5 Essential Tips to Track Expenses in Excel Daily

When it comes to managing your finances effectively, tracking your daily expenses is a critical habit. Microsoft Excel, with its robust functionality, can serve as a powerful tool to monitor your expenditures. Here are five essential tips to track your expenses in Excel daily:

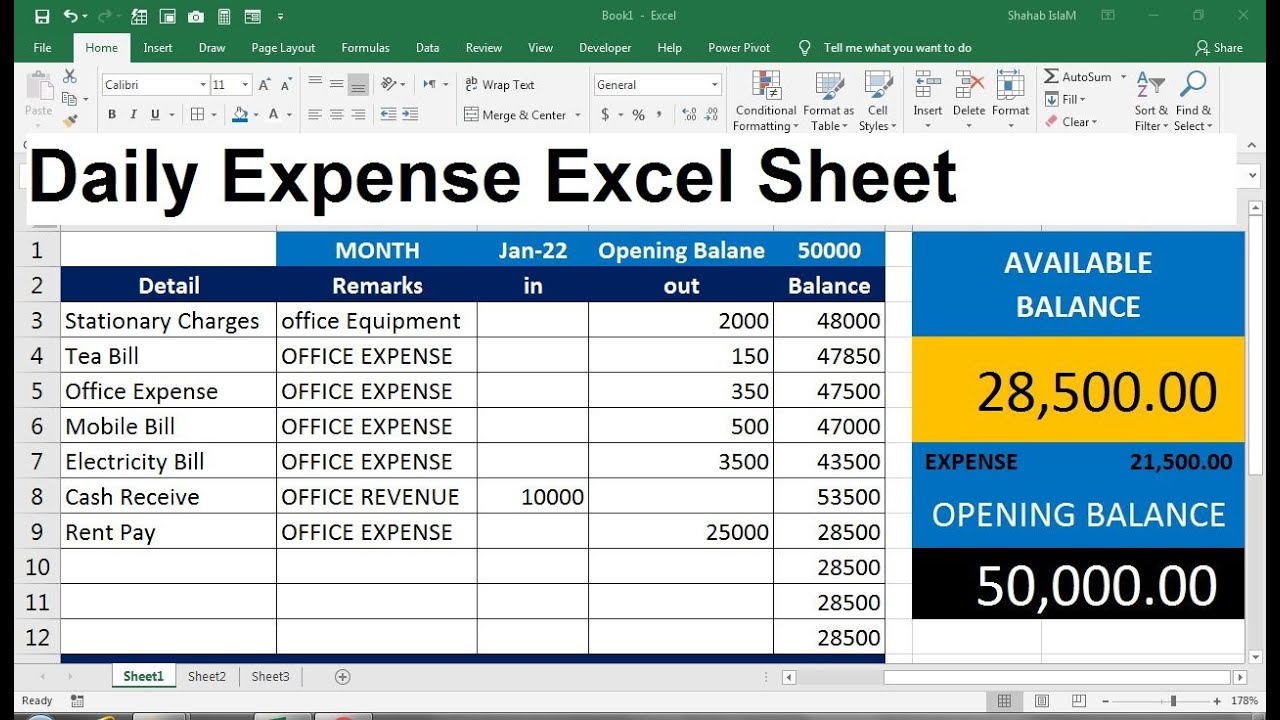

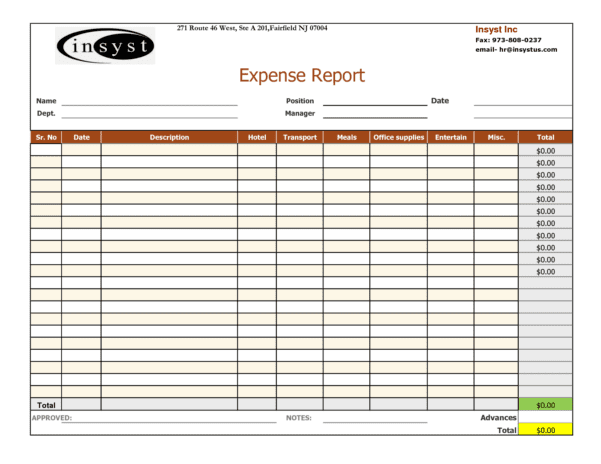

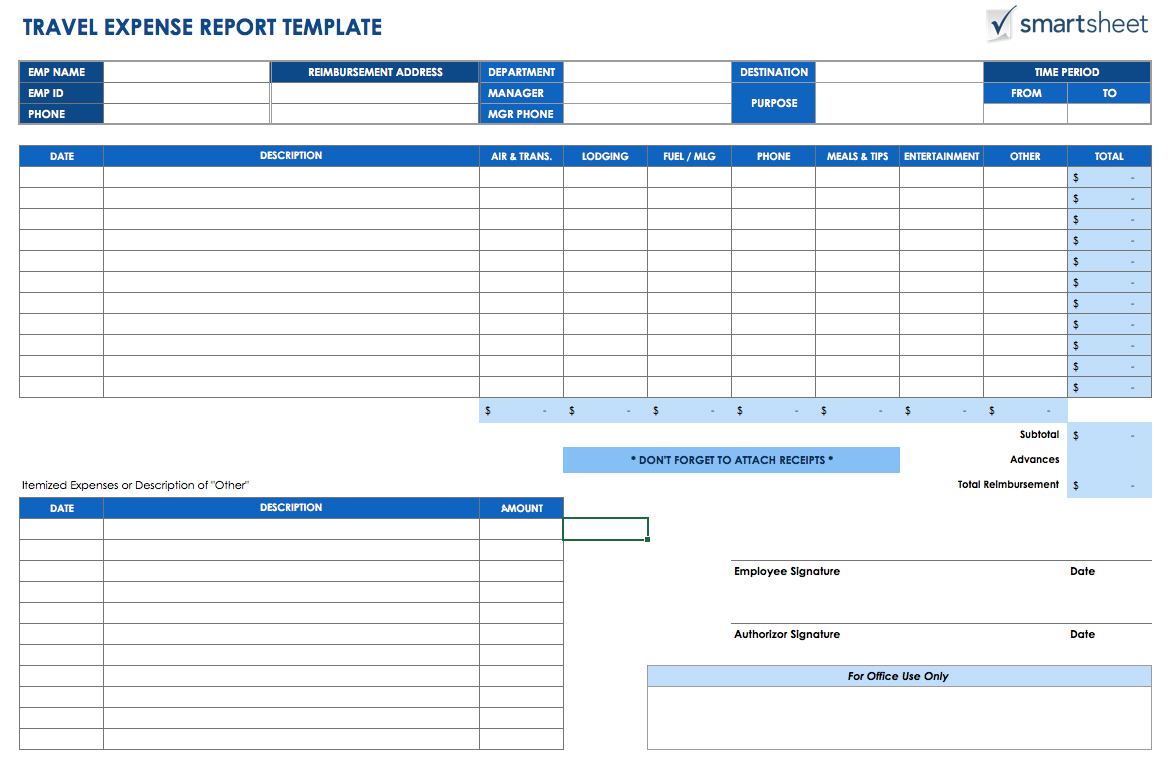

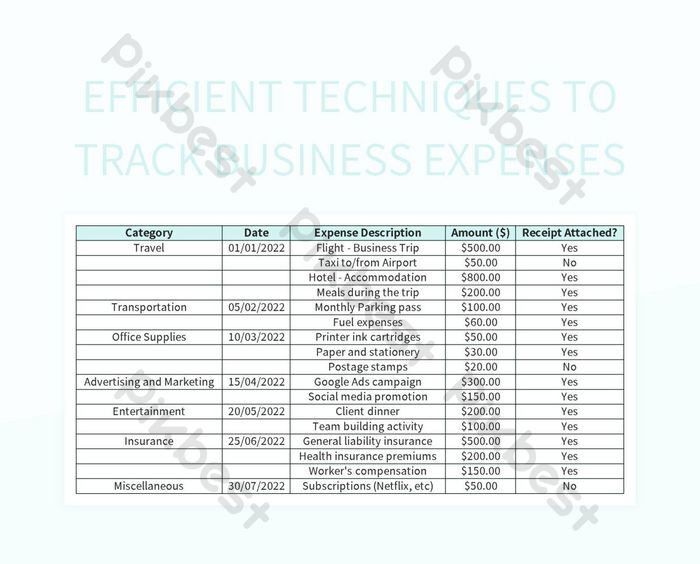

1. Set Up a Structured Template

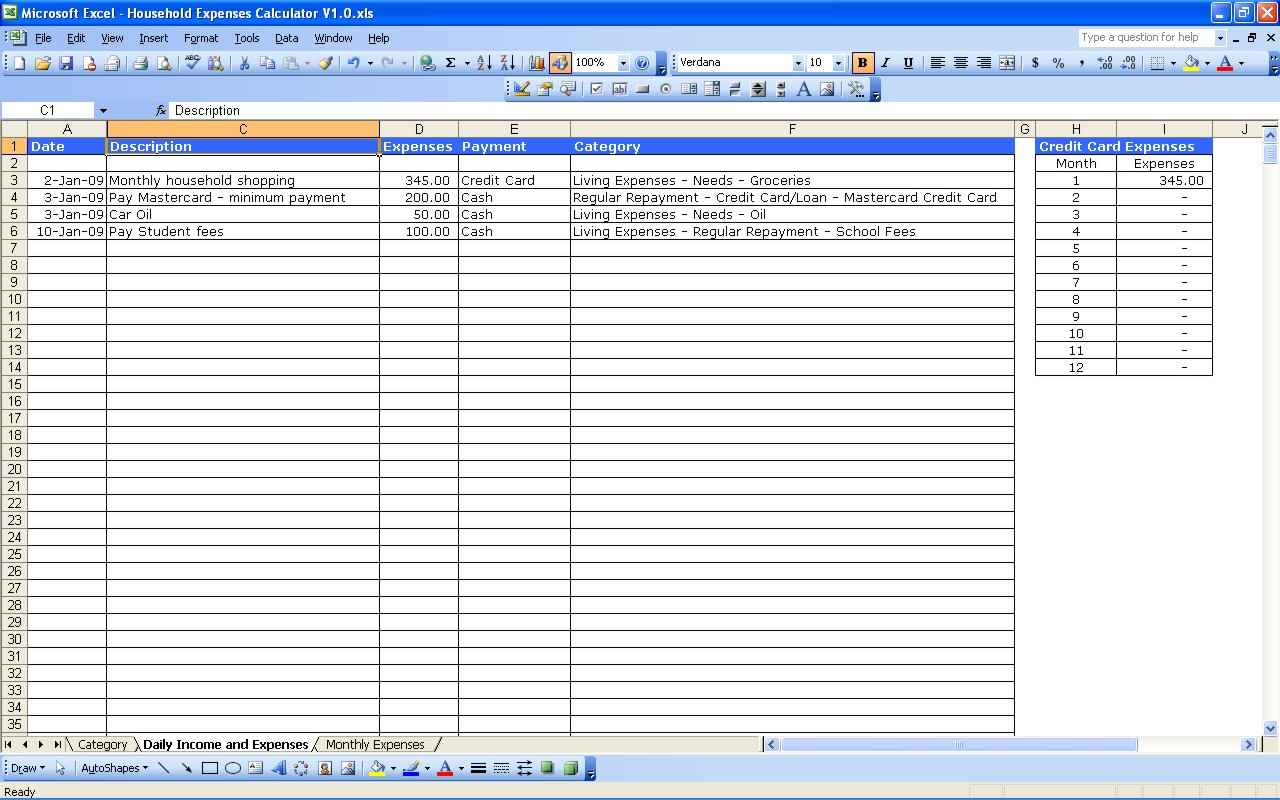

Before you start tracking, you need a template that suits your needs. Here’s how you can set it up:

- Create columns for Date, Category (e.g., Food, Transportation, Entertainment), Description (specific details of the expense), Amount (in currency), and Payment Method (Cash, Card, etc.).

- Format dates to ensure consistency, like using

MM/DD/YYYYformat. - Consider adding columns for Receipt Number or Merchant if needed for future reference or tax purposes.

📝 Note: Keeping your template simple yet informative can help in maintaining daily entries with ease.

2. Use Formulas to Summarize Data

Excel’s formulas are your ally in summarizing data quickly:

- Use

SUMIForSUMIFSto calculate totals for each category or the entire month. For instance,=SUMIF(Category, “Food”, Amount)will sum up all entries in the “Food” category. - Create a separate sheet for monthly summaries where you can track trends, set budget limits, and compare with previous months.

- Implement conditional formatting to highlight over-spending or categories nearing their budget limits.

🔍 Note: Excel formulas can automatically update totals as you enter new expenses, saving you time and reducing manual errors.

3. Regularly Update and Reconcile

Daily entries ensure accuracy and timeliness:

- Make it a habit to enter each expense as soon as it occurs. You can use mobile apps that sync with Excel if you’re not near a computer.

- Once a week, or at least monthly, reconcile your Excel entries with your bank statements to ensure all transactions are accounted for.

📅 Note: Regular updates prevent backlog and inaccuracies in your expense tracking.

4. Utilize Charts for Visual Tracking

Charts make tracking and understanding your spending visually easier:

- Use pie charts to see how your money is distributed among different expense categories.

- Line or bar graphs can illustrate spending trends over time, helping you identify patterns or anomalies in your expenses.

📊 Note: Visual data representation can reveal spending habits that might not be apparent from numbers alone.

5. Backup and Share Data

Ensuring data integrity and accessibility:

- Regularly back up your Excel file to avoid data loss. Cloud storage like OneDrive or Google Drive can be automatic and secure.

- Share your Excel workbook with a partner or accountant if necessary. Excel allows collaborative editing, making it easier for multiple people to manage finances.

💾 Note: Sharing and backup are essential to prevent data loss and facilitate teamwork in financial management.

By implementing these tips, you'll be well on your way to mastering your personal finances through Excel. The structured approach, regular updates, and visual aids will not only help you track your expenses daily but also give you insights into your spending habits, allowing for better budgeting and financial decision-making.

Can I track my expenses in real-time with Excel?

+

While Excel isn’t inherently real-time, you can use mobile apps linked with Excel for mobile entry. This will allow you to add expenses on-the-go, syncing with your Excel file when online.

How often should I update my expense tracker?

+

Ideally, you should update your expense tracker daily to ensure all expenses are accurately recorded. However, reconciling your entries with bank statements should be done at least weekly or monthly.

What if I need to track more complex expenses?

+

Excel can handle complex tracking. Use multiple sheets for different accounts or projects, advanced formulas for calculations, and perhaps even VBA scripting for automation if needed.