How to Correctly Fill Out Beneficiary Forms

Understanding Beneficiary Forms

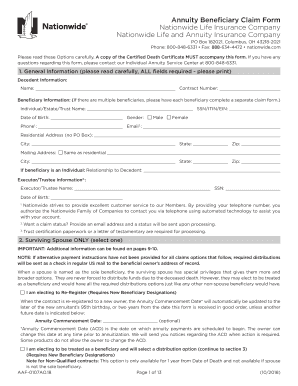

Navigating through beneficiary forms can often feel like trying to decipher a complex puzzle, particularly if you're unfamiliar with financial or legal terminology. Yet, these forms are essential for ensuring that your assets are distributed according to your wishes after you're gone. This blog post will guide you through the intricate process of filling out beneficiary forms, helping you to do so accurately and efficiently.

Why Filling Out Beneficiary Forms is Crucial

Understanding the importance of correctly filling out beneficiary forms can significantly influence how your assets are managed after your passing:

- Ease of Asset Transfer: Accurate forms facilitate a swift and smooth transfer of your assets to your designated beneficiaries, minimizing potential legal issues or delays.

- Minimizing Disputes: By clearly outlining your beneficiaries, you help prevent disputes or confusion among family members or potential heirs, reducing the likelihood of costly legal battles.

- Compliance with Legal Requirements: Financial institutions, insurance companies, and retirement accounts have specific requirements for beneficiary designations. Proper completion ensures compliance with these legal stipulations.

📝 Note: Incorrectly filled forms can result in your estate being managed according to state laws, possibly against your wishes.

Key Elements of Beneficiary Forms

Understanding the components of beneficiary forms is essential for filling them out correctly:

- Primary Beneficiaries: These are the first individuals to receive your assets, and you can list them with specific allocation percentages or dollar amounts.

- Contingent Beneficiaries: These individuals or entities inherit if the primary beneficiaries predecease you or are unable to receive the assets due to various reasons.

- Per Stirpes vs. Per Capita: ‘Per stirpes’ means that if a primary beneficiary has passed away, their share is divided among their descendants. ‘Per capita’ distributes the estate equally among surviving beneficiaries, disregarding their lineage.

- Trusts or Entities: You can name trusts or specific entities as beneficiaries, which requires additional information such as tax ID numbers or trust documents.

- Percentage or Dollar Amount: Depending on the asset type, you might allocate percentages or fixed amounts to each beneficiary.

Steps to Fill Out Beneficiary Forms

Here are the steps to correctly fill out your beneficiary forms:

1. Identify All Relevant Accounts and Policies

Start by listing all your financial accounts, insurance policies, and retirement plans that require beneficiary designations:

- Retirement Accounts (401(k), IRA)

- Life Insurance Policies

- Investment Accounts

- Bank Accounts (Savings, Checking, CDs)

📝 Note: Ensure each account’s beneficiary designation is in line with your will or trust to avoid discrepancies.

2. Gather Necessary Information

Collect the necessary details for each beneficiary:

- Full legal name

- Relationship to you

- Social Security Number or Tax ID (if applicable)

- Address

3. Determine Primary and Contingent Beneficiaries

Decide who will be your primary beneficiaries, then list your contingent beneficiaries. Consider the following:

- Do you want to distribute your assets equally or do you have specific percentages in mind?

- What happens if a primary beneficiary is no longer alive at the time of your passing?

4. Specify the Distribution Method

Choose between ‘per stirpes’ or ‘per capita’ distribution, or specify unique allocations based on circumstances:

- If you have children or grandchildren, consider the implications of each method.

5. Complete the Forms Accurately

Fill out each form carefully, making sure all information is current:

- Double-check names and numbers.

- Use legible handwriting or electronic signatures where applicable.

6. Review and Sign

After filling out the forms, review them for accuracy:

- Ensure all details are correct and current.

- Sign the forms in front of witnesses if necessary.

- Some forms might require notarization or specific signatures.

7. Update When Necessary

Life events necessitate updates to your beneficiary forms:

- Marriage, divorce, or the birth of children/grandchildren

- Death of a beneficiary

- Changes in financial status or beneficiary contact information

🔍 Note: Regularly reviewing and updating your beneficiary designations ensures they reflect your current wishes and circumstances.

Best Practices and Common Pitfalls

Here are some key tips to ensure your beneficiary forms are handled correctly:

- Use Full Legal Names: Avoid nicknames to prevent confusion.

- Be Specific with Relationships: Clearly state the relationship to avoid legal challenges.

- Percentage Allocations: Make sure the total percentage adds up to 100%.

- Use Designation Forms Properly: Financial institutions might have their forms; use them instead of generic ones.

- Avoid Common Errors: Not updating after major life events, incorrect beneficiary information, or not filling out all required fields.

Properly filling out beneficiary forms is crucial for ensuring your assets are distributed as intended. By understanding the elements of these forms, following the steps to complete them accurately, and being mindful of common pitfalls, you safeguard your financial legacy.

Having gone through the process, you've now equipped yourself with the knowledge to ensure your assets are distributed according to your wishes. This journey emphasizes the importance of clear and accurate beneficiary designations, reducing the likelihood of disputes and legal complications. Your due diligence in managing these forms means that after you're gone, your loved ones can receive their inheritances as intended.

What happens if I don’t name a beneficiary?

+

If you do not name a beneficiary, your assets might be distributed according to state intestacy laws, which may not align with your personal wishes. This can result in assets going to unintended individuals or entities, potentially leading to legal disputes among surviving relatives.

Can I name minors as beneficiaries?

+

Yes, but direct inheritance to minors can lead to legal complications. It’s advisable to set up a trust for minors or appoint a guardian of property to manage their inheritance until they reach the age of majority.

Do I need a lawyer to help with beneficiary forms?

+

While a lawyer isn’t necessary for most straightforward designations, consulting one can be helpful in complex situations, like when you’re dealing with multiple trusts, significant assets, or when family dynamics are complicated.