5 Simple Steps to Create a Balance Sheet in Excel

Creating a balance sheet is a fundamental part of understanding your company's financial health. Whether you're a small business owner or managing finances for a larger corporation, Excel provides a versatile platform for this task. Here are 5 simple steps to create a balance sheet in Excel that will help you keep your financial ducks in a row:

Step 1: Set Up Your Worksheet

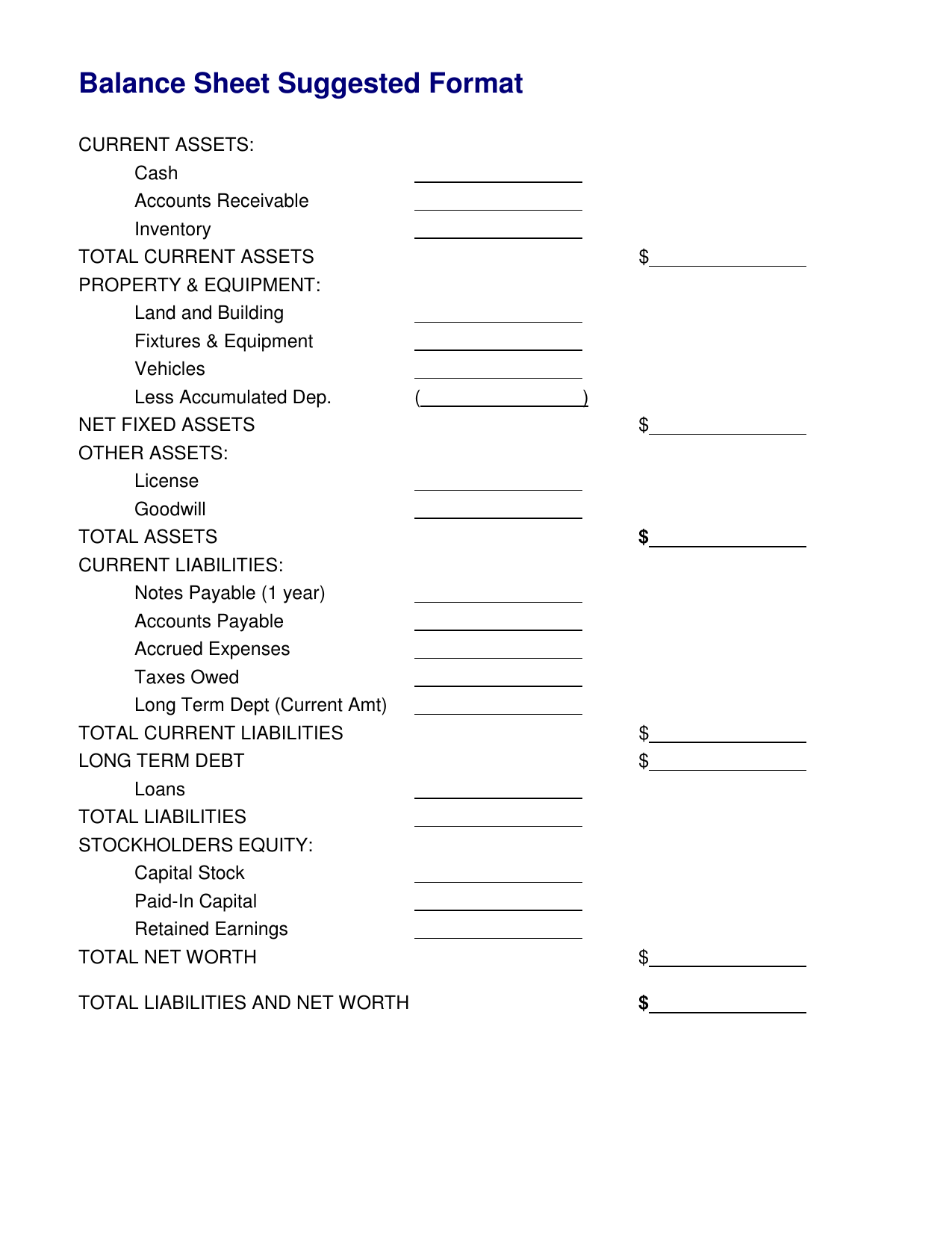

Open Excel and create a new workbook. Label the first sheet as “Balance Sheet” to keep things organized. Here’s how you can structure your spreadsheet:

- Column A: Headings for categories like “Assets”, “Liabilities”, and “Equity”.

- Column B: Sub-categories within each main category.

- Columns D through F: Use for the beginning, end balances, and changes in values.

📝 Note: Ensure the row heights and column widths are adjusted to clearly display your entries.

Step 2: Enter Your Assets

Assets are what your company owns and can be listed in order of liquidity:

| Category | Sub-Category | Beginning Balance | End Balance | Change |

|---|---|---|---|---|

| Current Assets | Cash | |||

| Accounts Receivable | ||||

| Inventory | ||||

| Non-Current Assets | Property, Plant, Equipment | |||

| Long-term Investments | ||||

| Intangible Assets |

📊 Note: The "Change" column helps in tracking changes over a specific period.

Step 3: Input Liabilities and Owner’s Equity

Liabilities are what your company owes, and equity represents what is owned by the company’s shareholders:

- Current Liabilities: Accounts Payable, Short-term Debt

- Non-Current Liabilities: Long-term Debt, Deferred Revenue

- Equity: Common Stock, Retained Earnings

Step 4: Calculate Totals and Check for Balance

Here’s where you ensure the balance sheet balances:

- Sum up the total assets, liabilities, and equity using Excel formulas.

- The formula for checking the balance is:

Total Assets = Total Liabilities + Equity

🚨 Note: If they don’t balance, recheck your figures for any calculation errors or missing entries.

Step 5: Format and Finalize

A polished balance sheet is not only functional but also professional:

- Apply appropriate formatting like bold headers, borders, and different fonts for readability.

- Use conditional formatting to highlight key figures or deviations from expected values.

- Add notes or explanations under the balance sheet if necessary for clarity.

In summary, creating a balance sheet in Excel requires a systematic approach. Start with a clear structure, then meticulously fill in the asset and liability details, calculate totals, and finally format the sheet for a professional look. Remember, the balance sheet should always balance, providing a snapshot of your company's financial position at a specific point in time. This tool is invaluable for making informed decisions and keeping your financial health in check.

What are the most common errors when creating a balance sheet?

+

Common errors include not double-checking calculations, missing out on liabilities, or not accounting for depreciation correctly.

Can I use macros to automate the creation of a balance sheet?

+

Yes, you can record or write macros to automate entering repetitive data, formatting, or performing calculations, but ensure you validate the output manually.

How often should a balance sheet be prepared?

+

Typically, balance sheets are prepared at the end of each fiscal quarter and year, but for active businesses, monthly statements can also be beneficial.