Filing Paperwork for SBR: Simplified Guide for Compliance

Managing an SBR (Short-Barrel Rifle) comes with a set of unique legal obligations, especially concerning the ATF (Bureau of Alcohol, Tobacco, Firearms, and Explosives) regulations. This guide aims to simplify the process of filing necessary paperwork for SBR compliance, ensuring that you meet all the legal requirements without the hassle.

Understanding the Basics of SBRs

Before delving into the paperwork, let’s establish some groundwork:

- Definition: A Short-Barrel Rifle has a barrel length of less than 16 inches or an overall length not exceeding 26 inches.

- Legal Requirements: Under the National Firearms Act (NFA), SBRs are classified as Title II weapons, requiring special tax and registration.

- Important Documents: Form 1 (for making your own SBR), Form 4 (for transferring an SBR), and Form 5 (for tax-exempt transfers) are the primary forms you’ll need to handle.

Filing Form 1: Application to Make and Register an SBR

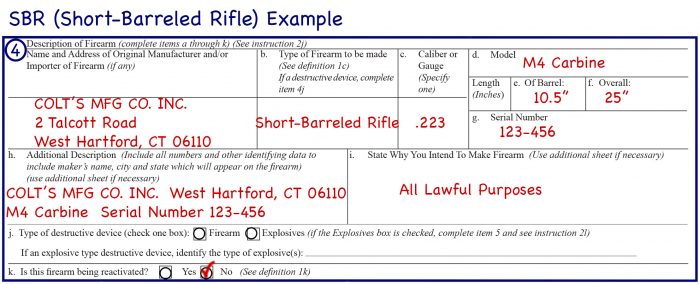

To build an SBR or modify an existing firearm into an SBR, you must submit Form 1:

- Personal Information: Fill out your details accurately, including your full name, address, and Social Security Number.

- Firearm Details: Provide information about the firearm - make, model, caliber, serial number, barrel length, and overall length. You need to specify that you are converting it to an SBR.

- Fingerprints and Photographs: Include 2 sets of fingerprint cards and 2 passport photos.

- Processing Fee: Pay the $200 tax with a check or money order made payable to the U.S. Department of Justice.

Once you’ve completed and sent Form 1 to the ATF:

- The ATF will conduct a background check on you.

- If approved, you’ll receive a stamp allowing you to proceed with the modification.

- Modifying your firearm before approval is illegal.

💡 Note: Double-check all your entries and ensure you use the current version of Form 1 available from the ATF’s website.

Filing Form 4: Transfer of an SBR

If you’re transferring an SBR from another person or a dealer, Form 4 is essential:

- Personal and Transferor Information: Fill out your details and the details of the person transferring the SBR.

- Firearm Description: Similar to Form 1, provide detailed information about the SBR.

- Processing Fee: Pay another $200 tax for the transfer.

- Complete the form accurately, as errors can lead to delays or rejection.

- The transferor should keep a copy of Form 4.

💡 Note: Both the transferor and the transferee are subject to background checks, so ensure that the transferor is ready with all required documents.

| Form Number | Use | Fee |

|---|---|---|

| Form 1 | Making an SBR | $200 |

| Form 4 | Transferring an SBR | $200 |

| Form 5 | Tax-Exempt Transfer | $0 |

Filing Form 5: Tax-Exempt Transfers

Under certain conditions, you can transfer an SBR without paying the transfer tax:

- Firearms being returned to a manufacturer for repair or modification.

- Firearms transferred to law enforcement agencies.

Filing Form 5 involves:

- Filling out the form with similar information as Form 4 but indicating that the transfer is tax-exempt.

- Submitting documentation to support the exemption.

Common Mistakes to Avoid

Here are some frequent errors to steer clear of:

- Missing or Incorrect Documentation: Ensure all required documentation is correctly filled and attached.

- Incomplete or Incorrect Forms: Any blank space or incorrect information can result in the rejection of your application.

- Not Understanding the Laws: Familiarize yourself with federal and local laws regarding SBRs.

After Approval

Once your paperwork is approved:

- Store the approved Form 1 or Form 4 with the firearm as proof of registration.

- Ensure the serial number on the firearm matches the one on your approved form.

- Maintain proper storage and handling practices to comply with NFA regulations.

By following this simplified guide, you can ensure that your SBR paperwork is handled correctly, avoiding legal issues and potential penalties. Remember, compliance with ATF regulations is not just a suggestion but a legal requirement. Keeping up-to-date with the latest forms and filing processes is crucial to staying within the law.

How long does it take for the ATF to approve Form 1 or Form 4?

+

The approval time can vary widely, but current estimates suggest it might take anywhere from 6 to 12 months due to backlogs. It’s beneficial to apply well in advance if you’re planning on acquiring an SBR.

Can I legally own an SBR without a special permit?

+

No. SBRs are regulated under the NFA, and you must have an approved tax stamp from the ATF to legally own or possess one.

What happens if my Form 1 or Form 4 is denied?

+

If your application is denied, the ATF will notify you in writing. You can reapply, appeal the decision, or make necessary corrections. In some cases, a denied application might lead to further scrutiny or investigation by the ATF.