Mastering Excel: How to Consolidate Balance Sheets Easily

If you're managing a business or doing financial analysis, you know how critical balance sheets are. These financial statements provide a snapshot of your company's financial health at a specific point in time, detailing assets, liabilities, and equity. However, when dealing with multiple balance sheets from different subsidiaries, periods, or divisions, consolidating this information can become a tedious task. Fortunately, with Microsoft Excel's powerful tools, you can streamline this process significantly. In this guide, we'll explore how to consolidate balance sheets in Excel, making your financial reporting both efficient and accurate.

Understanding Balance Sheets and Consolidation

A balance sheet, by its nature, must balance; assets should equal liabilities plus equity. When consolidating:

- Summarize similar line items across various balance sheets.

- Adjust for intercompany transactions to avoid double counting.

- Translate foreign currency values if necessary.

Preparing Your Excel Workbook

Before diving into consolidation, ensure your Excel workbook is structured for this purpose:

- Create separate sheets for each balance sheet you need to consolidate.

- Use a common format for headers and line items to simplify automation.

- Make sure all data is clean, with no missing values or inconsistent naming conventions.

Consolidation Techniques

Manual Consolidation

This method involves manually entering data from multiple sheets into a summary sheet. Here’s how:

- Create a ‘Consolidated Balance Sheet’ tab.

- List all line items that need consolidation.

- Use formulas like =SUM(Sheet1!A2, Sheet2!A2, Sheet3!A2) to sum corresponding items from different sheets.

While effective for small datasets, this technique can be error-prone and time-consuming for larger volumes.

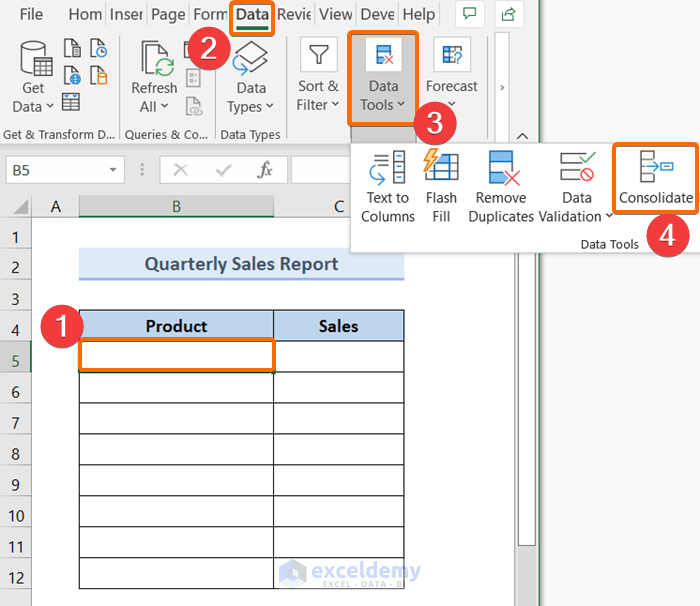

Using Excel’s Consolidate Function

Excel’s built-in Consolidate function makes this process less manual:

- Select a cell in the consolidated sheet where you want to start the consolidation.

- Go to Data > Consolidate.

- Choose the function (usually ‘Sum’ for balance sheets).

- Select the ranges from each sheet you want to consolidate.

- Check ‘Create links to source data’ for future updates.

🗒️ Note: Using the Consolidate function creates references to the original data, so any updates in the source sheets will automatically update in the consolidated sheet.

Using PivotTables for Advanced Consolidation

PivotTables offer an even more dynamic approach to consolidate balance sheets:

- Compile all balance sheet data into a single table with an additional column for identifiers (e.g., subsidiary, period).

- Insert a PivotTable.

- Use row labels for balance sheet line items, and column labels for identifiers.

- Sum or average values as necessary.

📊 Note: PivotTables enable quick filtering and sorting, which is particularly useful for financial analysis and reporting.

Consolidation with Macros

For repetitive tasks, VBA macros can automate the consolidation process:

- Develop a macro that loops through sheets, collects data, and consolidates it into a summary sheet.

- Ensure your macro handles different formats or adjustments like intercompany eliminations.

Common Challenges and Solutions

Here are some issues you might encounter:

- Data Discrepancies: Use Data Validation to ensure consistency in inputs.

- Intercompany Transactions: Create a separate sheet to track and eliminate these.

- Currency Conversion: Set up a currency conversion table or use XLOOKUP for dynamic conversions.

The Importance of Accurate Consolidation

Accurate balance sheet consolidation is vital for:

- Providing stakeholders with a clear financial picture.

- Ensuring compliance with accounting standards.

- Facilitating internal audits and external financial reporting.

In a business landscape where accuracy and speed are key, mastering the art of consolidating balance sheets in Excel not only saves time but also ensures that your financial reporting is both robust and reliable. Excel, with its array of tools from simple sum functions to sophisticated PivotTables, stands as an invaluable ally in navigating the complexities of financial consolidation.

What is balance sheet consolidation?

+

Balance sheet consolidation is the process of combining financial statements from different divisions, subsidiaries, or periods into a single, comprehensive report to provide an overall view of financial health.

Why should I use Excel for balance sheet consolidation?

+

Excel provides powerful tools like formulas, pivot tables, and VBA macros that can automate and streamline the consolidation process, making it efficient and less prone to manual errors.

Can Excel handle complex consolidation needs?

+

Yes, Excel can manage complex consolidation by using features like PivotTables for dynamic reporting, custom macros for specific adjustments, and Data Validation for maintaining data integrity.