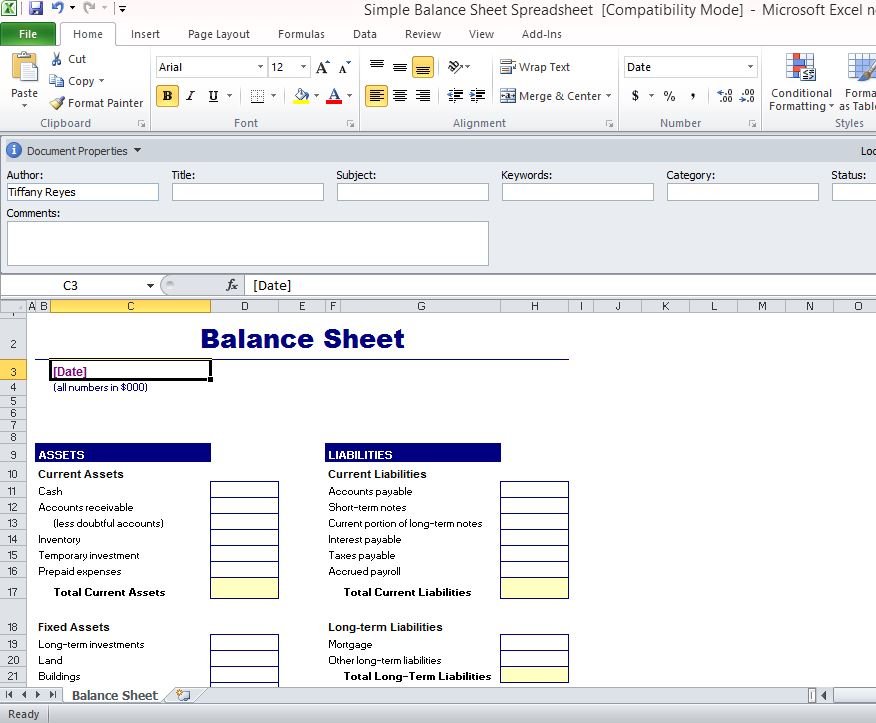

To start creating your balance sheet in Excel 2016:

Steps to Create a Simple Balance Sheet

1. Open Excel and Set Up Your Spreadsheet

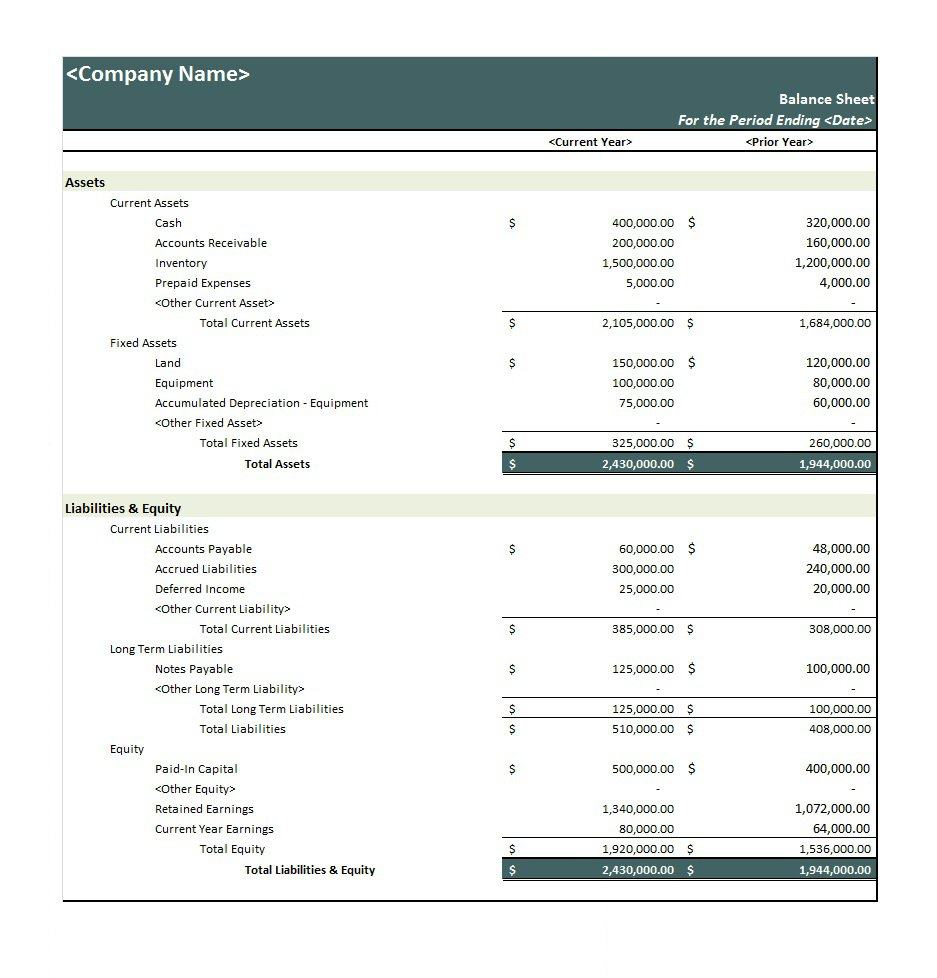

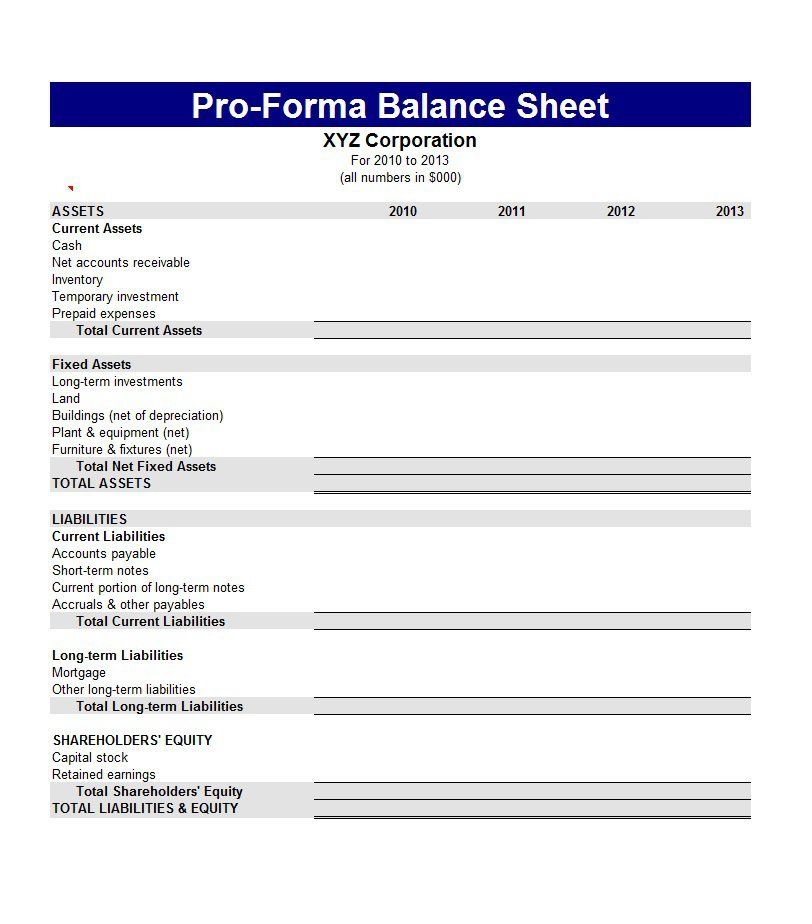

Launch Excel and open a new workbook. Decide on the layout of your balance sheet. Typically, a balance sheet includes two main sections:

- Assets: What you own, which includes current and non-current assets.

- Liabilities and Equity: What you owe and the owner's equity.

In the top row, you can label the sections:

| Assets | Liabilities | Equity |

|---|

📝 Note: Keep your layout simple for clarity. Too many columns or complex formulas might confuse users and hinder readability.

2. Label Your Rows

Next, list the common balance sheet items under each section:

- Assets:

- Cash

- Accounts Receivable

- Inventory

- Fixed Assets

- Liabilities:

- Accounts Payable

- Short-term Debt

- Long-term Debt

- Equity:

- Owner's Equity

- Retained Earnings

3. Input Values

Start entering your financial data into the cells. Remember:

- Assets go on the left, Liabilities and Equity on the right.

- Use positive numbers for all entries since balance sheets show values at a point in time.

- You can include totals for each section.

📊 Note: Consider using cell references or named ranges for clarity and ease of updating data.

4. Calculate Totals

To make sure your balance sheet is accurate:

- Use the

=SUM()function to add up all entries in each section. - Ensure that the total assets are equal to the total liabilities plus total equity.

Here's an example:

| Total Assets | Total Liabilities | Total Equity |

|---|---|---|

=SUM(B2:B5) |

=SUM(D2:D4) |

=SUM(E2:E3) |

📋 Note: Use conditional formatting to highlight discrepancies if the totals do not balance. This can help in quickly identifying errors.

5. Format Your Balance Sheet

A well-formatted balance sheet enhances readability and professionalism:

- Use consistent colors for headers and totals.

- Apply number formatting for currency.

- Align text and numbers appropriately (text left-aligned, numbers right-aligned).

- Ensure fonts are clear and legible.

💡 Note: Formatting is key. Consider using styles to make your balance sheet look professional and easy to understand.

6. Review and Adjust

Before finalizing your balance sheet:

- Check for calculation errors or inaccuracies.

- Adjust the layout or formatting if necessary for clarity.

- Consider adding comments or notes for any item that might need explanation.

👁️🗨️ Note: Make sure to save your work regularly and perhaps create a backup in case of any unforeseen issues.

Creating a balance sheet in Excel 2016 is a straightforward process when you follow these steps. Excel’s intuitive interface, along with its powerful calculation and formatting capabilities, makes it an ideal tool for financial reporting. A well-prepared balance sheet not only helps in understanding the financial position of your business but also assists in making informed decisions. By ensuring that your assets, liabilities, and equity are accurately presented, you equip yourself with the knowledge to navigate through financial planning, tax preparation, or even for seeking investment.

What’s the difference between current and non-current assets?

+

Current assets are cash or other assets expected to be converted to cash or consumed within a year. Non-current assets, like fixed assets, are held for longer periods and are not expected to be liquidated in the near term.

Why should assets equal liabilities plus equity?

+

According to the accounting equation, Assets = Liabilities + Equity. This fundamental principle represents the basis of double-entry bookkeeping, ensuring that the resources of a business (assets) are funded by either borrowed funds (liabilities) or owners’ investments (equity).

Can Excel handle complex balance sheets for large corporations?

+

Absolutely, Excel is versatile enough to manage complex balance sheets for corporations. However, as businesses grow, they often turn to more specialized software for financial reporting due to increased complexity and audit requirements.