Build an Excel Amortization Sheet for Land Contracts Easily

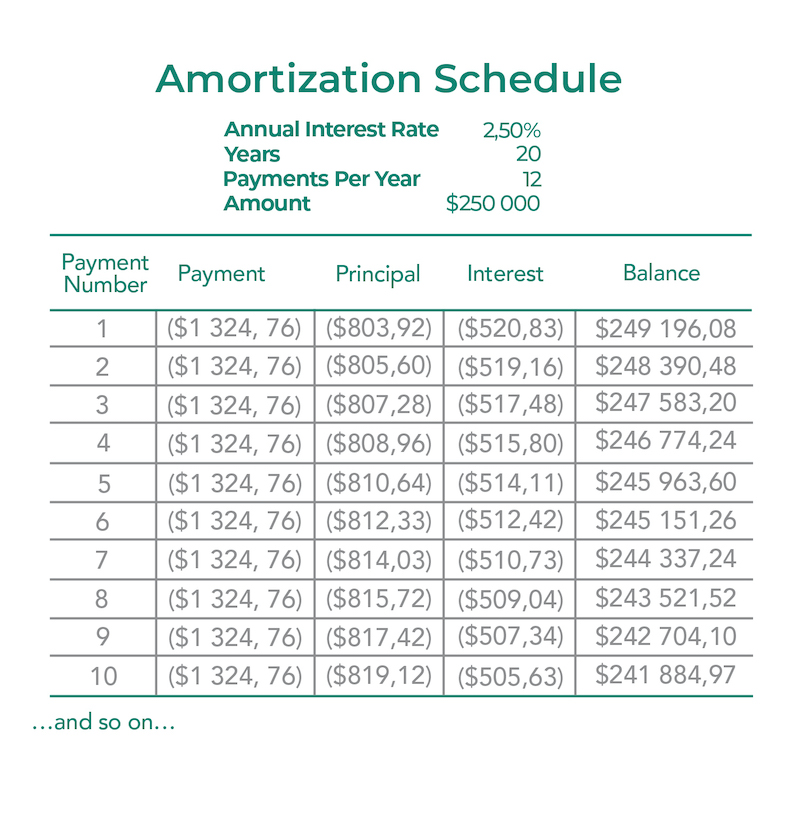

Managing land contract payments can be complex, but with an Excel amortization sheet, you can easily track your payments, interest, and principal reduction over time. This guide will walk you through the steps to create an Excel spreadsheet that automates these calculations, providing you with a clear view of your financial commitments.

Understanding Land Contracts

A land contract or installment sale agreement is a method of buying real property where the buyer makes payments directly to the seller over time. Here are some key points to understand:

- Purchase Price: The total price agreed upon for the land.

- Down Payment: An upfront payment made at the signing of the contract.

- Interest Rate: The annual interest rate applied to the outstanding balance.

- Monthly Payment: The amount paid monthly, which includes principal and interest.

- Term: The duration over which payments will be made.

Setting Up Your Excel Sheet

Here’s how you can set up your amortization sheet:

Creating Headers

Start by creating headers for your columns. These headers will outline the various components of your amortization schedule:

| Payment Number | Payment Date | Beginning Balance | Payment | Principal | Interest | Ending Balance |

|---|

Ensure these headers are formatted to make them stand out, for instance, by using bold and center alignment:

| Payment Number | Payment Date | Beginning Balance | Payment | Principal | Interest | Ending Balance |

|---|

Input Basic Data

Below the headers, input the following key figures:

- Purchase Price: The total cost of the land.

- Down Payment: The amount paid initially.

- Interest Rate: The annual rate of interest.

- Term: The total number of payments.

- First Payment Date: When the first payment is due.

📌 Note: Ensure that all figures entered are in numeric format, and the interest rate is expressed as a percentage.

Formulas for Calculating Payments

Here are the essential formulas you’ll need to populate your sheet:

- Monthly Payment: Use the PMT function to calculate the monthly payment:

=MSPMT(annual rate/12, term, -principal)

Where:

- annual rate is the interest rate divided by 12

- term is the number of payments

- principal is the initial loan amount after the down payment

=Beginning Balance * (annual rate/12)

=Monthly Payment - Interest

=Beginning Balance - Principal

Adding Rows for Each Payment

Now, add rows for each payment until you reach the end of the term. Here’s how you can do it:

- Payment Date: Use the EDATE function to increment the date by one month.

=EDATE(Previous Date, 1)

🧮 Note: After setting up the first row, you can copy formulas down for subsequent rows, but make sure to adjust cell references where necessary.

In summary, creating an Excel amortization sheet for a land contract involves setting up headers, inputting basic data, calculating payments, and then expanding the schedule with payment details. This methodical approach ensures you have a clear overview of your financial commitments, making it easier to track your progress in paying off the land.

What if my land contract has balloon payments?

+

To accommodate balloon payments, modify your Excel sheet to reflect the specific payment structures. Ensure the formulas calculate the increased payment or final lump sum accordingly.

How do I adjust for early payoff?

+

To simulate an early payoff, you’ll need to recalculate the remaining term’s payments considering the new principal amount.

Can I add additional payments to the schedule?

+

Yes, you can incorporate additional payments by adjusting the principal amount in the sheet or adding an extra payment column.