Real Estate Closing Documents: Your Drafting Guide

The journey of buying or selling property culminates with the closing process, where numerous documents are exchanged, reviewed, and signed. Understanding and drafting these real estate closing documents is essential for a smooth transaction. This comprehensive guide will walk you through the steps involved in drafting these documents, ensuring you're well-prepared for the final stages of your real estate deal.

Understanding the Purpose of Closing Documents

Before diving into the specifics, it's important to grasp why these documents are crucial:

- Legal Transfer of Property: They legally transfer the property title from the seller to the buyer.

- Proof of Ownership: They serve as evidence of ownership.

- Compliance with Law: They ensure all transactions are compliant with local and state laws.

- Record Keeping: They facilitate record-keeping for future reference or disputes.

Key Closing Documents

Here are the primary documents you'll encounter during the closing process:

1. Purchase Agreement

The purchase agreement is the heart of the real estate transaction. It outlines:

- The agreed purchase price

- Names of the parties involved

- Property details

- Terms of the sale

- Any contingencies or conditions

🔍 Note: Ensure all terms in the purchase agreement are clear and unambiguous to avoid future disputes.

2. HUD-1 Settlement Statement or Closing Disclosure

This document summarizes all the costs and charges the buyer and seller will pay. Since the implementation of the TILA-RESPA Integrated Disclosure (TRID) rule, the Closing Disclosure replaced the HUD-1 Settlement Statement for most transactions, except reverse mortgages and HELOCs.

- Loan terms, monthly payment, and amount financed

- Transaction summary including cash required at closing

- Cost breakdown, including loan costs, title costs, etc.

⚠️ Note: Review the Closing Disclosure carefully, as it must be provided three days before closing to comply with TRID rules.

3. Promissory Note

This is the document where the buyer commits to repay the loan. It includes:

- Loan amount, interest rate, payment schedule

- Penalties for late payments

- Conditions for acceleration of debt

4. Deed

The deed transfers ownership of the property from the seller to the buyer:

- Legal description of the property

- Any reservations or restrictions

Types of deeds include warranty deeds, which come with guarantees against liens, and quitclaim deeds, which transfer whatever interest the grantor has, with no warranty.

5. Loan Documents

If financing is involved, additional loan documents will be required:

- Mortgage or Deed of Trust

- Loan Estimate

- Truth-in-Lending Disclosure

- Hazard Insurance Binder

6. Title Insurance

Title insurance protects against title defects, undisclosed liens, or errors in the public record. Here, you'll need:

- Commitment for Title Insurance

- Policy of Title Insurance

7. Additional Forms and Affidavits

Depending on the transaction, other documents might be required:

- Affidavit of Title

- Occupancy and Transfer Tax Forms

- Compliance Agreements (e.g., for Home Owners Associations)

- Escrow Instructions

Drafting Tips for Real Estate Documents

Accurate Information

Accuracy is paramount in closing documents:

- Double-check all personal information, property descriptions, and legal terms.

- Ensure all figures (like purchase price, loan amounts, and taxes) match throughout documents.

Legal Compliance

Drafting must align with local laws:

- Consult with a real estate attorney or closing agent for compliance.

- Be aware of any state or local requirements for specific documents.

Clarity and Specificity

Every term and condition should be spelled out clearly:

- Avoid vague language or industry jargon unless necessary.

- Include all relevant contingencies and conditions explicitly.

Consistency

Consistency across documents ensures a seamless closing:

- Use identical language where terms are repeated.

- Coordinate dates, times, and conditions across related documents.

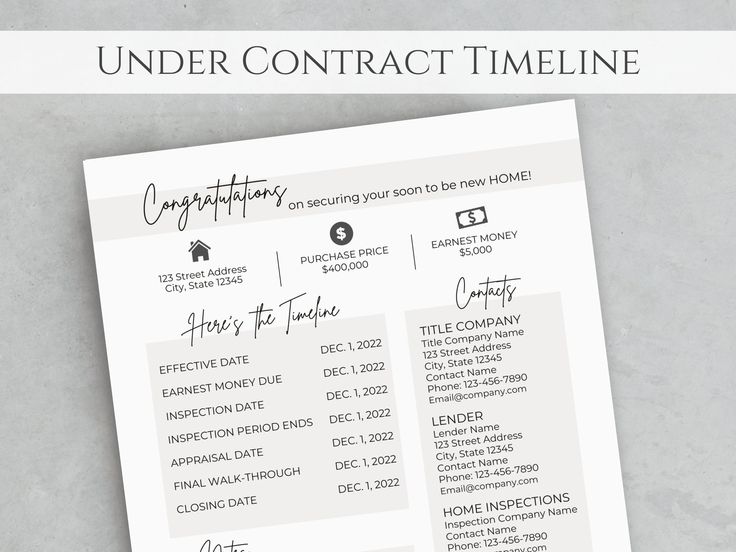

Sample Table for a Closing Timeline

| Step | Action | Typical Timeline |

|---|---|---|

| 1 | Loan Application | Immediately after contract signing |

| 2 | Title Search | 2-4 weeks |

| 3 | Home Inspection | Within the first 10 days |

| 4 | Appraisal | 1-2 weeks after inspection |

| 5 | Loan Approval | 4-6 weeks |

| 6 | Preparation of Closing Documents | After loan approval, 1-2 days |

| 7 | Signing of Closing Documents | 3 business days after receiving Closing Disclosure |

| 8 | Closing | After signing documents |

Best Practices for the Closing Process

- Early Document Review: Start reviewing documents as soon as possible to identify potential issues.

- Use of Professional Services: Engage title companies, closing agents, or real estate attorneys for drafting and review.

- Check For Accuracy: Ensure all parties have had the opportunity to review and approve documents.

- Documentation for Future Reference: Retain copies of all documents signed for future reference.

📑 Note: Using digital platforms can streamline the review and signing process significantly.

As we navigate the intricacies of real estate closing documents, it's clear that thorough preparation, legal compliance, and accuracy are non-negotiable. By understanding the key documents, following drafting tips, and adopting best practices, you can ensure a successful closing, safeguarding your investment and peace of mind. This guide provides you with the tools to approach the closing with confidence, turning what could be a stressful event into a milestone in your real estate journey.

What is the difference between a HUD-1 Settlement Statement and a Closing Disclosure?

+The HUD-1 Settlement Statement was used before the implementation of the TILA-RESPA Integrated Disclosure (TRID) rule for most real estate transactions, detailing all charges to the borrower and seller. The Closing Disclosure, introduced by TRID, replaced the HUD-1 for most loans except for reverse mortgages and Home Equity Lines of Credit (HELOCs). It must be provided to the buyer at least three business days before closing and contains a more detailed breakdown of the loan terms, projected payments, and all closing costs.

What are some common mistakes to avoid when drafting closing documents?

+Common mistakes include: incorrect property description, misspelling names or addresses, missing signatures or dates, discrepancies in figures, omitting necessary disclosures or contingencies, and failing to comply with local and state laws. Always double-check these elements.

Can I close a real estate deal without an attorney?

+While some states allow for self-closing, most advise or require the presence of a real estate attorney to ensure legal compliance and protect your interests. Even where not legally required, professional guidance can prevent costly mistakes.