Stamps Needed for IRS 10-Page Paperwork Return

The world of tax filing is filled with nuances, from filling out complex forms to ensuring every detail aligns with the IRS regulations. Among the myriad details that tax filers need to keep in mind, one seemingly minor yet critically important aspect is the need for adequate postage when returning your tax documents. This comprehensive guide dives deep into understanding how many stamps you might need for a 10-page IRS paperwork return.

Why Correct Postage is Crucial

Before delving into the specifics of stamp requirements, let's touch upon why postage matters:

- Avoid Return Penalties: IRS documents need to be filed by the deadline. Insufficient postage can lead to your documents being returned, causing delays and potential penalties.

- Timely Processing: Correct postage ensures your return reaches the IRS in a timely manner, crucial for refunds or avoiding fines.

- Respect for IRS Procedures: The IRS expects filers to follow guidelines, including correct postage to ensure smooth operations.

Understanding IRS Paperwork Volume

IRS paperwork can vary from basic individual returns to complex business forms, but for the purposes of this guide, let's assume we're discussing the standard 10-page tax return:

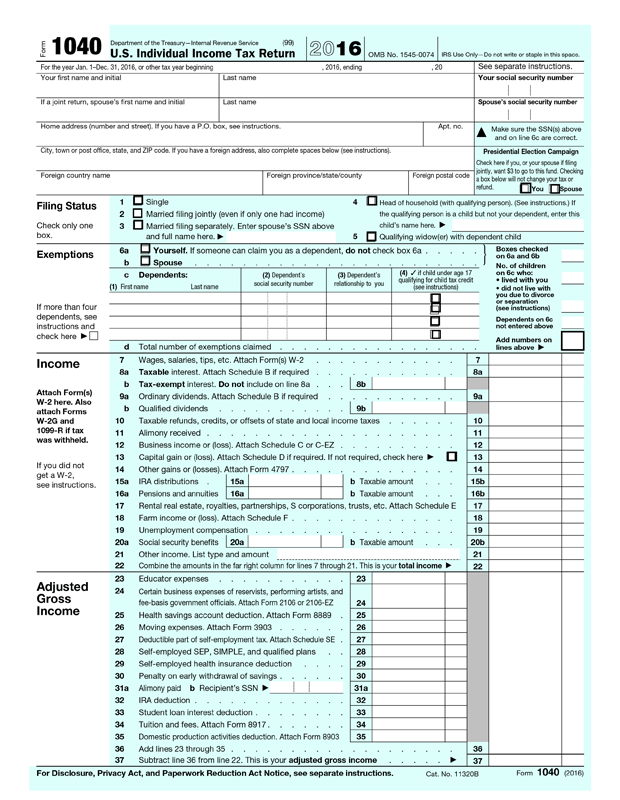

- Form 1040: Typically, this form runs between 2 to 4 pages.

- Additional Schedules: Additional schedules like Schedule A for itemized deductions, Schedule B for interest and dividends, and others can add significantly to the page count.

- Supporting Documents: Receipts, statements, and worksheets can increase the volume, leading to a 10-page document.

Calculating Postage

To estimate the stamp requirement for your 10-page IRS paperwork, you need to consider:

- Weight: The average paper used for IRS documents weighs about 5 pounds per ream (500 sheets). Thus, each sheet weighs roughly 0.1 ounces. A 10-page document therefore weighs approximately 1 ounce.

- Thickness: IRS documents, particularly those with attachments, can exceed the maximum thickness allowed for a single first-class stamp.

- Stamped or Metered: The type of postage you use affects the cost. Metered mail typically has a different rate than stamps.

- Non-Machinable Surcharges: IRS documents often require manual sorting, which can add a surcharge to the postage.

Now, let's look at the potential stamp requirements:

| Service | Description | Postage Rate | Additional Considerations |

|---|---|---|---|

| First-Class Mail (Stamped) | Up to 1 ounce | $0.55 | May need additional stamps if over 1 ounce or non-machinable |

| First-Class Mail (Metered) | Up to 1 ounce | $0.51 | Similarly, may require extra postage for weight or thickness |

| Non-Machinable Surcharge | For square, rigid, or oddly shaped envelopes | $0.20 | Often applicable for IRS documents |

📝 Note: Postage rates are subject to change, so always check current USPS rates before mailing.

Practical Steps to Ensure Correct Postage

Here's how you can ensure your IRS paperwork has the correct postage:

- Weigh Your Documents: Using a kitchen scale or a post office scale to get an accurate weight.

- Check Dimensions: Ensure your envelope doesn't exceed the size or thickness limitations for standard postage.

- Use Post Office Services: The USPS offers services to weigh and stamp mail correctly to avoid underpayment.

- Consider Certified Mail: For added security, consider certified mail, which adds to the overall cost but provides tracking and proof of delivery.

📧 Note: If you're unsure, bringing your documents to the post office allows for professional weighing and stamp calculation, which is often the safest option.

Alternative Mailing Methods

Besides traditional mail, consider:

- Priority Mail: With flat-rate envelopes, Priority Mail can be cost-effective and provides tracking.

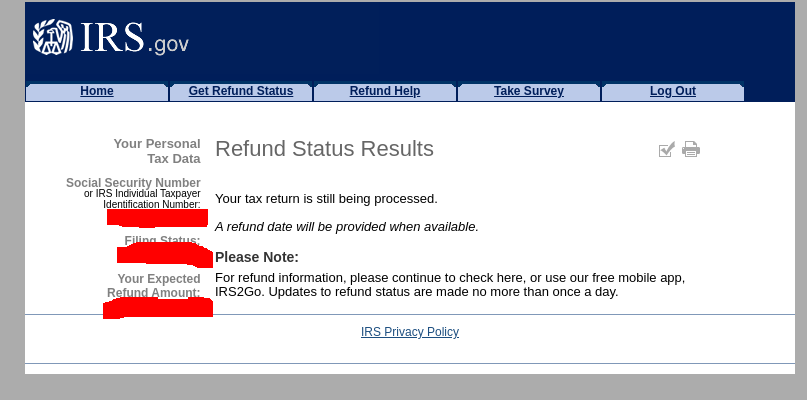

- Electronic Filing: Filing taxes electronically eliminates the need for mailing and postage altogether.

Ultimately, filing taxes can be a daunting task, but ensuring your IRS paperwork has the correct postage is a small yet vital step. Adequate postage ensures your documents reach the IRS on time, avoiding potential penalties or delays. Whether you choose to mail your documents or opt for the ease and efficiency of electronic filing, understanding the intricacies of postage ensures your peace of mind during tax season.

How can I avoid underpaying for postage when sending IRS documents?

+

The best way to ensure you pay the correct postage is by taking your documents to the post office for weighing and stamp calculation. Additionally, consider certified mail for tracking purposes.

Can I send my tax return through Priority Mail?

+

Yes, you can send your tax return via Priority Mail, which can be cost-effective if using a flat-rate envelope, and it includes tracking.

What are the benefits of electronic tax filing over mailing?

+

Electronic filing eliminates the need for mailing, reduces errors, speeds up processing, provides confirmation of receipt, and often leads to faster refunds or confirmation of filing.