5 Easy Steps to Copy Balance Sheet into Excel

Creating a balance sheet is an essential part of understanding the financial health of your business. Excel, with its robust capabilities, offers a perfect environment for constructing and analyzing balance sheets. Here are five straightforward steps to copy your balance sheet into Excel efficiently:

Step 1: Gather Your Data

Before opening Excel, ensure you have all the relevant financial data:

- Assets: Current assets (cash, accounts receivable, inventory) and long-term assets (property, plant, and equipment).

- Liabilities: Current liabilities (short-term loans, accounts payable) and long-term liabilities (long-term loans, bonds payable).

- Equity: Owner’s equity, retained earnings, and contributed capital.

- Previous Financial Statements: For reference and continuity.

Step 2: Open Excel and Create Headers

Once you’ve collected your data:

- Open a new workbook in Excel.

- Enter headers at the top of your columns. Common headers might be:

| Account | Amount |

|---|---|

| Assets | |

| Liabilities | |

| Equity |

Step 3: Copy Your Data

Now that your spreadsheet is ready:

- Current Assets: Copy your cash, accounts receivable, inventory, and other current assets into Excel.

- Long-term Assets: Input your property, plant, equipment, and other long-term assets.

- Current Liabilities: Enter your short-term loans, accounts payable, etc.

- Long-term Liabilities: Include long-term loans, bonds payable, and more.

- Equity: Add owner’s equity, retained earnings, and contributed capital.

📝 Note: Be thorough while copying; any errors can skew your analysis.

Step 4: Organize and Summarize

With your data entered, it’s time to structure it:

- Use the SUM function to calculate totals for each category.

- Summarize Assets, Liabilities, and Equity.

- Verify that your balance sheet balances (Assets = Liabilities + Equity).

- Format your numbers for better readability. Consider using currency formats or adding commas.

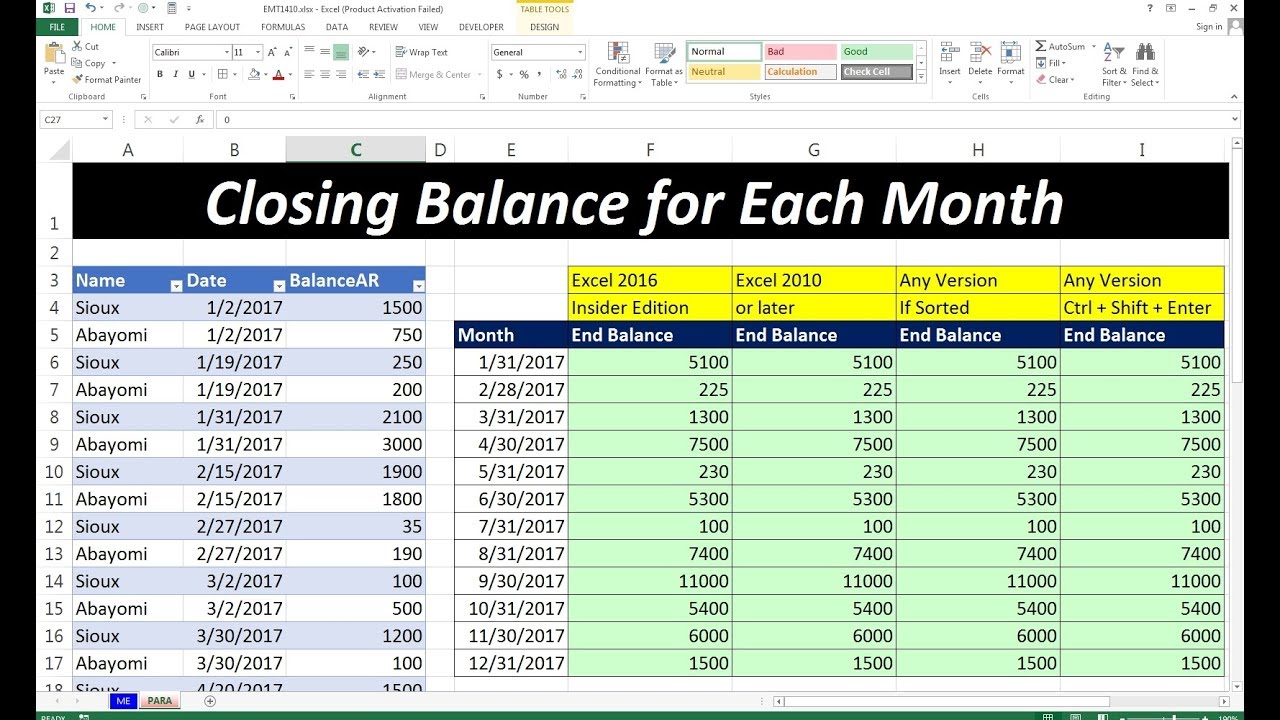

Step 5: Add Visuals and Analysis

To make your balance sheet more informative:

- Use Excel’s built-in charts to visually represent your data.

- Add pie charts to show proportions of asset types or liabilities.

- Create graphs to track changes over time or compare different periods.

In conclusion, copying your balance sheet into Excel allows for efficient financial analysis and presentation. By following these steps, you can set up, enter, and visualize your financial data, making your business's financial situation clearer and more actionable. The process not only helps in spotting trends and changes but also in making strategic decisions based on the financial health of your company.

How often should I update my balance sheet?

+

It’s a good practice to update your balance sheet monthly to reflect the current financial status of your business. However, you might need to update it more frequently during critical financial periods or if there are significant changes.

Can Excel automatically update my balance sheet?

+

While Excel does not automatically update a balance sheet from external financial systems, you can use formulas and data connections to pull data from other sources, reducing manual entry but still requiring periodic review and updates.

What should I do if my balance sheet doesn’t balance?

+

If your balance sheet doesn’t balance, double-check your entries for accuracy. Ensure all assets, liabilities, and equity are correctly recorded. Look for common mistakes like omitted entries, transposed numbers, or incorrect formulas. If discrepancies persist, consider consulting an accountant.