Excel Payroll Sheet: Step-by-Step Creation Guide

In this tutorial, we'll guide you through the process of creating an Excel payroll sheet, from setting up the basic structure to integrating advanced functions for automatic calculations and report generation. This comprehensive guide will ensure that by the end, you have a fully functional payroll system tailored to your business's specific needs.

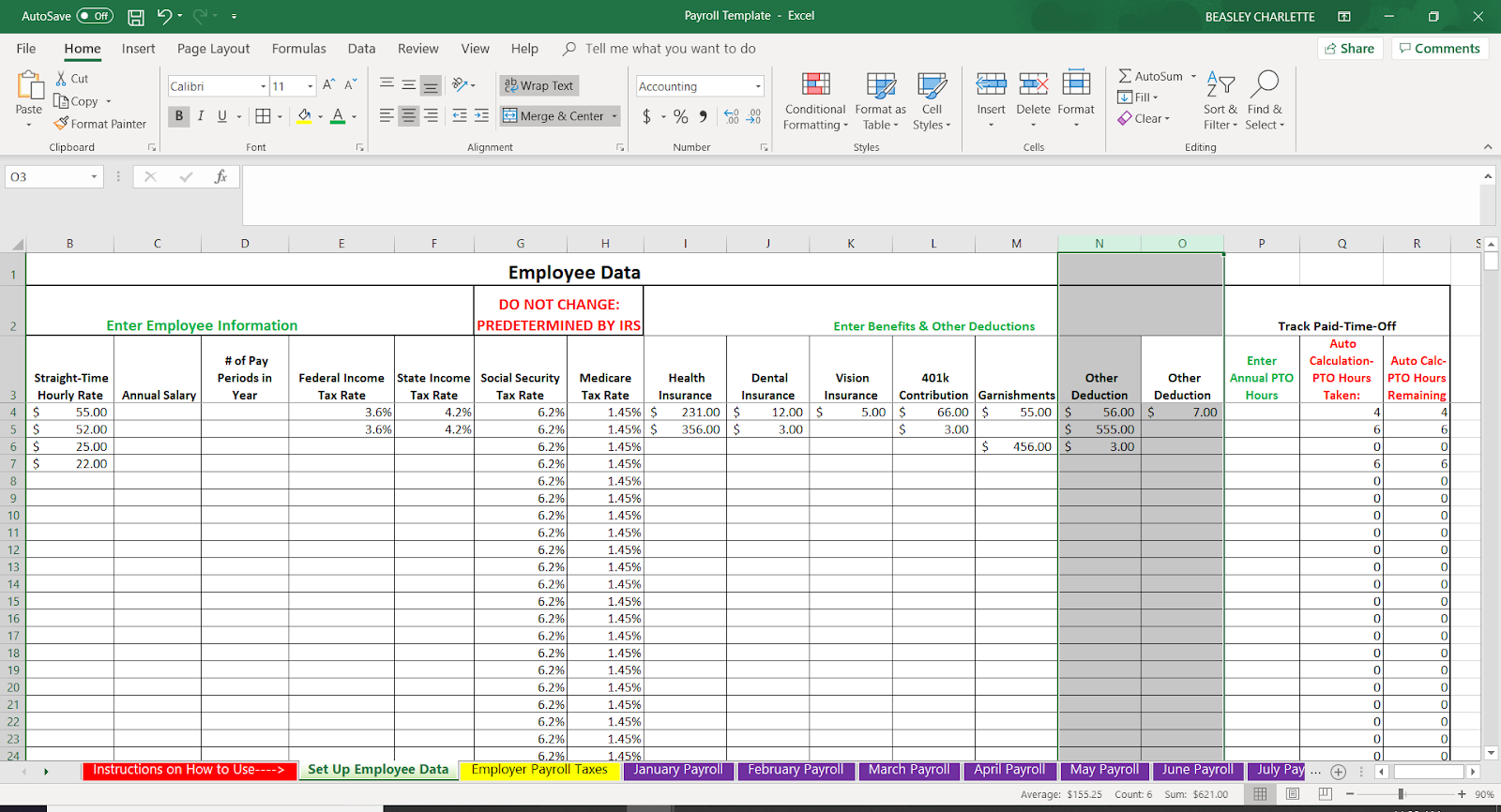

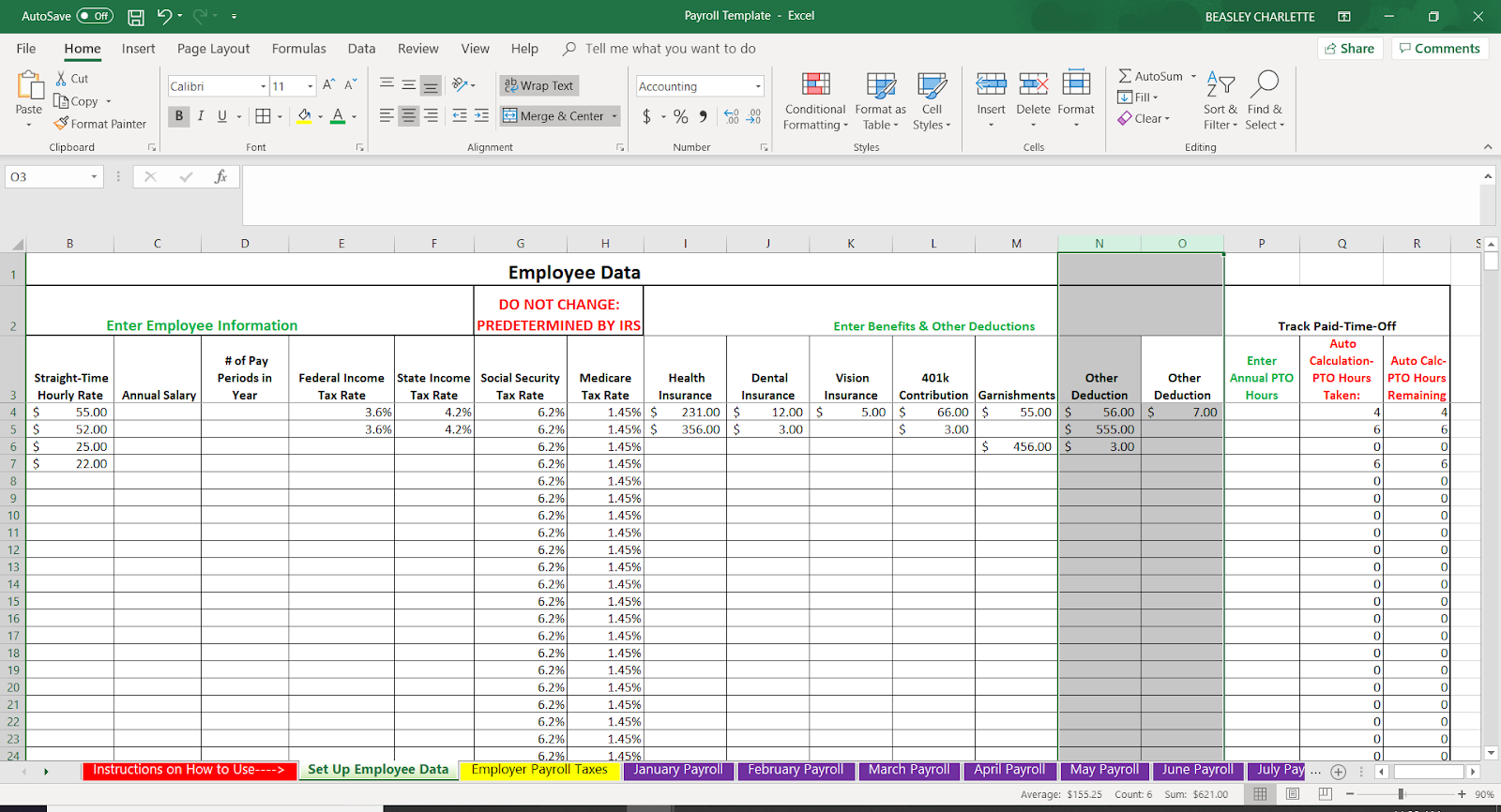

Setting Up Your Excel Sheet

Begin by opening a new Excel workbook. Your first step is to define the layout:

- Header Row: Label columns for Employee ID, Name, Hourly Rate, Hours Worked, Gross Pay, Deductions, Net Pay, and any other necessary fields like overtime or taxes.

- Data Rows: Use the rows beneath the header to input employee data. Start with a couple of rows for sample entries before scaling up.

Here’s how you might structure your spreadsheet:

| Employee ID | Name | Hourly Rate | Hours Worked | Gross Pay | Deductions | Net Pay |

|---|---|---|---|---|---|---|

| EMP-001 | John Doe | $15.00 | 40 | |||

| EMP-002 | Jane Smith | $18.00 | 35 |

📝 Note: Leave cells blank where calculations will be entered later, like Gross Pay, Deductions, and Net Pay.

Entering Basic Data

- Employee Information: Enter employee details in the relevant columns.

- Hourly Rates & Hours: Fill in the hourly wage and the number of hours worked. Remember to account for any overtime.

Calculating Gross Pay

Here’s where formulas come into play:

- Regular Pay: Use a formula like

=B2*C2to calculate basic pay where B2 is the hourly rate and C2 is hours worked. - Overtime Pay: If applicable, include overtime calculations using

=IF(C2>40,(C2-40)*1.5*D2,0). Adjust the formula for your country’s overtime rate. - Gross Pay: Sum up regular and overtime pay to get gross pay.

📌 Note: Excel formulas are case-insensitive, but for clarity in this tutorial, we'll capitalize function names.

Deductions and Net Pay

Next, we’ll deal with deductions:

- Taxes: Depending on your location, you might need to calculate various taxes. For example, income tax might be

=D2*0.2for 20% taxation. - Other Deductions: Include any other fixed or variable deductions like health insurance or retirement plans.

- Net Pay: Subtract total deductions from gross pay to find net pay.

Automating Payroll Calculations

Here, we’ll automate the process to minimize errors:

- Drop-down Lists: Use data validation to create drop-down menus for frequent entries, reducing input errors.

- Named Ranges: Define ranges for frequently used data to simplify formula writing.

- Automatic Updates: Set up your spreadsheet to recalculate automatically as data is entered or changed.

💡 Note: Named ranges can greatly simplify complex formulas and make your workbook more dynamic and easier to manage.

Advanced Features

To make your payroll sheet more sophisticated:

- Conditional Formatting: Highlight overtime or excessive hours.

- Error Checking: Use Excel’s error checking tools to ensure data integrity.

- Macros: Record macros for repetitive tasks like distributing the payroll sheet via email.

Generating Payroll Reports

To compile reports:

- Summarize Data: Use functions like SUMIF, SUMIFS, or PivotTables to consolidate information.

- Payroll Register: Create a tab or section for a payroll register summarizing all employees’ pay for a given period.

- Custom Reports: Create dynamic reports using VLOOKUP or INDEX/MATCH for specific analyses.

After setting up your payroll system, it’s worth considering a few key takeaways:

- Accuracy in inputting data is crucial to avoid payroll errors.

- Automation through formulas and conditional formatting reduces human error and speeds up the process.

- Regular review and updating of payroll data keeps your system compliant with changing regulations.

- The integration of advanced Excel features like PivotTables can transform raw payroll data into actionable insights.

How do I handle overtime in my payroll sheet?

+

To handle overtime, you can use an IF statement in your formula to calculate regular time pay and additional overtime pay. Adjust the formula based on local overtime pay rules.

Can I protect sensitive payroll data?

+

Yes, Excel allows you to protect worksheets and workbooks with passwords. You can also lock specific cells or hide sensitive formulas to prevent unauthorized changes.

What are the advantages of using a pivot table for payroll reports?

+

PivotTables offer dynamic data analysis, allowing you to summarize payroll data by various criteria like departments, dates, or employee types, making report generation quick and efficient.