Claim Back PPI: No Paperwork Required Guide

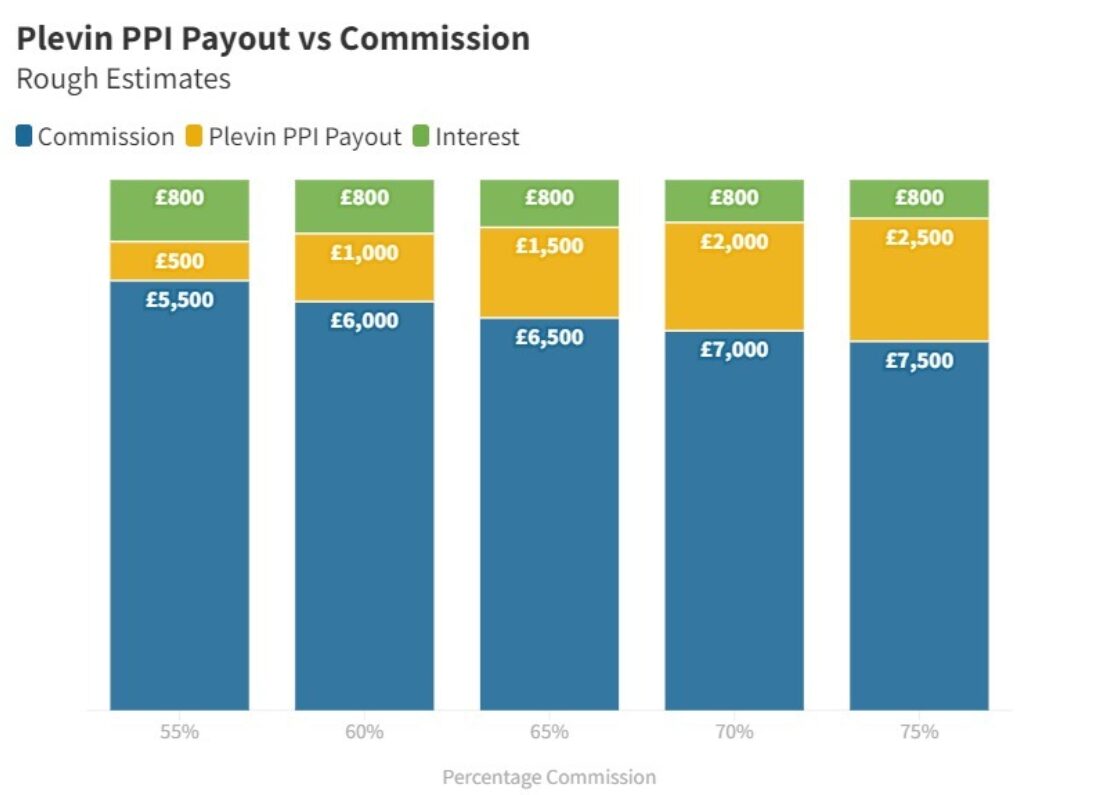

Have you ever taken out a Payment Protection Insurance (PPI) policy with your loan or credit card? If so, you might be entitled to a refund. PPI mis-selling has been a contentious issue in the UK, resulting in a massive compensation payout from banks to customers. However, many people are put off from claiming because of the thought of navigating through complex paperwork. Fear not; this guide will show you how to claim back PPI with no paperwork required.

Understanding PPI

Before diving into the claim process, it’s crucial to understand what PPI is. Payment Protection Insurance was designed to cover repayments on loans, credit cards, or other forms of credit in case the borrower became unable to work due to illness, disability, or unemployment. However, it was often mis-sold by financial institutions, leading to widespread claims for compensation.

Why No Paperwork?

The good news is that with digital advancements and new regulations, the process of reclaiming mis-sold PPI has become much simpler. Here’s why:

- Consumer Rights Act 2015: This act has made it easier for consumers to claim back PPI without extensive documentation.

- Online Platforms: Several websites and services allow you to initiate a claim with minimal input.

Steps to Claim Back PPI Without Paperwork

Step 1: Confirm If You Have PPI

Begin by verifying if you actually have PPI attached to your financial products. Here’s how:

- Check Statements: Look through your credit card or loan statements for any mention of PPI, Insurance, or similar terms.

- Ask Your Lender: Contact your bank or lender directly through their customer service or online banking portal.

Step 2: Choose Your Claiming Method

Now that you’ve confirmed you had PPI, here are the methods to proceed:

- Direct Approach: Contact the bank or credit provider directly via their website or phone.

- Online Services: Use one of the many reputable online PPI claim firms that require only basic information.

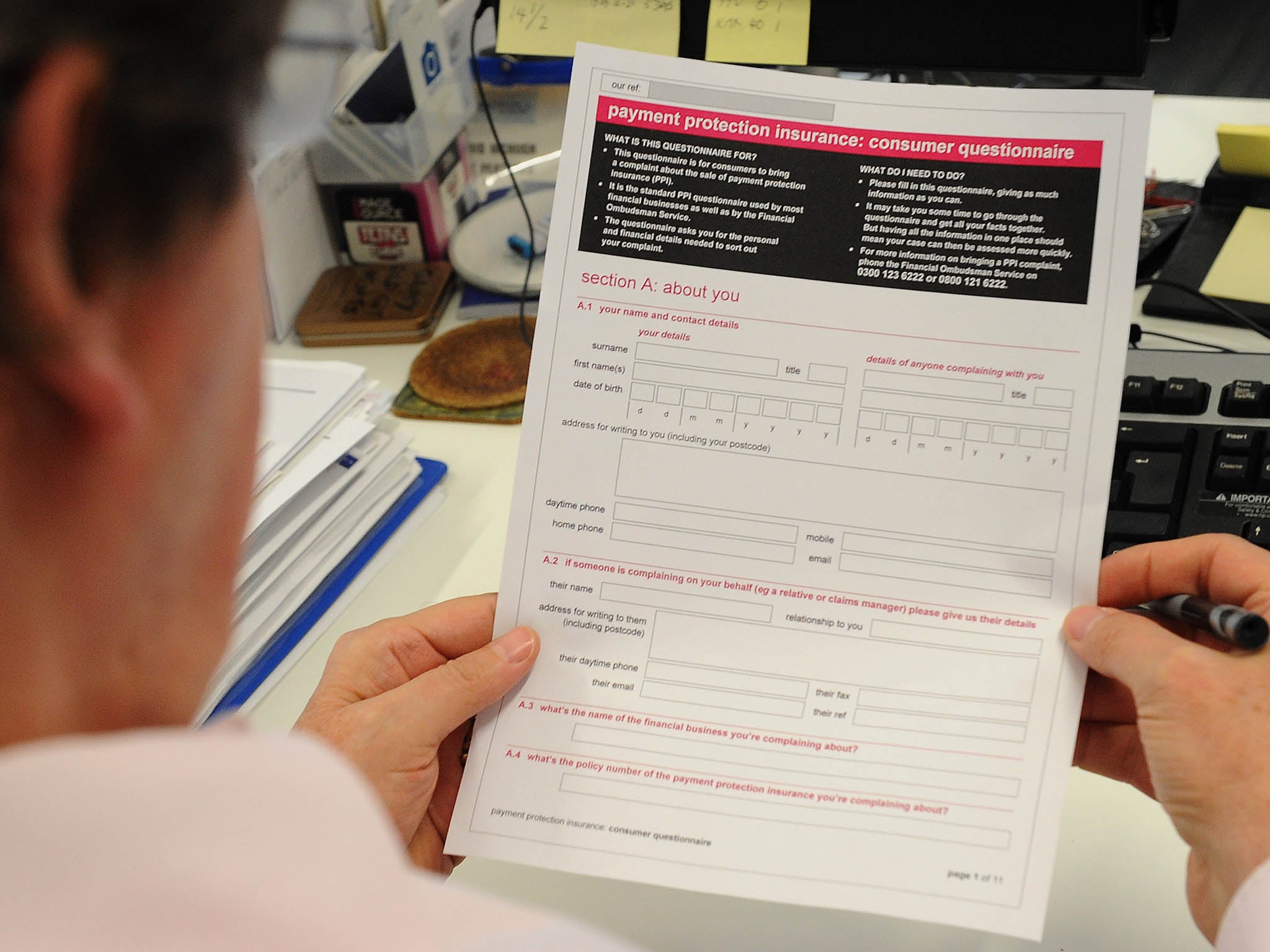

Step 3: Fill in Basic Information

Whether you go direct or through a service, you’ll need to provide:

- Name and Address

- Contact Information

- Policy Details or Account Number

⚠️ Note: Make sure to provide accurate information to avoid delays or rejection of your claim.

Step 4: Reviewing the Claim

Once your claim is submitted:

- The Provider: Will review your claim against their records. They might ask for additional details, but typically, the process has now become paperless.

- Claims Management Company: If you use an online service, they’ll handle this step for you, seeking to get the best possible outcome with minimal interaction from your side.

Step 5: Acceptance or Appeal

If your claim is successful:

- You’ll be informed of the compensation amount, usually through email or a letter.

If the claim is denied:

- Appeal: You can appeal the decision within 6 months by contacting the Financial Ombudsman Service (FOS) or using the appeal services of a claims management company.

💡 Note: The process might take longer than expected, so patience is key.

Final Thoughts

Claiming back PPI has now become an easy process, one that you can navigate without drowning in paperwork. Online platforms and regulatory changes have streamlined the path to reclaiming what you’re owed, making it less daunting for many consumers. Remember, you don’t have to accept a “No” for an answer; appeals are an option, and often, they succeed.

Is it still possible to claim PPI?

+

Yes, even though the deadline for making a claim directly with banks has passed, you can still claim through the Financial Ombudsman Service or use online claims services to seek compensation.

Do I need a lawyer to make a PPI claim?

+

Not necessarily. You can claim on your own or through an online claims company, which will handle the process for you without the need for legal representation.

How long does it take to receive a PPI refund?

+

Typically, it can take a few weeks to a few months for a refund to be processed once your claim is accepted. The timeline can vary based on the bank’s process or if an appeal is required.

What if I’ve already claimed, but I’m not satisfied with the compensation?

+

If you believe you were under-compensated or misinformed, you can appeal the decision with the Financial Ombudsman Service.

Are there any risks in using online PPI claims services?

+

As with any service, choose reputable companies to avoid scams or poor service. Research and read reviews to ensure you’re dealing with a trustworthy entity.