5 Steps to Retrieve Lost TurboTax Documents

If you've misplaced your TurboTax files, fret not; there are several methods to recover your tax information. Losing essential tax documents can be distressing, particularly when tax season is upon us. This guide will walk you through a comprehensive, step-by-step process to retrieve your lost TurboTax documents without unnecessary stress or extra costs.

1. Check Your Email for TurboTax Transaction Records

Your first step should be to scour your email inbox and spam folder for any communication from TurboTax. During the process of preparing your taxes with TurboTax, the software often sends various emails confirming your account, purchase receipts, or PDF copies of your tax documents:

- Search for keywords like "TurboTax," "Tax Return," or your year of filing.

- Spam or junk folder often filters important emails, so don't overlook this potential treasure trove.

📧 Note: Be aware of phishing emails that may mimic TurboTax communications. Look for official domain names and check the authenticity of the email's sender.

2. Use TurboTax Account Recovery Tool

TurboTax provides an account recovery tool designed for situations exactly like this:

- Go to the TurboTax website and find the “Login” link.

- Click on “Forgot User ID or Password?” to initiate the recovery process.

- Follow the on-screen instructions, providing your name, email, or phone number to recover your account.

💡 Note: If you've changed your email or phone number since creating your TurboTax account, make sure to update this information for future use.

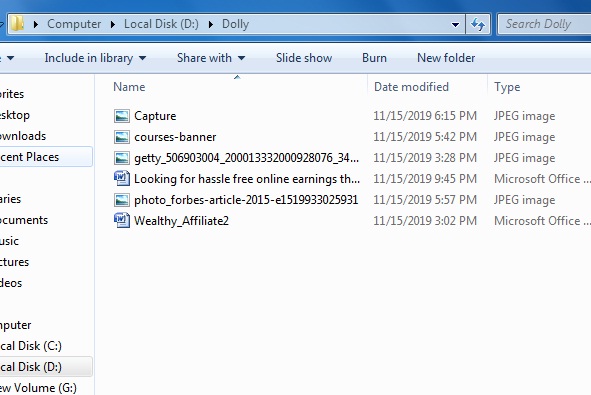

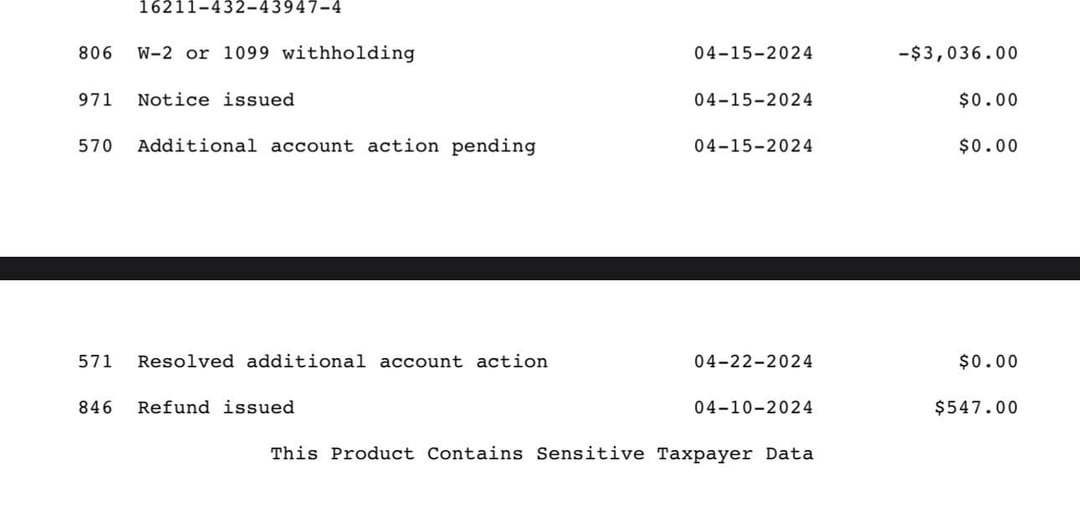

3. Access Your Tax Return Online Through IRS Portal

Should the above methods fail, the IRS portal offers another route to retrieve your tax documents:

- Log in to your IRS account or create one if you haven’t already.

- Retrieve transcripts of past tax returns. Although this won’t give you your exact TurboTax files, it can help you reconstruct your tax information.

| Document Type | Access Method | Details Provided |

|---|---|---|

| Tax Return Transcript | IRS e-Services | Most line items from your original return |

| Account Transcript | IRS e-Services | Recent account activity, tax balances, and payments |

| Wage and Income Transcript | IRS e-Services | Forms W-2, 1098, 1099, etc. from the IRS database |

📝 Note: While IRS transcripts don't replace TurboTax files, they are incredibly useful for reconstructing your financial records.

4. Contact TurboTax Support

Sometimes, reaching out directly to TurboTax customer support can lead to quick resolution:

- Use the phone or live chat support available on their website.

- Be prepared to provide personal information and details of your TurboTax account.

☎️ Note: Call centers can be busy during tax season; patience and perseverance are key.

5. Rebuild Your Tax Return

If all else fails, you might need to recreate your tax return:

- Import financial data from your financial institutions, which many banks allow.

- Gather receipts and records to manually input data into a new return.

While this approach might not retrieve your original TurboTax documents, it ensures you're not completely lost when tax time rolls around.

Throughout this journey of retrieving lost TurboTax files, a calm approach and a systematic method can alleviate the initial panic. By revisiting the emails sent by TurboTax, using their account recovery features, exploring IRS resources, contacting support, or even rebuilding your tax documents, you can ensure that your tax preparation is not derailed by the loss of digital records.

How can I prevent losing my TurboTax documents in the future?

+

To prevent future losses, back up your TurboTax files to cloud storage like Dropbox or Google Drive. Consider using password managers to safeguard login details, and regularly update your recovery email and phone number with TurboTax.

What if I can’t recover my TurboTax documents using any of the mentioned methods?

+

Reach out to TurboTax support with as much information as you can provide. Alternatively, you might need to recreate your tax return manually or seek professional help from a tax advisor.

Can I use an IRS transcript instead of my TurboTax document?

+

Yes, IRS transcripts provide most of the data from your original return, though they won’t include all information. They can be very useful in reconstructing your tax return or for reference purposes.