3 Simple Ways to Calculate Future Value in Excel

Understanding Future Value in Excel

Calculating the future value of an investment or saving scheme is crucial for personal finance, business planning, and investment analysis. Excel, with its robust financial functions, makes this task straightforward. In this comprehensive guide, we'll explore three simple methods to calculate future value using Microsoft Excel.

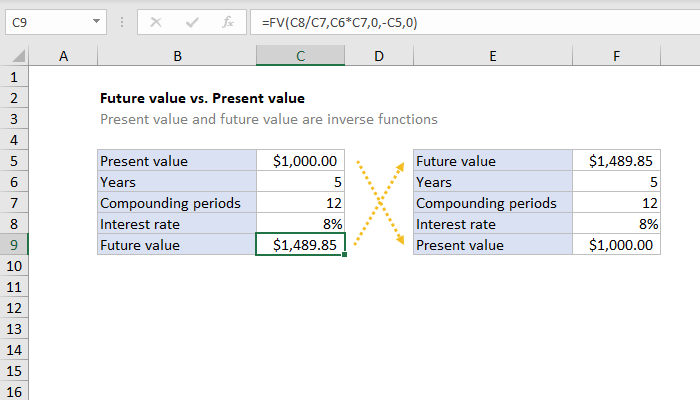

Method 1: Using the FV Formula

Excel provides a built-in function called FV (Future Value), which calculates the future value of an investment based on a constant interest rate, regular payments, and the number of periods. Here's how you can use it:

- Select a cell where you want the result to appear.

- Enter the following formula:

=FV(rate, nper, pmt, [pv], [type]) - rate: The interest rate per period. If you're calculating annually, this is your annual interest rate.

- nper: The total number of payment periods. For example, if you're looking at a 5-year investment with annual payments, this would be 5.

- pmt: The payment made each period; this should be constant during the investment's life.

- [pv]: Optional. The present value or the lump-sum amount that the payment stream's future value is worth now. If omitted, it's assumed to be 0.

- [type]: Optional. Indicates when the payments are due. Use 0 if payments are due at the end of the period, 1 if at the beginning.

- Press Enter to see the result.

💡 Note: If your investment doesn't involve regular payments (pmt), you can omit or set this argument to 0.

Method 2: Manual Calculation Using Formula

While Excel provides the FV function, understanding how to manually calculate future value can give you a better insight into the calculations:

Simple Interest

- Simple Interest formula: FV = PV * (1 + (r * t))

- Where:

- FV is the future value.

- PV is the present value.

- r is the annual interest rate (expressed as a decimal).

- t is the number of years.

Compound Interest

- Compound Interest formula: FV = PV * (1 + (r/n))^(n*t)

- Where:

- n is the number of times interest is compounded per period. If it’s compounded annually, n = 1.

- To calculate this in Excel, you would enter:

=PV * (1 + (rate/times_compounded))^(times_compounded*years)

Method 3: Goal Seek Feature

Excel's Goal Seek feature allows you to find the future value by determining what rate or number of periods you need to achieve a specific goal. Here's how:

- Set up your worksheet with known values for present value, payments, etc.

- Enter an estimated future value or use one of the other methods to get an approximate value.

- Go to Data > What-If Analysis > Goal Seek.

- In the Goal Seek dialog:

- Set the cell containing your future value as the "Set cell".

- Enter your target future value in the "To value" field.

- Select the cell that contains the variable you want to change (rate or nper).

- Click OK, and Excel will adjust the value to meet your target.

| Function | Description |

|---|---|

| FV | Calculates the future value of an investment |

| PV | Calculates the present value of an investment |

| Goal Seek | Finds the input value that results in the formula producing the desired output |

These methods provide you with the tools to calculate future values effectively in Excel, whether you're looking at savings accounts, investments, loans, or any financial scenarios requiring future value estimation.

In the final wrap-up, understanding how to calculate future value in Excel is not just about crunching numbers but also about strategic planning. Whether you’re saving for retirement, planning an investment, or just trying to understand the growth potential of your money, Excel offers simple yet powerful tools to get the answers you need. By using these methods, you can better prepare for the future, make informed financial decisions, and visualize how your investments or savings can grow over time.

Remember, while these calculations provide a theoretical outcome, real-world scenarios often include variables like tax implications, changes in interest rates, and economic fluctuations, which require more comprehensive analysis. However, mastering these basic calculations can give you a solid foundation for more advanced financial modeling.

Can I calculate future value for irregular payments?

+

Yes, you can. Although the built-in FV function assumes regular payments, you can use a combination of manual calculations or other Excel functions like PMT for each irregular payment to estimate the future value.

What if my interest rate changes over time?

+

For changing interest rates, you would need to manually calculate the future value for each period with its specific rate or use more advanced functions like IRR or create a custom model in Excel.

How accurate are these calculations for long-term investments?

+

The accuracy depends on the stability of the inputs like interest rates. For long-term investments, these methods give a starting point, but real-world factors might affect the actual outcome significantly.