5 Essential Tips for Adult Job Paperwork

The transition into the professional world or moving up within your career ladder often involves a significant amount of paperwork. From filling out employment forms to understanding benefits and contracts, the administrative side of job transition can be overwhelming. Here, we'll delve into five essential tips to manage and navigate adult job paperwork with ease and efficiency.

1. Understand Your Documentation Requirements

When you're entering or progressing in the job market, you'll encounter various documents that are essential for your employment:

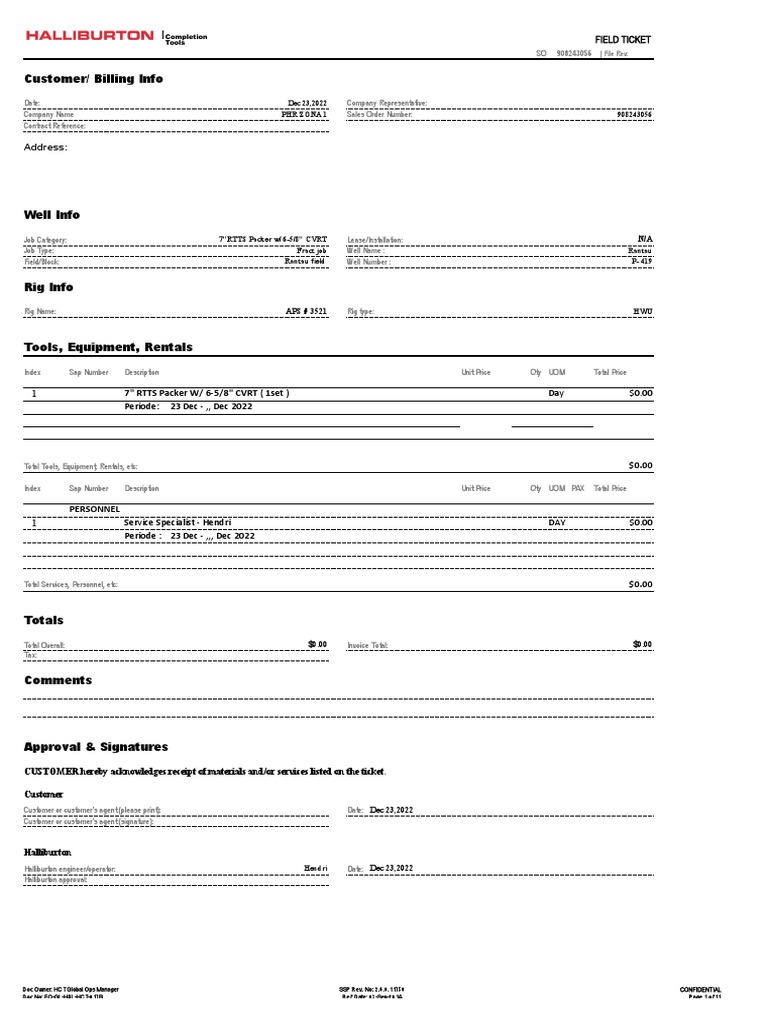

- Application Forms: These can range from basic information to detailed background checks.

- Contracts: Whether you're starting a new job or signing for a promotion, contracts outline your rights and responsibilities.

- Benefits Enrollment: Health insurance, retirement plans, and other perks require specific forms to enroll.

- Tax Forms: W-4 for withholding tax and possibly state-specific forms.

- Identification Documents: You might need to present proof of identity like a driver's license or passport, and social security card.

Make a checklist of all required documents before your job start date or review date. Some companies might offer an onboarding portal where you can view, complete, and submit these documents online. If not, be prepared to bring originals or certified copies to your interview or first day at work.

🗒️ Note: Always make copies of documents before handing them over to HR or your employer.

2. Read and Negotiate Your Contract

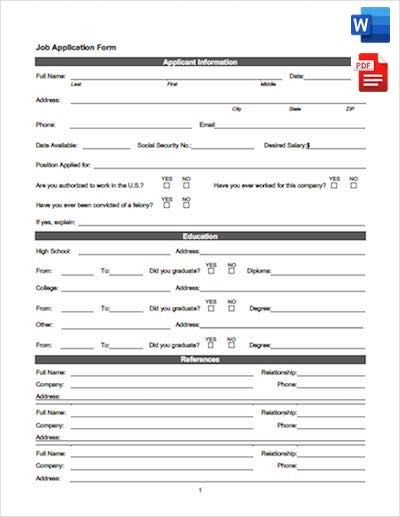

Contracts are not just formalities; they're legal agreements that define your employment. Here are key areas you should pay attention to:

- Position and Responsibilities: Ensure the job description matches what you discussed during your interview.

- Compensation and Benefits: Clarify your salary, bonuses, stock options, and benefits.

- Working Hours and Location: Check for any clauses about remote work or travel requirements.

- Termination and Notice Periods: Understand how either party can end the relationship.

- Confidentiality and Non-compete Clauses: These can have significant long-term implications.

- Probation Period: Know what is expected during this phase, if applicable.

Don’t sign anything without a thorough review. If in doubt, consider consulting with a legal advisor or ask for clarification from HR. Negotiating terms like salary or flexibility can be done before signing. Keep a digital and physical copy of your contract for future reference.

⚖️ Note: Be aware of any clauses that might limit your career mobility post-employment.

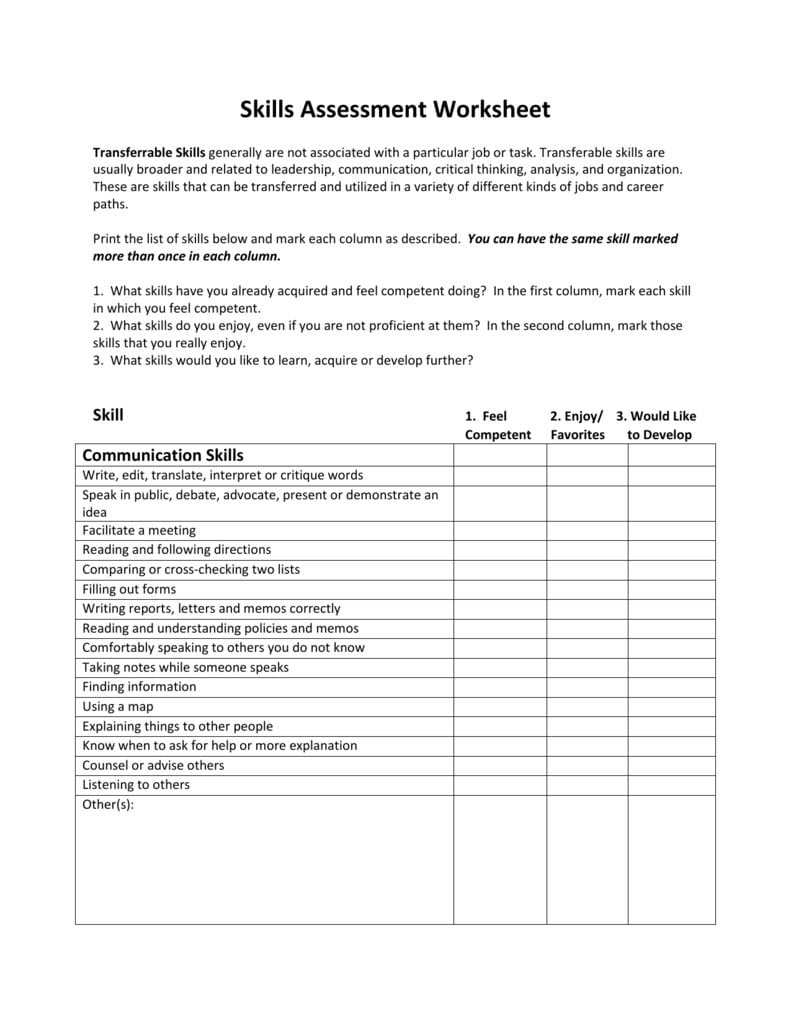

3. Stay Organized with HR Documents

After obtaining employment, keeping your HR documents in order is crucial:

- Keep a HR Folder: Use both physical and digital formats for ease of access.

- Document Tracking: Track when documents are due or need updates (e.g., performance reviews).

- Annual Reviews: Mark your calendar for periodic review of documents like benefits and contracts.

- HR Portal: Familiarize yourself with your company's HR portal if available.

Organization prevents missed deadlines for enrollments or renewals, and it’s invaluable during performance reviews or when you need to reference your job agreement.

📁 Note: Consider using cloud storage like Dropbox or Google Drive for easy access and backup of HR documents.

4. Understand Your Benefits Package

Your benefits can be one of the most valuable aspects of your compensation package. Here’s what to consider:

- Health Insurance: Know your coverage, including out-of-pocket expenses and provider networks.

- Retirement Plans: Understand contributions, company matching, vesting schedules, and retirement age.

- Paid Time Off: This includes vacation, sick leave, and holidays.

- Additional Perks: Look for perks like gym memberships, commuting subsidies, or educational benefits.

Review your options during the open enrollment period, and consider speaking with an HR representative to maximize your benefits package according to your needs. Also, keep an eye on when certain benefits change or end, as life events can impact your eligibility.

🔍 Note: Often, companies offer flexible benefit plans. Use them to tailor your package to your personal situation.

5. Know Your Tax Obligations

Taxes are an integral part of your income, and managing them correctly can save you money and headaches:

- Accurate Withholdings: Ensure you're withholding the correct amount to prevent underpayment penalties.

- Deductions and Credits: Understand what you're eligible for, including work-related expenses.

- 401(k) or IRA Contributions: These can reduce your taxable income significantly.

- Tax-Exempt Benefits: Some benefits, like health insurance premiums paid by the employer, can be tax-exempt.

- Tax Filing: Keep records for tax filing purposes; you might need specific HR documents.

It's prudent to review your withholdings each year or when there's a significant change in your income or personal situation. If your tax situation is complex, consulting a tax advisor can be worthwhile.

💰 Note: Over or underpaying taxes can lead to penalties; aim for a balanced withholding amount.

Handling job paperwork might seem daunting, but with a systematic approach, you can ensure you're well-informed, organized, and protected. From understanding the necessary documentation to negotiating terms of your contract, staying on top of benefits, and managing taxes, these tips provide a foundation for smooth transitions and sustained professional well-being.

What if I make a mistake on my paperwork?

+

If you make an error, correct it as soon as possible. Often, companies have a process for amending forms or contracts. Contact HR or the relevant department to rectify the mistake.

Can I negotiate a contract after signing it?

+

Once signed, it’s legally binding, but some terms might be open for renegotiation, especially if there have been significant changes in the job scope or your situation. Always consult HR or a legal advisor for significant changes.

How often should I review my HR documents?

+

It’s a good practice to review your HR documents at least annually during open enrollment periods or when you experience life changes like marriage or moving. This ensures your benefits and agreements align with your current needs.