How to Remove Your Name from House Documents Easily

Deleting your name from property-related documents might seem like a daunting task, but with the right guidance, it can be streamlined. Whether you are looking to update property records, remove yourself from a mortgage, or just simplify your estate, understanding the procedure is beneficial. This guide provides detailed steps for you to confidently navigate this legal process.

Step-by-Step Guide to Removing Your Name from House Documents

Understanding Property Deeds

Before you delve into the process, familiarize yourself with property deeds:

- Warranty Deed: Promises that the property title is clear.

- Quitclaim Deed: Transfers interest in the property without any warranty.

- Deed of Trust: Often involves a third party in a mortgage agreement.

🔍 Note: Different types of deeds might require different handling. Be sure to consult legal advice if you’re unsure which applies to your case.

Legal Consultation

To ensure you understand the implications and follow the correct procedure:

- Seek an attorney or a title company for guidance.

- Discuss potential tax implications and liabilities.

Preparing the Quitclaim Deed

Once you’ve decided to proceed:

- Download a quitclaim deed form from your state’s official website or purchase one from an office supply store.

- Complete the deed with accurate personal information for both the grantee and grantor.

- Sign the document in front of a notary.

- Retain a copy for your records.

Recording the Deed

Record the quitclaim deed with the appropriate government office:

- Locate your county recorder or register of deeds.

- Pay the recording fee, typically between 10 to 30.

- Wait for confirmation that the deed has been recorded.

Notifying Parties

Inform related parties to ensure a smooth transition:

- Notify your lender if you’re removing your name from a mortgage.

- Inform any homeowner association, property management, or relevant agencies.

- Update records with utility providers.

📢 Note: Failing to notify can lead to billing issues or disputes later.

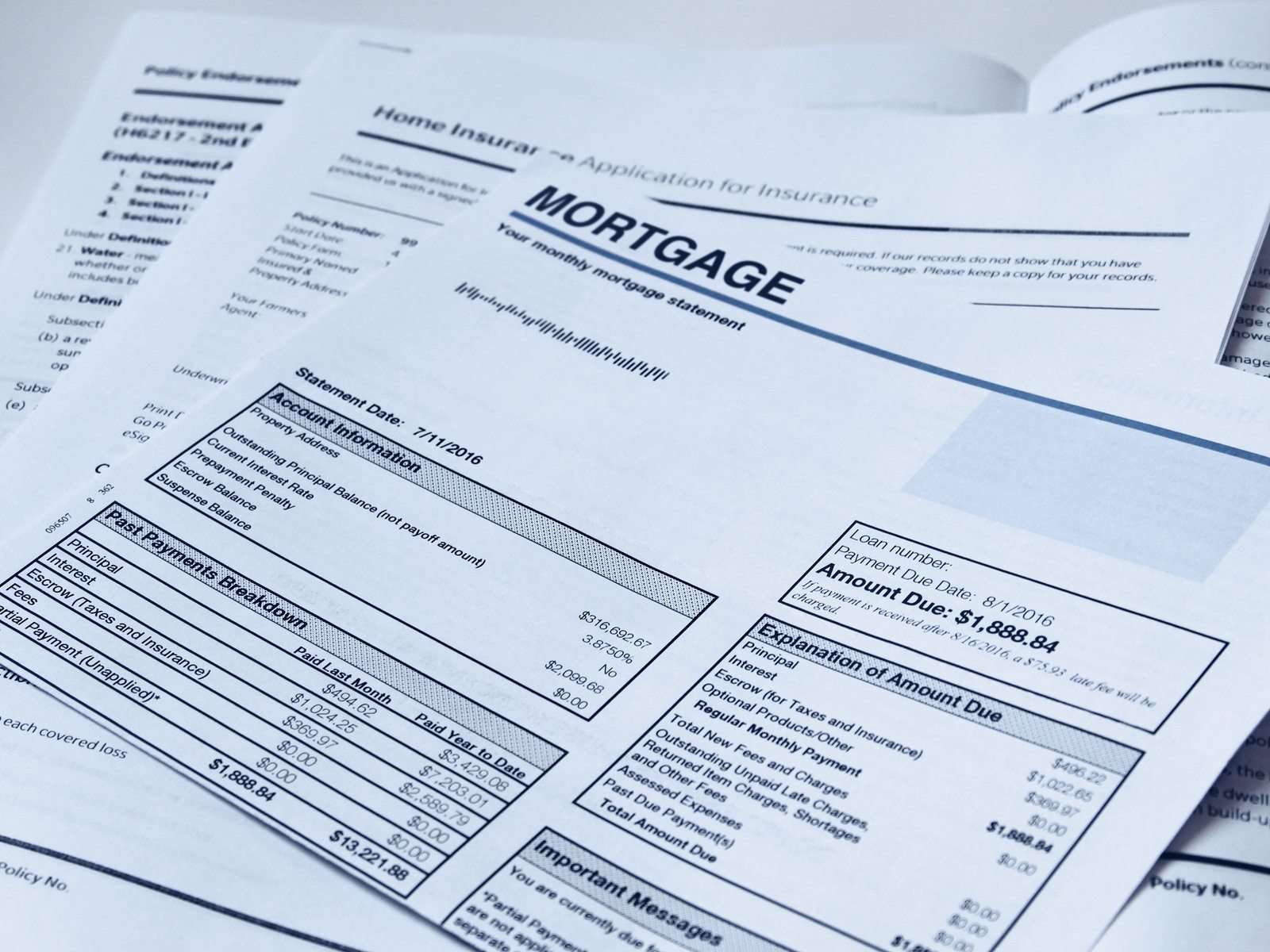

Handling Mortgage and Other Liens

If your property is under a mortgage:

- Determine if the lender will allow a partial release or refinance is necessary.

- Refinance the mortgage to exclude your name if required.

| Type of Action | Description |

|---|---|

| Partial Release | Lender agrees to remove a borrower while others remain liable. |

| Refinance | New mortgage loan where only one name remains on the title. |

After Removal: What to Expect

Now that your name has been removed from the house documents:

- No longer responsible for property tax, mortgage payments, or HOA dues unless agreed otherwise.

- Your credit score might not be affected by the property’s mortgage, assuming timely payments by other owners.

- Consider updating your will or estate planning to reflect this change.

Navigating the process of removing your name from house documents can seem intricate, but with this guide and potentially the assistance of professionals, it can be handled effectively. Each step involves specific legal and financial considerations, making it crucial to approach this task thoughtfully. From understanding the various types of deeds to engaging in legal consultations, preparing and recording the quitclaim deed, and managing mortgage and liens, this guide has outlined the key stages. While the journey might require patience and due diligence, your estate and personal legal matters can be streamlined as a result.

How long does it take to remove a name from a property deed?

+

The process can vary, typically taking anywhere from a few weeks to several months, depending on legal requirements, state processes, and complexities like mortgages.

Can I remove my name from a property deed if there’s still a mortgage?

+

Yes, but the lender must agree. Options include refinancing or obtaining a partial release. This can be challenging if your income was crucial for the mortgage approval.

What are the tax implications of removing my name from a deed?

+

There might be tax implications if the removal involves a gift or if it significantly changes your estate’s taxable value. Consult a tax advisor to understand your situation better.