Guide to Obtaining Last Year's Tax Return Paperwork

When you find yourself in a situation where you need to retrieve copies of your previous year's tax returns, it can feel daunting at first. Whether you've lost the paperwork, need them for mortgage applications, audits, or other personal reasons, knowing how to access this critical information is vital. This guide will walk you through the steps to obtain your tax returns from last year, detailing what you need, how to request them, and tips for a smooth process.

Understanding Why You Might Need Your Tax Returns

Before diving into the process, let’s consider why you might need your tax returns:

- Mortgage Applications: Lenders often require copies of your tax returns to verify income and tax liabilities.

- Identity Theft: In case of fraudulent activity, obtaining your tax transcripts can help you report the issue to the IRS.

- Financial Audits: Sometimes, you might be under audit, and you’ll need to provide proof of income and deductions.

- Legal or Divorce Proceedings: Tax returns can be crucial in determining alimony, child support, or asset distribution.

Preparing to Obtain Your Tax Returns

Gather Necessary Information

To streamline your request, gather the following:

- Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- The tax year for which you need the returns.

- Any previously filed address or filing status if you’ve moved or changed your status.

Choose Your Method of Request

You have three main options:

- Online: The IRS provides an online service for retrieving tax transcripts.

- By Mail: This method requires filling out and mailing Form 4506-T or Form 4506-T-EZ.

- In Person: Visit your local IRS Taxpayer Assistance Center (TAC).

Steps to Request Your Tax Returns

Online Method

If you opt for the online route:

- Create or log in to your IRS account on irs.gov. New users will need to provide information to verify identity.

- Navigate to the “Get Transcript” section and select “Tax Return Transcript.”

- Select the tax year you need and proceed with the verification process.

- You can download your transcript immediately or request it to be mailed to you.

👉 Note: Only the primary taxpayer can request a transcript online if the return was filed as a single, head of household, or qualifying widow(er) with dependent child.

By Mail Method

Here’s how to do it by mail:

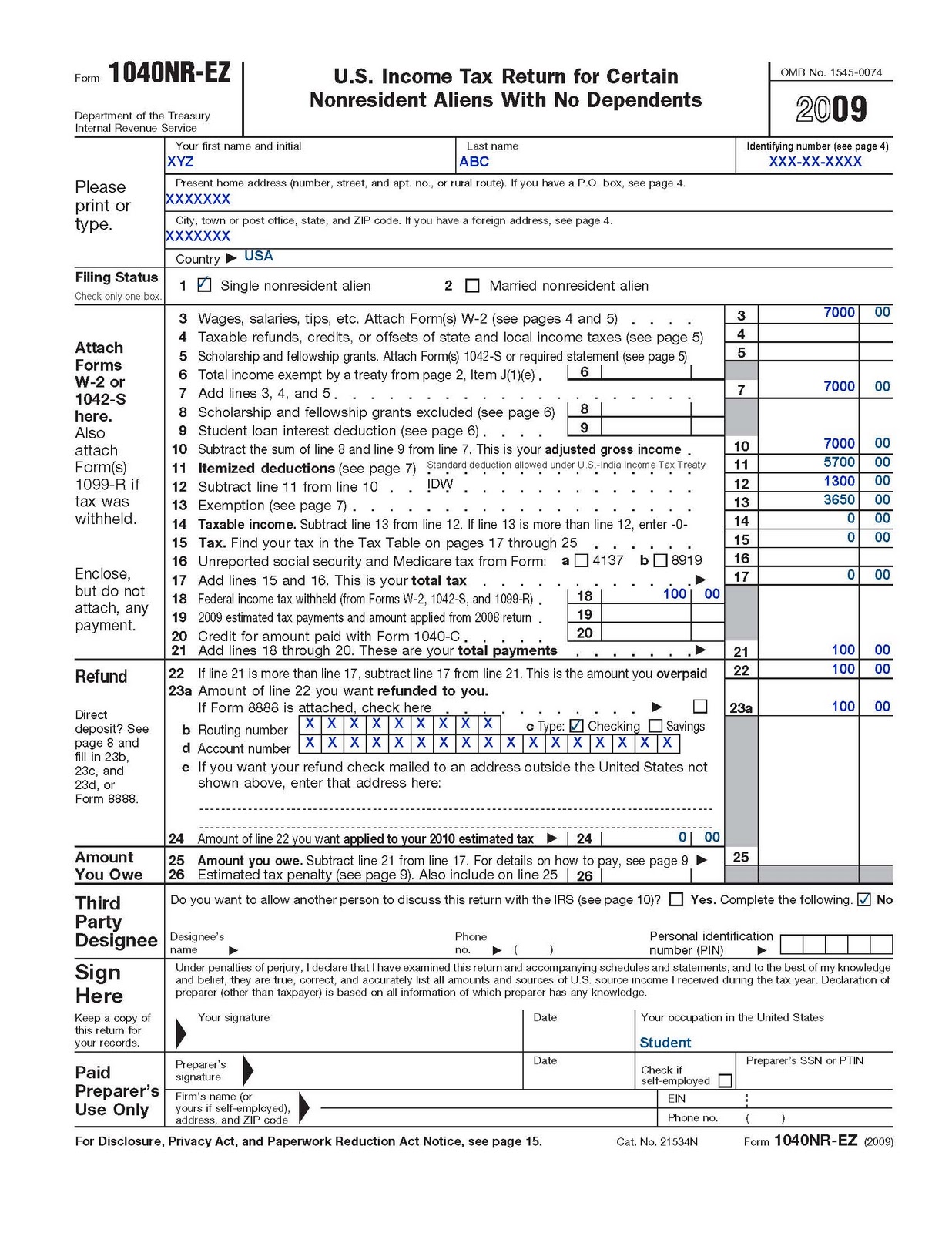

- Download and fill out Form 4506-T or Form 4506-T-EZ from the IRS website. The former allows you to request copies of other years’ returns or transcripts, while the latter is specific to tax return transcripts.

- Specify the year and type of return (e.g., “1040”).

- Sign the form and mail it to the address listed on the form based on where you live.

- The IRS will send your return or transcript by mail, which can take 5 to 10 business days to process.

In Person Method

For immediate service:

- Find your local IRS Taxpayer Assistance Center using the IRS website.

- Bring two forms of ID, your SSN/ITIN, and any previous tax filings if possible.

- Be prepared to wait, as TACs operate on a first-come, first-served basis.

Understanding What You’ll Receive

The IRS offers different types of transcripts:

- Tax Return Transcript: Shows most line items from your return exactly as filed, including any adjustments made by the IRS.

- Account Transcript: Details any subsequent adjustments to your account after your return was filed.

- Wage and Income Transcript: Contains data from W-2s, 1099s, and other income-related documents.

Key Considerations and Tips

Here are some tips to make the process smoother:

- Security: Be cautious with your information, especially online. Ensure you’re on the legitimate IRS website.

- Cost: Transcript requests are free, but there might be a fee for physical copies of your returns.

- Timing: Plan ahead. The process can take time, especially if requesting by mail.

- Storage: Keep digital copies in secure online storage or a physical safe place for future reference.

Obtaining your tax returns from last year isn't just about accessing documents; it's about understanding your financial history and having the paperwork to back it up. Whether for applications, audits, or simply for peace of mind, these steps ensure you have the necessary information when you need it. Remember to keep your personal data secure, plan for potential delays, and consider the implications of your method of choice for both speed and security.

Can I obtain my tax returns if I haven’t filed for the year?

+

No, you can only request transcripts or copies of returns that have been filed with the IRS.

How long does the IRS keep records of my tax returns?

+

The IRS generally keeps records of individual tax returns for three years from when the return was due or filed, whichever is later. After this, they might be available through archives or by special request.

What should I do if my address has changed since I filed my taxes?

+

When requesting by mail or in person, include your previous address along with your current address in your request to avoid any confusion or delay.