Fill Out Bankruptcy Paperwork: Step-by-Step Guide

In today's financial climate, bankruptcy has become a viable option for many individuals and businesses facing overwhelming debt. Declaring bankruptcy can provide a fresh financial start, but navigating through the legal and administrative procedures can be daunting. Here's a comprehensive, step-by-step guide to filling out bankruptcy paperwork, which aims to demystify the process and help you through this challenging period with greater confidence.

What Type of Bankruptcy Should You File?

Before you start filling out forms, it’s crucial to understand the different types of bankruptcy:

- Chapter 7 Bankruptcy: Also known as liquidation bankruptcy, this involves selling off non-exempt assets to pay creditors. It’s typically quicker but requires passing a means test to qualify.

- Chapter 13 Bankruptcy: Often referred to as a wage earner’s plan, it allows debtors to restructure their debt and repay creditors over time, usually 3 to 5 years.

⚠️ Note: Choose the type of bankruptcy based on your income, debts, and financial situation, as this will affect your available options and the forms you need to fill out.

Step 1: Attend Credit Counseling

Prior to filing for bankruptcy, you are required to attend a credit counseling session within 180 days before filing. The counseling must be from an approved agency. Here’s how to approach this step:

- Search for an approved credit counseling agency from the U.S. Department of Justice website.

- Complete the course, which typically lasts 1 to 2 hours, either online or in person.

- Obtain a certificate of completion, which you’ll need to file with your bankruptcy paperwork.

Step 2: Collect Documentation

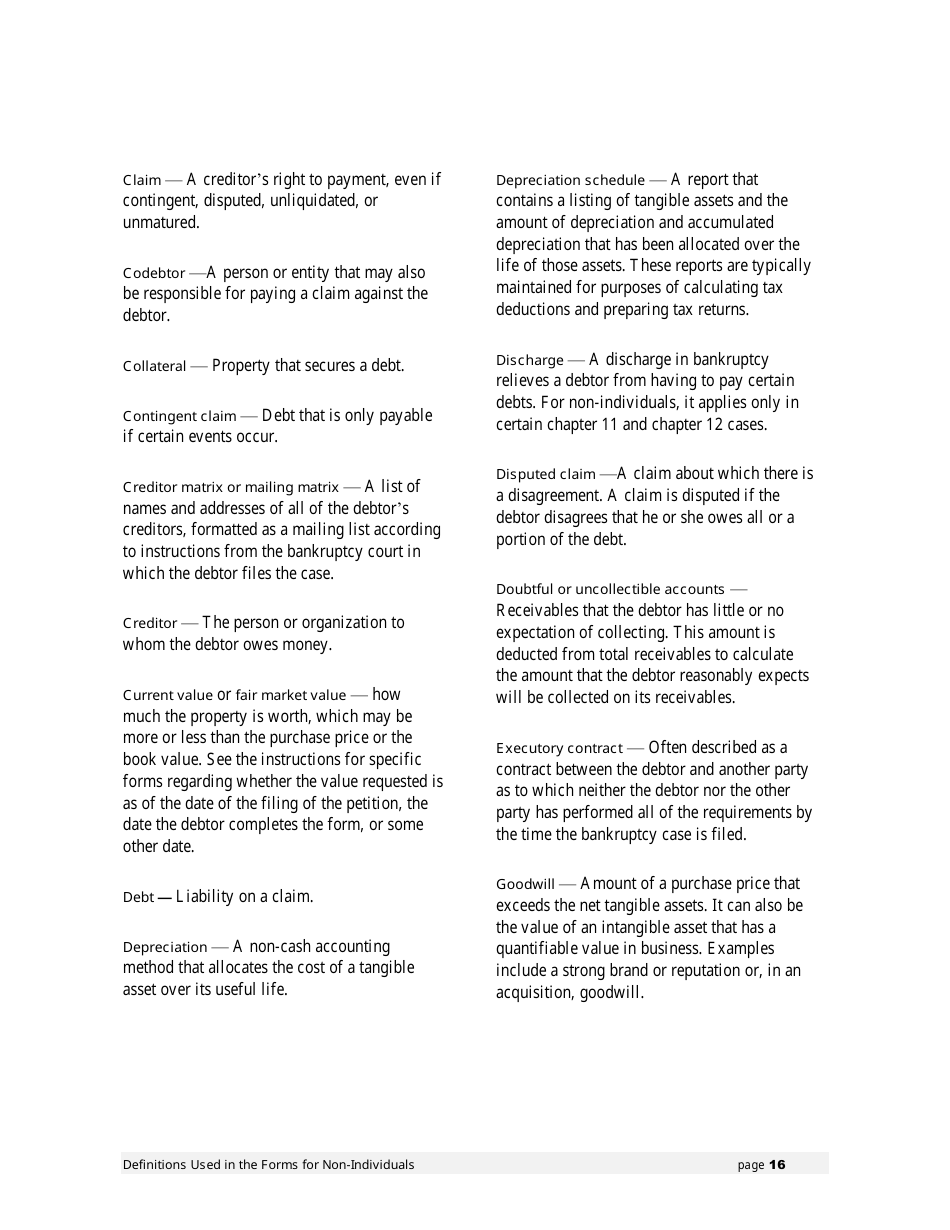

Gather all financial documents. Here’s what you’ll need:

- List of all creditors, including amounts owed.

- Income documentation (recent pay stubs, tax returns).

- Expenditure records (rent/mortgage statements, utility bills).

- Asset inventory (bank statements, property titles, vehicle registrations).

- Details on recent financial transactions or large purchases.

Step 3: Download Bankruptcy Forms

Bankruptcy forms can be found on the official website of the U.S. Courts or through legal aid websites. Here are some key forms:

| Form | Description |

|---|---|

| B 101 | Voluntary Petition for Individuals Filing for Bankruptcy |

| B 106 | Schedule A/B: Property |

| B 107 | Statement of Financial Affairs for Individuals Filing for Bankruptcy |

| B 108 | Chapter 13 Plan |

📌 Note: Ensure all forms are up-to-date, as bankruptcy laws can change, and using outdated forms can lead to complications.

Step 4: Fill Out the Forms

Filling out the bankruptcy paperwork requires meticulous attention to detail. Here’s what you need to do:

- Complete the Voluntary Petition (B 101) with your personal information and bankruptcy chapter.

- Detail your assets in Schedule A/B (B 106). Be thorough as over-looking assets can cause legal issues.

- Fill out Schedule C to claim exemptions for assets you wish to keep.

- List your income, expenses, creditors, and debts in the other schedules and statements. Accuracy here is paramount as it directly impacts your repayment plan or discharge of debts.

Step 5: File Your Bankruptcy

Once all forms are filled out, it’s time to file:

- Pay the filing fee, which varies depending on the type of bankruptcy you’re filing for.

- Submit all necessary documents to your local bankruptcy court. Filing can be done in person, through mail, or electronic filing where available.

- Attend a meeting of creditors, which usually occurs about 30 days after filing. This is where you answer questions about your finances under oath.

After this stage, you’ll need to complete a financial management course, provide additional documents as requested by the trustee, and attend the 341 Meeting of Creditors.

Step 6: Complete Post-Filing Tasks

After filing, there are several steps to take:

- Attend the 341 Meeting of Creditors.

- Complete the debtor education course, which you must do within 60 days of your creditors’ meeting.

- Follow up on any objections or issues raised by creditors or the trustee regarding your case.

Upon the successful completion of these steps, you'll receive your discharge order, officially releasing you from liability for certain debts.

In the end, filling out bankruptcy paperwork involves more than just paperwork; it's about taking control of your financial future. By understanding the process and completing these steps with care, you are paving the way to not only legal relief from debt but also towards financial recovery. Remember, if any part of this process seems overwhelming, consider seeking professional help from a bankruptcy attorney or financial advisor.

What if I Can’t Afford the Bankruptcy Filing Fee?

+

You can apply for a fee waiver by completing Form B 103B if your income is less than 150% of the poverty line. Alternatively, you can make installment payments to the court.

Can I File for Bankruptcy Without a Lawyer?

+

Yes, you can file “pro se” or represent yourself in bankruptcy court. However, the complexity of bankruptcy law makes it beneficial to have legal representation.

Will My Employer Find Out If I File for Bankruptcy?

+

Bankruptcy filings are public records, but your employer won’t automatically be notified. However, if you owe money to your employer or there’s a payroll deduction for a Chapter 13 plan, they might find out.