5 Essential Tips for Excel Budget Sheets

The power of spreadsheets for personal and business financial management cannot be overstated, and Microsoft Excel remains at the forefront of tools that help in this regard. Creating and managing an Excel budget sheet can be a game-changer for your finances, offering insights, control, and projections at your fingertips. Whether you're starting fresh or looking to refine your existing budget, here are five essential tips to make your Excel budget sheet work best for you.

1. Design for Clarity and Efficiency

Begin with a clear layout design that enhances readability and usability:

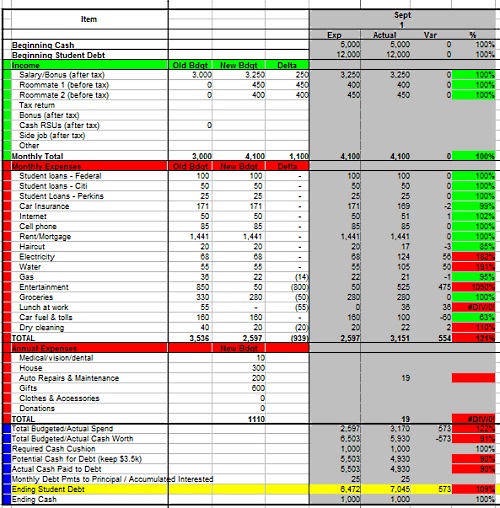

- Categorization: Organize your budget into sections like Income, Expenses, Savings, and Investments.

- Color Coding: Use colors to visually distinguish between different categories or to highlight important figures.

- Formatting: Apply bold formatting for headers and use currency formats where applicable to avoid manual calculations.

2. Utilize Formulas for Efficiency

Excel’s strength lies in its ability to automate calculations with formulas:

- AutoSum: Use functions like

=SUM()for quick summations. - Dynamic Calculations: Formulas like

=B2*C2can automatically calculate totals based on unit price and quantity. - Cell References: Instead of hardcoding values, use cell references for flexibility. For example,

=D5instead of500for a total income.

3. Incorporate Forecasting and Savings Goals

Budgeting isn’t just about tracking what’s already happened; it’s about planning for the future:

- Monthly Projections: Use the

=B2*12to extrapolate monthly figures into yearly. - Savings Targets: Set specific savings goals and track your progress using bar charts or sparklines to visualize.

- What-If Analysis: Utilize Excel’s tools like Scenario Manager for different financial scenarios.

4. Regular Maintenance and Review

Your budget sheet isn’t a one-time creation; it needs consistent care:

- Updates: Update your budget sheet regularly to reflect changes in income, expenses, or financial goals.

- Validation: Use data validation rules to ensure entered data matches expected formats (e.g., dates, currency).

- Backup: Save your work frequently and consider using cloud storage like OneDrive for backups.

🔍 Note: Regular review can help you identify trends, make better financial decisions, and adjust your budget as necessary.

5. Security and Accessibility

While your budget sheet is personal, securing it and ensuring accessibility can be beneficial:

- Password Protection: Protect sensitive sheets with Excel’s built-in password protection.

- Share with Conditions: Use ‘Share’ options in Excel to collaborate while restricting certain cell edits.

- Mobile Access: Utilize Excel Online or the mobile app for on-the-go budget management.

Combining Strategies for Success

By following these tips, you can create an Excel budget sheet that is not only comprehensive but also dynamic and user-friendly. The integration of design for clarity, the efficiency of formulas, the inclusion of forecasting tools, regular maintenance, and the application of security measures ensures that your budget sheet remains an invaluable tool in managing your finances effectively.

How often should I update my Excel budget sheet?

+

It’s recommended to update your budget sheet weekly or monthly. This allows for timely adjustments and better tracking of your financial progress.

Can I share my Excel budget sheet securely?

+

Yes, you can share your budget sheet by using Excel’s share options with permissions to restrict editing, and password protect sensitive sheets to ensure security.

What are the best practices for using formulas in an Excel budget?

+

- Use relative cell references for flexibility.

- Avoid hardcoded values; instead, reference cells.

- Utilize functions like

SUM,AVERAGE,IF, andVLOOKUPfor dynamic calculations.