Fill ITR 2 Excel Sheet for 2017-18 Easily

Are you gearing up to file your Income Tax Return (ITR) for the financial year 2017-18 in India? The ITR-2 form is essential for individuals and HUFs not having income from profits and gains of business or profession. Here’s a detailed guide to help you fill out your ITR-2 Excel Sheet with ease:

Understanding the ITR-2 Form

ITR-2 is suitable for:

- Individuals who are Hindu Undivided Family (HUF)

- People whose total income includes income from salary/pension, house property, capital gains, other sources (including winning from lottery and racehorses), and income from other person as referred to in sections 60 to 64 of the Income Tax Act.

Preparation Before Filling the Form

Before you begin filling out your ITR-2:

- Collect your Form 16 from your employer(s).

- Gather information on house property, including any loans taken or rent received.

- Ensure you have details of capital gains, such as shares, mutual funds, property sales, etc.

- Look for TDS (Tax Deducted at Source) certificates, Form 16A, 16B, or 16C.

Downloading and Setting Up the ITR-2 Excel Utility

Download the ITR-2 Excel utility from the official Income Tax e-filing website:

- Visit incometaxindiaefiling.gov.in.

- Go to the ‘Downloads’ section and click on ‘ITR Forms (A.Y. 2018-19)‘.

- Choose ‘ITR-2‘ under ‘Excel Utilities’.

- Click ‘Download’ to get the utility.

Filling the ITR-2 Excel Form

Once downloaded:

- Open the file using Microsoft Excel 2007 or newer versions.

- The utility will open with several sheets, including ‘Instructions’, ‘General Info’, ‘Salary’, ‘House Property’, ‘Capital Gains’, ‘Other Income’, and more.

- Use the ‘Instructions’ sheet as your guide to navigate through the form.

Entering Your Details

Here’s how you should proceed:

General Info Sheet

- Fill in personal details like name, PAN, address, residential status, etc.

- Choose the assessment year as 2018-19.

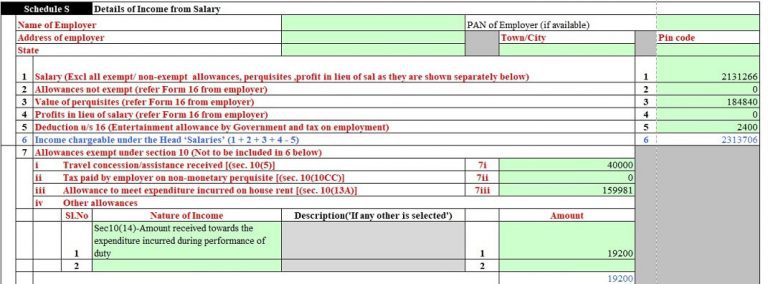

Salary Sheet

- Input your gross salary from Form 16.

- Enter any allowances and deductions like HRA, LTA, professional tax, etc.

- Calculate your net salary after allowable deductions.

House Property Sheet

- If you own property, enter rental income, pre-construction interest, and any self-occupied property details.

- Deduct standard deduction, interest on housing loans, and other expenses.

Capital Gains Sheet

- Details of long-term and short-term capital gains should be entered here.

- Calculate tax on capital gains, taking into account any exemptions or deductions.

Other Income Sheet

- Record income from other sources like interest income, dividends, lottery winnings, etc.

Calculating Your Total Income and Tax

Use the ‘Computation of Income’ sheet to:

- Sum up all income and adjust for any set off or carry forward losses.

- Compute total tax liability after deductions under sections 80C to 80U.

- Enter TDS details from Form 16 and 16A.

Final Verification

Before submission:

- Go through all sheets to ensure accuracy.

- Check if all necessary schedules like TCS, details of investment in unlisted equity shares, etc., are filled if applicable.

- Verify all details match with the documents like Form 16, bank statements, etc.

⚠️ Note: Save your progress regularly and validate data before submission to avoid errors.

Once you've ensured that all data is correctly entered and verified, you're ready to e-file your ITR-2. The process isn't just about filling in numbers; it's about understanding your tax obligations and the implications of your financial decisions. Filing your tax return on time is not only a legal requirement but also a prudent step towards financial discipline. It allows you to claim refunds or set off losses, providing a clearer picture of your financial health. Keep this guide handy, and with this knowledge, you're well on your way to mastering your tax filing for 2017-18.

Can I file ITR-2 if I have income from salary and a small business?

+

No, ITR-2 is for individuals not having income from business or profession. If you have income from both, you’ll need to file ITR-3 or ITR-4.

How can I make corrections if I’ve already filed my ITR?

+

You can file a revised return to correct mistakes. Remember to do this within the stipulated time, usually by the end of the relevant assessment year or before assessment, whichever is earlier.

What if I forget to report some income?

+

Not reporting income can lead to penalties or legal action. Use the revised return option to correct your returns if you have missed any income.