How to Complete Your 401k Forms Easily

Completing your 401(k) forms doesn't have to be a daunting task. Whether you're enrolling in a plan for the first time, changing your investment options, or setting up beneficiaries, understanding the process can save you time and reduce potential errors. In this guide, we'll walk you through the steps to fill out your 401(k) forms with ease, ensuring that your retirement savings are in good hands.

Step 1: Gather Necessary Information

Before diving into the forms, ensure you have all the required information ready:

- Your full legal name

- Social Security Number

- Date of Birth

- Address

- Employment details (employer’s name, your hire date, and current employment status)

- Bank account details for automatic contributions or withdrawals

- Beneficiaries’ names, relationship to you, and their Social Security Numbers

ℹ️ Note: Having this information at hand will streamline the process and avoid unnecessary delays or errors.

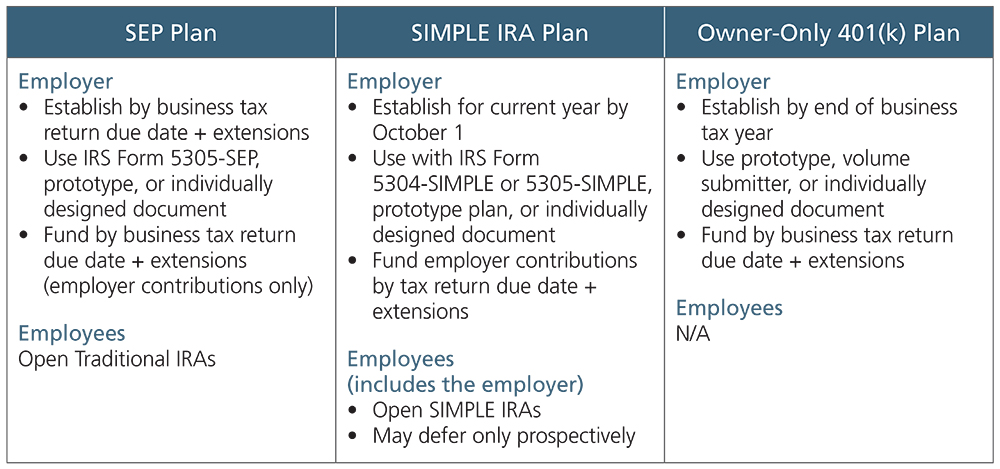

Step 2: Understanding Your 401(k) Plan Options

401(k) plans offer various investment options, each with its own level of risk and reward:

| Investment Type | Description | Risk Level |

|---|---|---|

| Stocks | Shares in publicly traded companies. | High |

| Bonds | Debt securities issued by entities promising to pay back with interest. | Medium to Low |

| Mutual Funds | Collections of stocks and bonds managed by professionals. | Varies based on fund type |

| Target-Date Funds | Automatically adjust the investment mix based on your age or expected retirement date. | Varies |

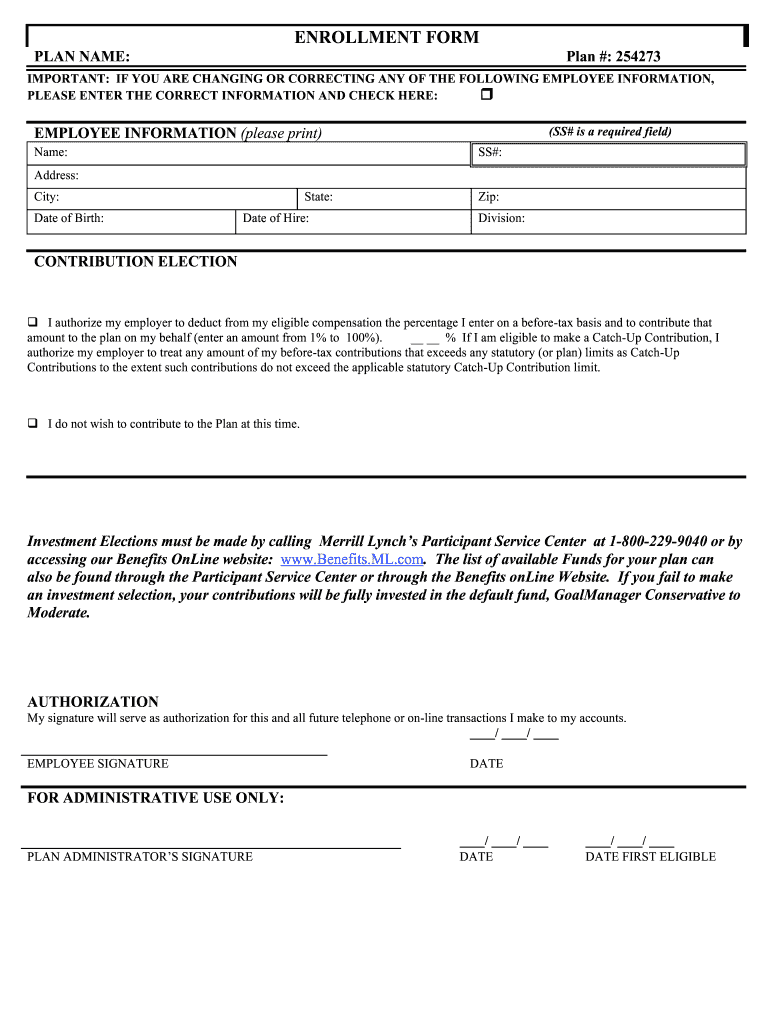

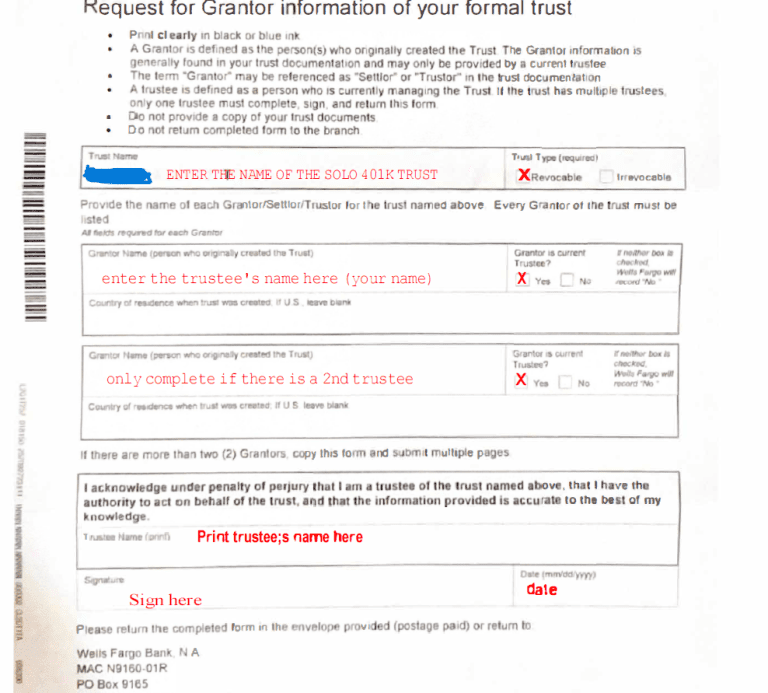

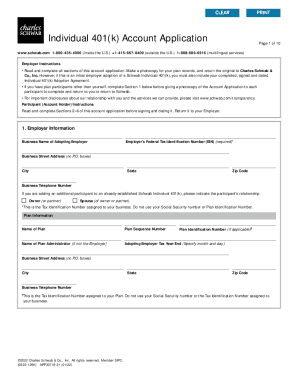

Step 3: Filling Out Enrollment Forms

Now that you understand your options, follow these steps to complete your enrollment:

- Personal Information: Fill in your personal details. Ensure that your Social Security Number is correct to avoid any identity issues.

- Employment Details: Provide your employer’s information, including the plan sponsor name if it’s a company plan.

- Contribution Decisions: Decide on how much you wish to contribute. Most plans allow for:

- Pre-tax contributions to lower your taxable income

- After-tax Roth contributions for tax-free withdrawals in retirement

- Investment Elections: Select your investment funds. Remember your risk tolerance and retirement timeline when making these choices.

- Beneficiary Information: Designate beneficiaries who will receive your 401(k) funds in case of your demise.

⚠️ Note: Mistakes in filling out forms, especially with Social Security Numbers or beneficiary information, can lead to significant problems in the future.

Step 4: Confirming and Submitting Your Forms

After completing your forms:

- Review all entries for accuracy.

- Sign and date the forms.

- If submitting electronically, follow the instructions provided by your employer or plan administrator.

- If paper forms, make copies for your records before submitting.

Step 5: Reviewing and Adjusting Your 401(k) Plan

Even after initial setup, keep your 401(k) updated:

- Periodically review your investment choices.

- Update beneficiary designations if life circumstances change (marriage, divorce, birth of children, etc.)

- Adjust contribution amounts if your financial situation changes.

Completing your 401(k) forms correctly is crucial for securing your financial future. By following these steps, you can ensure your retirement savings are not only well-managed but also set up in a way that benefits you optimally. Taking time to understand your plan's specifics, making informed decisions on contributions and investments, and keeping everything up to date will put you in a strong position for your retirement years. Remember, your 401(k) is more than just a savings account; it's a key component of your financial strategy, helping to build wealth over time.

Can I change my 401(k) contribution amount after enrolling?

+

Yes, you can adjust your contribution rate at any time, usually through your employer’s HR system or by contacting your plan administrator.

What happens if I make a mistake on my 401(k) form?

+

Contact your plan administrator or HR department as soon as possible. They can guide you on how to correct the error without affecting your account adversely.

Do I need to include 401(k) contributions on my tax return?

+

Pre-tax contributions lower your taxable income, so you don’t need to include them on your tax return. Roth contributions, however, are taxed before they go into your 401(k).