Creating a Balance Sheet in Excel: Simplified Guide

In today's fast-paced business environment, understanding your financial status is crucial for making informed decisions. Whether you're a small business owner, a financial analyst, or just someone looking to manage personal finances, creating a balance sheet in Excel can provide a clear snapshot of your financial health. This comprehensive guide will walk you through the steps to create an effective balance sheet, highlighting its importance and offering tips for better financial management.

Why Use Excel for Balance Sheets?

Excel is a powerful tool for financial modeling due to:

- Accessibility: Most people have access to Excel or similar spreadsheet software.

- Customizability: You can tailor your balance sheet to fit your specific needs.

- Automation: Excel allows for formulas to automatically update figures, reducing manual errors.

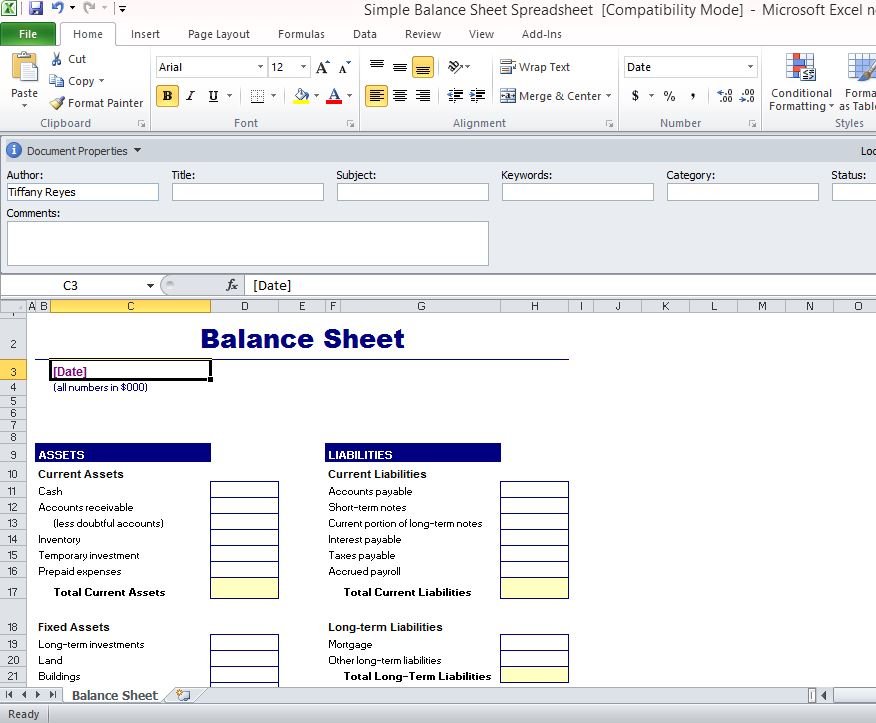

Setting Up Your Excel Balance Sheet

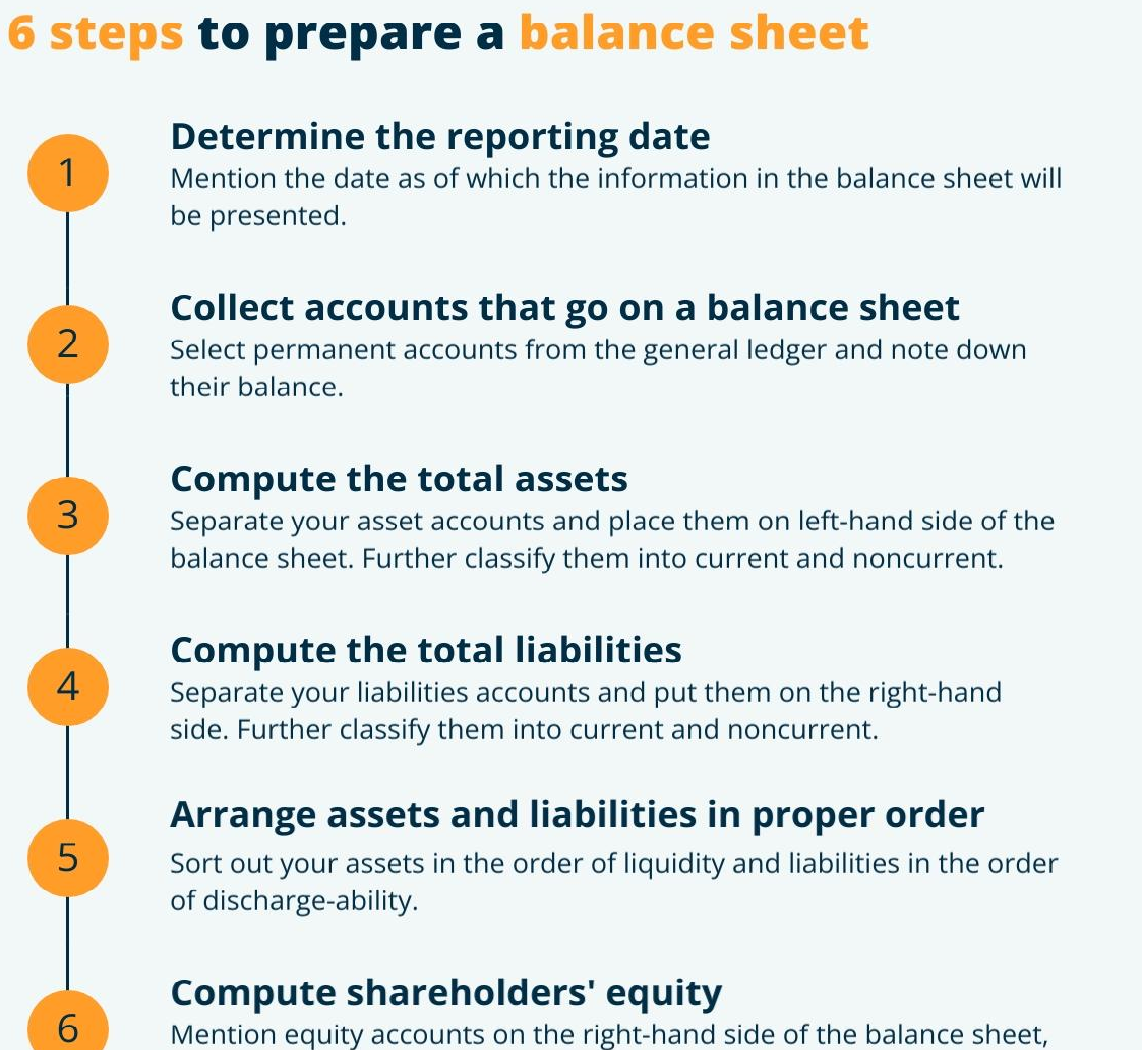

Here's how to set up your balance sheet:

1. Layout Your Spreadsheet

Start by organizing your Excel worksheet:

- Label column A as “Items.”

- Label column B as “Amount.”

- At the top of column A, insert the title “Balance Sheet.”

- Create sections for Assets, Liabilities, and Owner’s Equity.

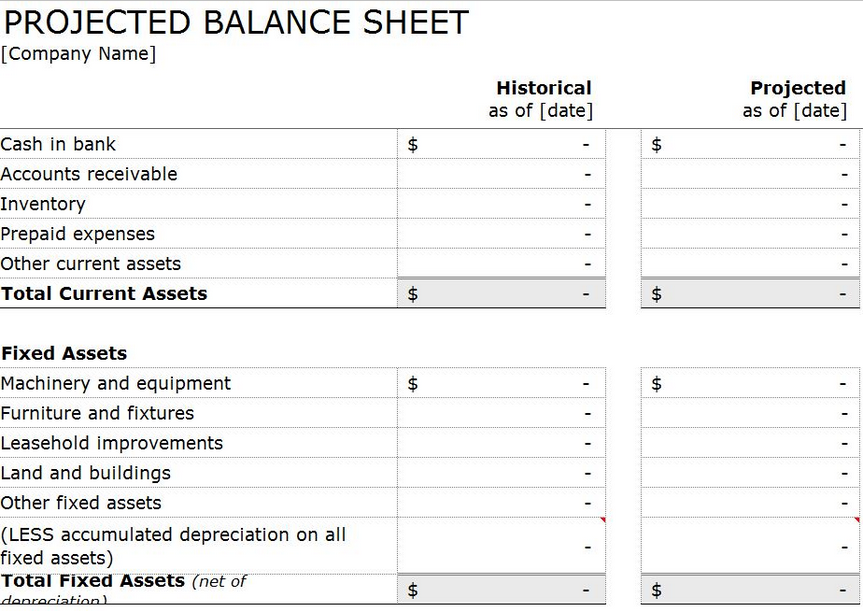

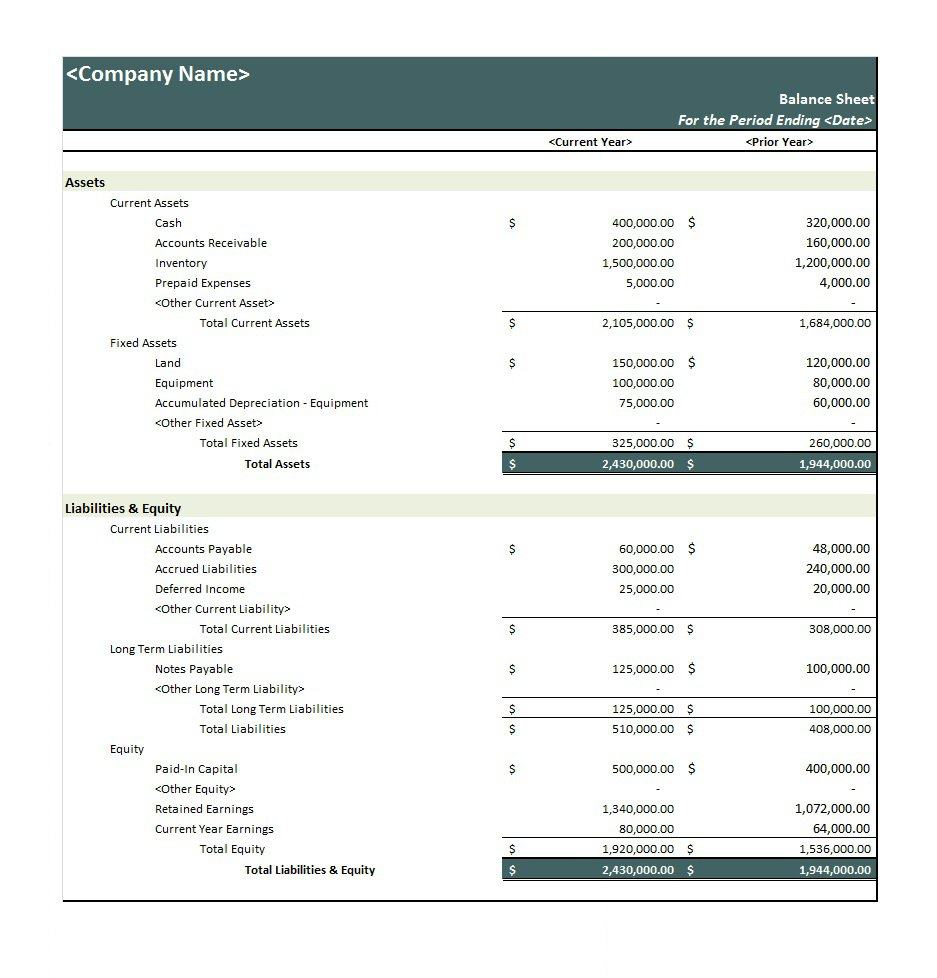

2. Listing Assets

Begin with listing your assets:

- Current Assets: Cash, accounts receivable, inventory, etc.

- Long-term Assets: Property, plant, equipment, intangible assets like patents or copyrights.

3. Entering Liabilities

Below assets, list out your liabilities:

- Current Liabilities: Accounts payable, short-term loans, accrued expenses.

- Long-term Liabilities: Long-term debt, deferred taxes.

4. Calculating Owner’s Equity

Owner’s Equity is the difference between your total assets and total liabilities. Use the formula:

Owner’s Equity = Total Assets - Total Liabilities

5. Auto-Summing Values

At the end of each section (Assets, Liabilities, Owner’s Equity), use the SUM function to calculate totals. For example:

- In the cell under Current Assets, you might write

=SUM(B2:B10)if your asset list ends in row 10.

6. Check for Balance

Ensure that Total Assets equals the sum of Total Liabilities and Owner’s Equity:

- Use

=B11=B14+B15to verify balance, where B11 is Total Assets, B14 is Total Liabilities, and B15 is Owner’s Equity.

⚠️ Note: If your balance sheet doesn't balance, review all entries for errors or consider hidden liabilities.

7. Formatting for Clarity

Format your balance sheet to enhance readability:

- Use bold for headings and totals.

- Apply borders to separate sections.

- Right-align numbers in the Amount column for easy reading.

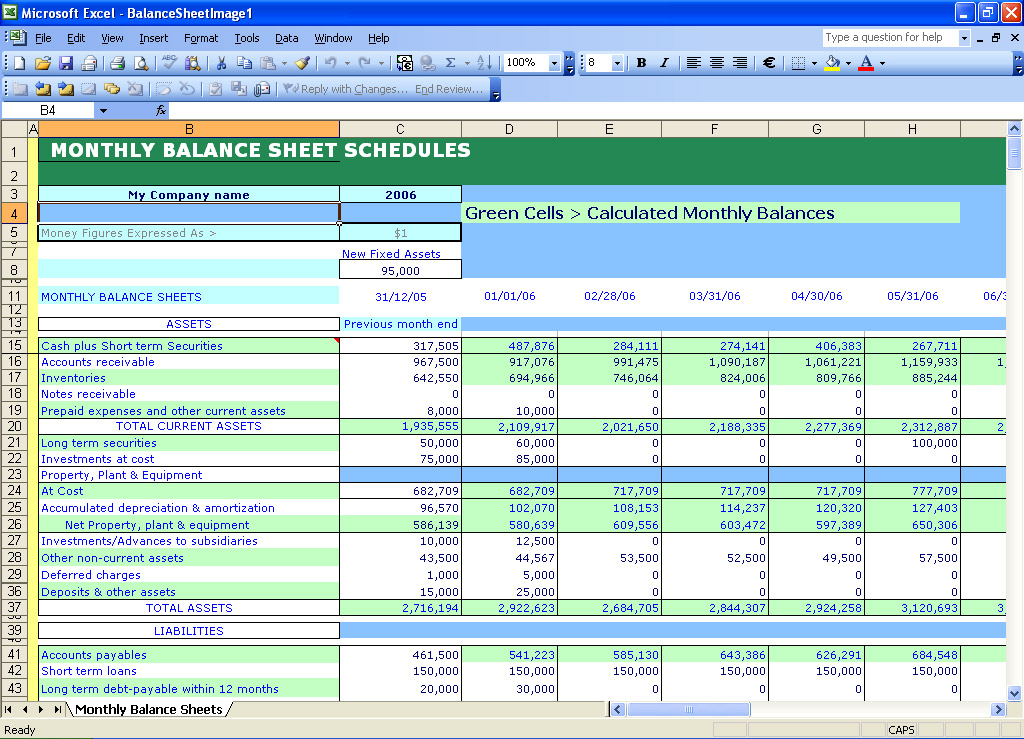

Maintaining and Updating Your Balance Sheet

To keep your balance sheet current:

- Regular Updates: Update your balance sheet monthly or quarterly, ensuring all transactions are accounted for.

- Reconcile Accounts: Reconcile your bank statements with your entries to catch any discrepancies.

- Use Formulas: Formulas can help automate calculations, but always review manual entries for accuracy.

Keeping your balance sheet up-to-date provides you with real-time insights into your financial position, aiding in strategic planning and decision-making.

To summarize this guide, creating and maintaining a balance sheet in Excel involves setting up the structure, entering your financial data accurately, and ensuring the balance equation holds true. This process not only helps in visualizing your financial health but also supports in making strategic financial decisions. With practice and regular updates, your ability to manage finances through balance sheets in Excel will grow, offering you clarity and control over your business's financial trajectory.

What is the main purpose of a balance sheet?

+

The primary purpose of a balance sheet is to provide a snapshot of a business’s financial position at a specific point in time, detailing what the business owns (assets), what it owes (liabilities), and the value of the owner’s equity.

Can I create a balance sheet for personal finances?

+

Yes, absolutely! A balance sheet can be tailored for personal use to show your net worth, helping you understand your financial health and make informed personal financial decisions.

How often should I update my balance sheet?

+

For business, updating your balance sheet monthly or quarterly is advisable. For personal finance, doing this quarterly or annually can provide valuable insights into your financial progress.

What should I do if my balance sheet does not balance?

+If your balance sheet does not balance, review all entries for accuracy. Check for transposed figures, missing transactions, or clerical errors. Also, consider if there might be hidden liabilities not yet accounted for.