5 Easy Steps to Create a Balance Sheet in Excel

Keeping track of your finances is crucial for the success of any business, whether you're a budding entrepreneur or a seasoned business owner. One of the most essential financial documents you should have at your fingertips is the balance sheet. This document provides a snapshot of your company's financial health at a specific point in time, showing what you own (assets), what you owe (liabilities), and the equity you've invested or earned over time. Creating a balance sheet in Excel might seem daunting at first, but fear not, as this guide will walk you through the process in five easy steps.

Step 1: Open a New Spreadsheet

Start by launching Microsoft Excel. If you’re using an older version or a different spreadsheet program like Google Sheets, the steps will be similar.

- Open Excel.

- Click on ‘File’ and then ‘New’ or select ‘Blank Workbook’ to start with a new spreadsheet.

Step 2: Input Your Company Information

At the top of your spreadsheet, input your company’s name, the balance sheet’s preparation date, and the reporting period. For instance:

| Company Name: | ABC Corporation |

|---|---|

| Balance Sheet Date: | December 31, 2023 |

| Reporting Period: | Fiscal Year 2023 |

Save your workbook with a meaningful name, such as ‘ABC_Corp_Balance_Sheet_2023.xlsx’.

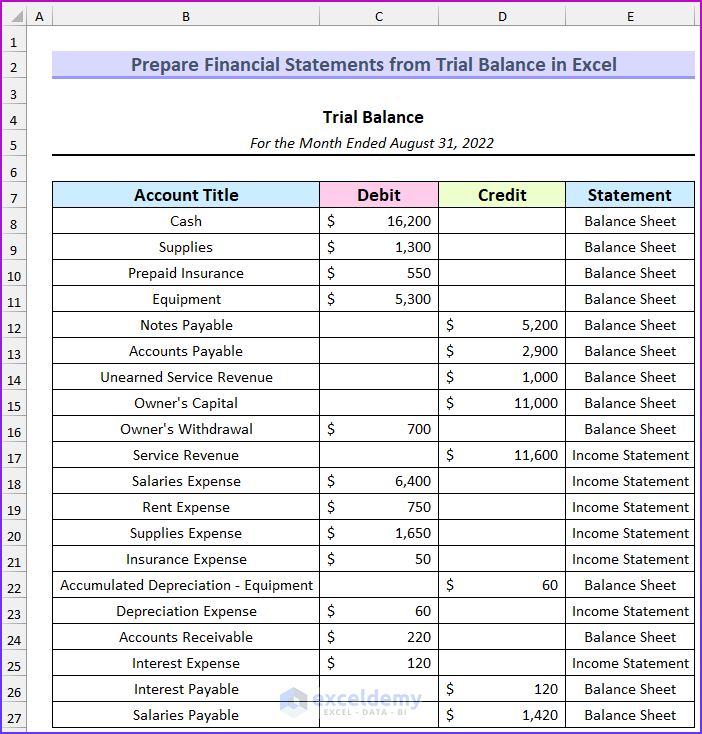

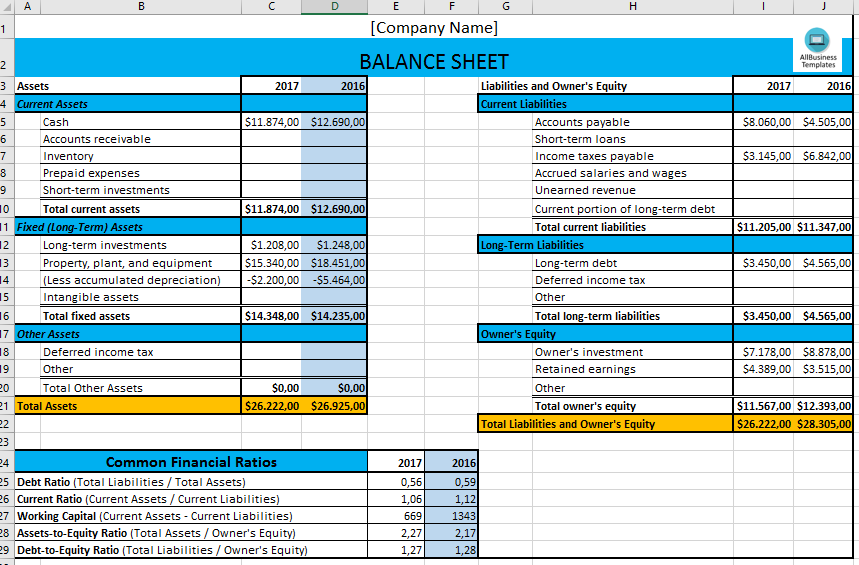

Step 3: Create Categories for Assets, Liabilities, and Equity

Now, you will categorize your financial data into three main sections: Assets, Liabilities, and Equity.

Assets

- List current assets such as cash, accounts receivable, inventory, etc.

- List non-current assets like property, plant, equipment, and intangible assets.

Liabilities

- Enumerate current liabilities like accounts payable, short-term debt, accrued expenses, etc.

- Include long-term liabilities such as mortgages, bonds payable, and deferred tax liabilities.

Equity

- Record your owner’s equity, including paid-in capital and retained earnings.

Step 4: Enter Financial Data

In this step, you will input the actual values for each category you’ve set up. Here are some tips:

- Assets: Ensure that the order is liquid to non-liquid. Start with cash and end with non-current assets.

- Liabilities: Also, order from short-term to long-term liabilities.

- Equity: Calculate retained earnings by subtracting the dividends paid from the net income.

When entering values, make sure they are consistent with your company’s financial records, double-checking for accuracy. Use the following format:

- Align your entries with the category rows you’ve created.

- Use descriptive names for each line item, and remember to include the unit of currency ($, €, etc.).

- You might want to leave one column empty between Assets, Liabilities, and Equity for clarity.

Step 5: Calculate Totals and Balance the Sheet

The key feature of a balance sheet is that total assets must equal total liabilities and equity. Here’s how you can do this:

- Use the SUM function to calculate totals for each major section.

- Align the totals next to their respective sections.

- Check if your assets equal liabilities plus equity. If not, you might need to review your entries or find where you might have gone wrong.

📊 Note: If your figures do not balance, it's likely you have a mistake in your data entry. Double-check for transposed numbers, wrong placement of decimal points, or if all related accounts have been updated.

After this process, your balance sheet should be well-structured, displaying your company's financial position accurately. This document is essential for tracking your business's financial health, and with these steps, you're now equipped to create one effectively.

To sum up, creating a balance sheet in Excel is a straightforward process once you know the steps. By following these instructions, you ensure that your financial reporting remains accurate and beneficial for decision-making. Remember, a well-maintained balance sheet not only helps with financial oversight but also instills confidence in investors and lenders.

Why is a balance sheet important?

+

A balance sheet is crucial because it provides a snapshot of your company’s financial health at a given time, showing what you own (assets) and what you owe (liabilities). This document helps in making informed business decisions, securing loans, attracting investors, and evaluating the company’s performance over time.

What if my balance sheet doesn’t balance?

+

If your balance sheet doesn’t balance, it indicates an error. Common mistakes include incorrect data entry, misclassification of accounts, or not updating all related accounts. Recheck your figures, ensure all entries are in the right section, and review any account balances that have changed recently.

How often should a balance sheet be prepared?

+

Depending on your business’s needs, a balance sheet should be prepared at least monthly, quarterly, and annually. Monthly balance sheets help keep track of day-to-day operations, while quarterly and annual statements are crucial for external reporting, such as to shareholders or for tax purposes.