5 Costs of Mortgage Paperwork for $600K Home

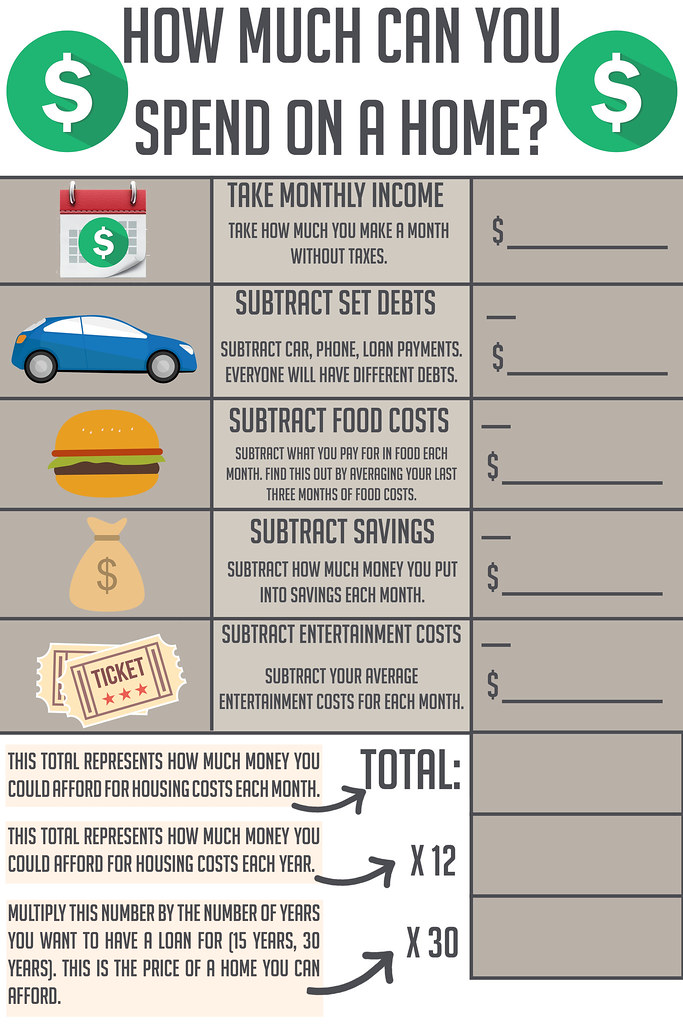

Buying a home is an exciting journey, one that involves numerous steps, each with its own set of costs and paperwork. When you're looking at purchasing a $600,000 property, understanding the various mortgage-related expenses is crucial. These costs not only include the down payment and interest but also the often underestimated fees associated with mortgage paperwork. Let's explore the five significant costs of mortgage paperwork that come with buying such a valuable asset.

1. Application Fees

The first step in securing a mortgage is to apply for one. This process isn’t free, and lenders charge an application fee to cover the costs of processing your mortgage application. These fees can range from 300 to 500 or more, depending on the lender and complexity of your loan:

- Administrative tasks like pulling your credit report.

- Data entry, file management, and preliminary underwriting.

- Cost of verification processes like employment and asset checks.

2. Appraisal Fees

An appraisal of the property is a vital step in securing a mortgage, ensuring the home’s value aligns with what’s being paid for it. This appraisal fee can vary significantly:

| Average Cost | Range |

|---|---|

| 450</td> <td>300 - $600 |

💡 Note: Lenders require an independent appraiser, usually not affiliated with the bank, to evaluate the property's value to determine the loan amount they'll grant.

3. Title Search and Insurance

Before you can purchase your home, a title search ensures there are no legal issues with ownership. Here’s what you might encounter:

- Title Search Fee: 200 - 400, which covers the cost of examining public records to confirm ownership history.

- Title Insurance: This insurance protects against legal claims or issues not uncovered during the title search:

- Owner’s Policy: Typically 0.5% - 1% of the home purchase price, ensuring ownership for you.

- Lender’s Policy: Around $1000, which protects the mortgage lender against title-related claims.

4. Closing Costs

Closing costs are an amalgamation of various fees paid at the closing of your mortgage. For a $600,000 home, expect these costs to be:

- 2% - 5% of the home’s purchase price:

- Loan origination fees

- Attorney fees

- Notary fees

- Recording fees

- Taxes and government fees

- Escrow and settlement fees

- Home inspection fees

💡 Note: Closing costs can be negotiated or even covered by the seller, but it's wise to prepare for them as they significantly impact your upfront cash requirements.

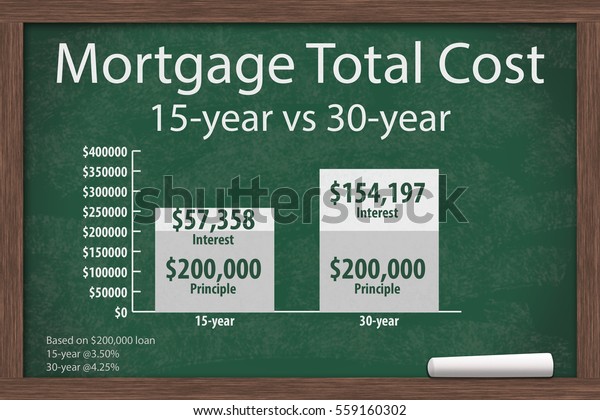

5. Mortgage Points and Discount Points

To lower your interest rate or influence your loan terms, buyers can opt to pay for points, which are essentially prepaid interest:

- Each point equals 1% of the loan amount.

- 1 point can reduce your interest rate by 0.25% to 0.5%.

- On a 600,000 home, one point could cost 6,000.

Discount points help buyers reduce their long-term mortgage costs by providing cash at closing in exchange for a lower interest rate.

Summing up, the costs of mortgage paperwork for purchasing a $600,000 home extend beyond the initial down payment and monthly mortgage payments. From application and appraisal fees to title insurance and closing costs, these expenses are integral to the home buying process. They're not just "fees"; they're investments in securing your home ownership. Understanding these costs allows buyers to budget wisely, negotiate effectively, and potentially save money over the life of their loan. Navigating these expenses with foresight and knowledge will help make your dream of owning a home a reality with minimal financial surprises.

What is a mortgage application fee used for?

+

The application fee covers the costs of processing your mortgage application, including administrative tasks, data entry, and preliminary underwriting activities.

Can I negotiate mortgage closing costs?

+

Yes, many closing costs can be negotiated. It’s advisable to discuss these fees with your lender and possibly get the seller to cover some or all of them.

Why do I need to pay for an appraisal?

+

An appraisal ensures the property’s market value aligns with the loan amount you’re requesting. It protects both the lender from over-lending and the buyer from overpaying for the property.