5 Ways to Import Excel Sheets into Virtual Tax

Managing your tax documentation effectively is crucial for seamless tax reporting and compliance. Importing Excel sheets into Virtual Tax can streamline this process, reducing manual data entry, minimizing errors, and ensuring your financial data is current and accurate. Here are five comprehensive methods to import your Excel sheets into Virtual Tax software, tailored to both individual and business needs:

1. Manual Import via CSV

Manual Import using CSV files is the most straightforward method, especially for smaller datasets:

- First, convert your Excel sheet to a CSV file, which is universally readable by tax software.

- Log into your Virtual Tax account and navigate to the Import Data section.

- Choose Upload CSV File from the options provided.

- Select your CSV file from your computer, review the field mapping (the way your data corresponds to Virtual Tax fields), and import it.

Manual import is ideal for:

- Small businesses or individuals with less frequent tax filings.

- Situations where tax professionals need to manually adjust specific entries for accuracy.

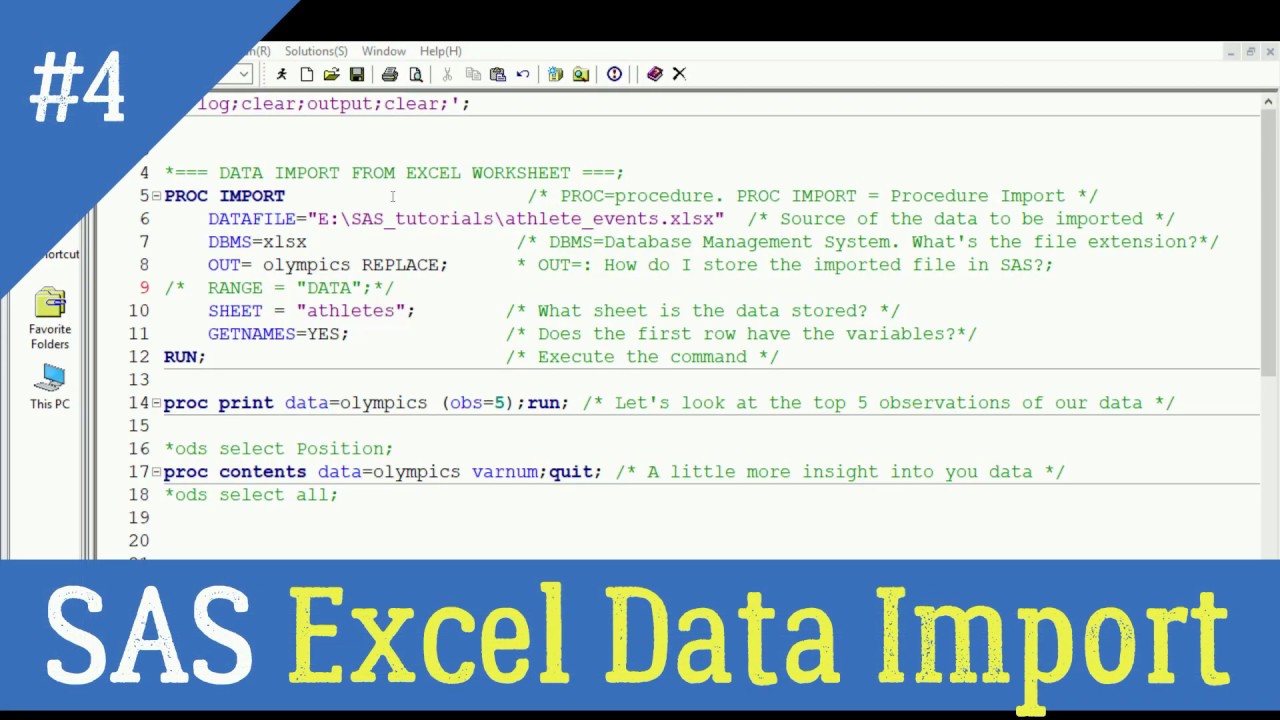

2. Batch Import via API

For larger organizations handling substantial volumes of financial data, a Batch Import through an API (Application Programming Interface) is efficient:

- Ensure your Excel sheet conforms to the specific format required by Virtual Tax.

- Access the developer's portal in Virtual Tax, where you can find instructions on setting up an API key.

- Use the Virtual Tax API to establish a connection, map your Excel data to Virtual Tax fields, and execute a batch import.

Benefits of API integration:

- Allows for automated data synchronization, keeping your tax records up-to-date without human intervention.

- Facilitates large-scale data import, reducing manual workload and potential for human error.

3. Direct Import with Add-Ons

Many accounting and tax software, including Virtual Tax, offer add-ons that can simplify importing Excel data:

- Install the appropriate Virtual Tax add-on for your Excel or accounting software.

- Link your Virtual Tax account to the add-on, which will establish a direct connection.

- Use the add-on interface to map your Excel data to Virtual Tax's data fields and import your financial information.

Considerations for add-ons:

- Ensure that the add-on supports the Excel format you are using.

- Review any limitations regarding the volume of data the add-on can process in one go.

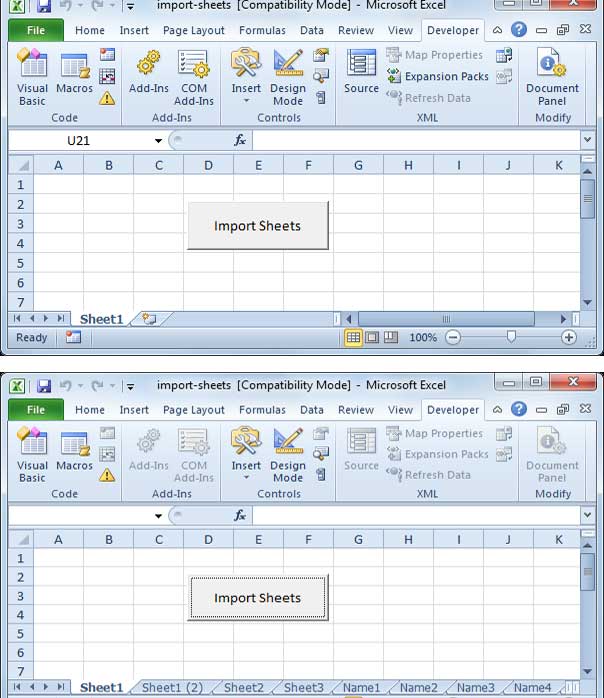

4. Sync with Cloud Storage Solutions

Cloud storage platforms like Dropbox, Google Drive, or OneDrive offer a seamless way to keep your tax documentation synced:

- Upload your Excel sheet to your preferred cloud storage service.

- Connect Virtual Tax to this cloud service by providing necessary permissions or API keys.

- Configure Virtual Tax to automatically import new or updated files from your cloud storage, ensuring your tax data is always current.

Advantages of this approach:

- Allows for real-time updates, reducing the need for manual imports.

- Provides a secure backup of your tax-related documents.

5. Optical Character Recognition (OCR) and Data Entry

For paper-based records or non-standard Excel formats, OCR technology can extract data from scanned documents:

- Use an OCR software or Virtual Tax’s built-in OCR feature to scan your documents.

- The system will attempt to read, interpret, and convert the data into an importable format.

- Review and correct the data as needed before importing into Virtual Tax.

Important considerations:

- OCR accuracy depends on the quality of the scanned documents. Ensure clarity to minimize errors.

- Some manual data review and correction might still be necessary to maintain data integrity.

💡 Note: Before importing any data, ensure your Excel sheets are formatted correctly. Virtual Tax will map the data based on predefined column headers or specific data structures.

Each of these methods offers distinct advantages for importing Excel data into Virtual Tax, enabling better tax management. They cater to different scales of data handling and ensure that your tax documentation process is as efficient as possible. Selecting the most suitable method depends on your data volume, the frequency of your tax filings, and your comfort level with technology.

What is the advantage of using an API for importing tax data?

+

Using an API allows for automated data syncing, making the process seamless for businesses with large volumes of tax data. It reduces manual effort, ensures accuracy, and keeps records current.

Can I import data from my accounting software to Virtual Tax?

+

Yes, many tax and accounting software solutions offer direct import options or add-ons for integrating with Virtual Tax, simplifying the data transfer process.

How often should I import my tax data?

+

The frequency of importing data depends on your business’s tax obligations. For monthly filings, import monthly. For yearly, consider syncing once a quarter to ensure accuracy.