FMLA Paperwork Costs: What to Expect

Understanding the Family and Medical Leave Act (FMLA) can be essential for employees planning to take leave due to serious health conditions, childbirth, or other qualifying reasons. While the act provides significant benefits, it's often accompanied by a series of paperwork, which many find confusing. In this blog, we'll delve into the typical costs associated with FMLA paperwork and what you can expect in terms of financial implications.

Overview of FMLA

The FMLA entitles eligible employees to take unpaid, job-protected leave for specified family and medical reasons, with the continuation of group health insurance coverage under the same conditions as if the employee hadn’t taken leave. Here are some key points:

- Eligibility: Employees must have worked for the employer for at least 12 months, have at least 1,250 hours of service over the past 12 months, and work at a location where the company employs 50 or more employees within 75 miles.

- Leave Duration: Eligible employees can take up to 12 workweeks of leave in a 12-month period, or up to 26 workweeks of military caregiver leave.

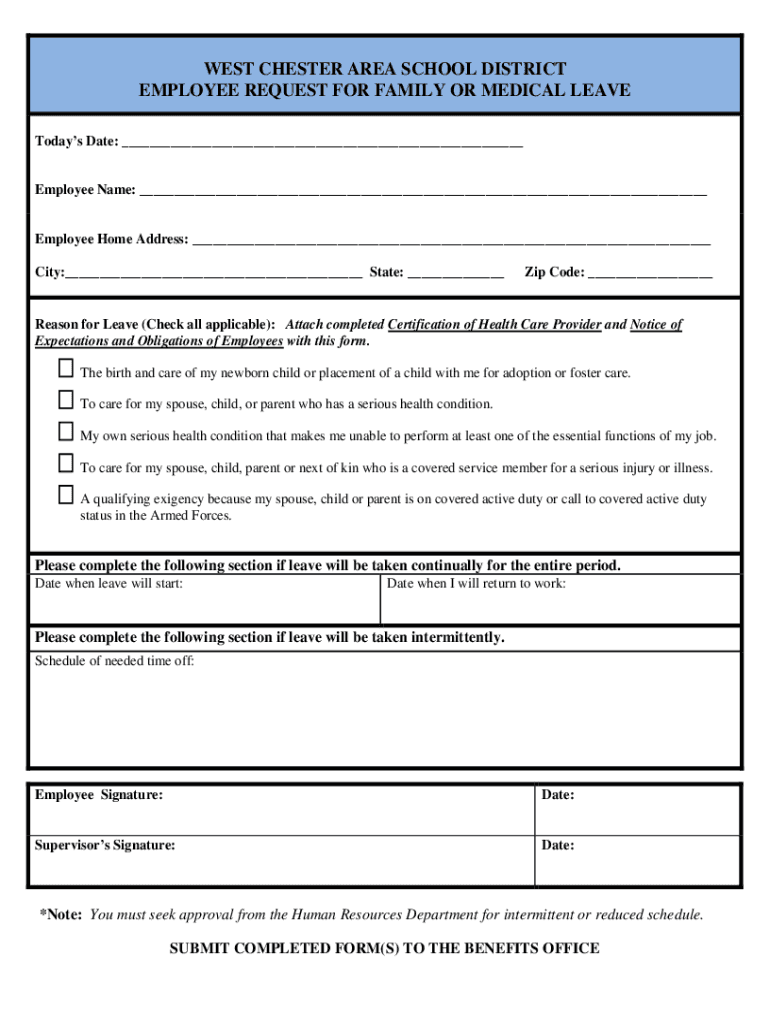

- Reasons for Leave: Birth of a child, adoption or foster care placement, care for a spouse, child, or parent with a serious health condition, or the employee’s own serious health condition.

Costs Associated with FMLA Paperwork

The financial aspects of the FMLA often revolve around the costs of managing the paperwork, both for the employer and employee. Here are some typical costs involved:

1. Filing Fees

While there are generally no government filing fees required directly by FMLA, some states or companies might have fees associated with processing forms or certifying leave:

- Notary Fees: If documents need to be notarized, costs can range from 10 to 30 per document.

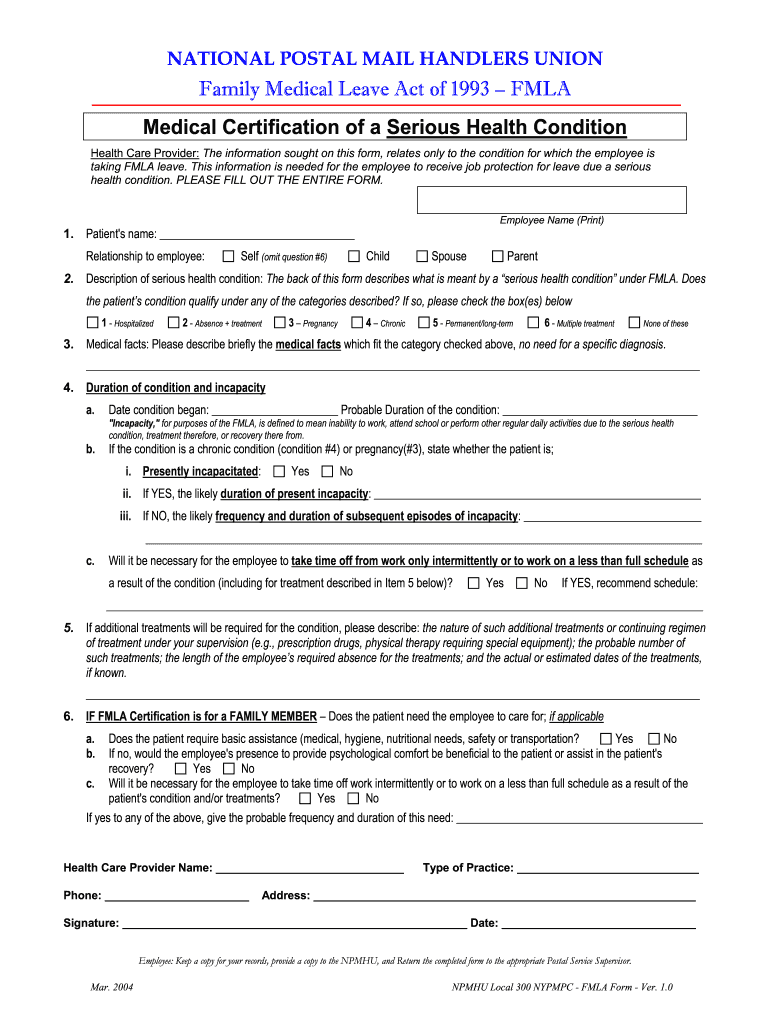

- Doctor’s Fee: Often, medical certification requires a doctor’s signature or medical records, which might incur fees depending on your healthcare provider.

2. Administrative Costs

These are indirect costs related to:

- HR or Payroll Time: The time spent by HR or payroll to manage and document FMLA requests can be significant, indirectly affecting the employer’s bottom line.

- Costs of Temporary Replacement: Hiring temporary workers to cover for the employee on leave might increase labor costs.

3. Legal Fees

Should there be any disputes or complications with FMLA requests:

- Lawyer’s Fees: Employees or employers might need legal advice to ensure compliance with FMLA regulations, with hourly rates typically from 150 to over 500 depending on the attorney’s experience.

4. Missed Work Earnings

Since FMLA leave is usually unpaid:

- Loss of Salary: Employees can lose significant income if they don’t have adequate leave benefits or disability insurance to cover part of their salary.

- Health Insurance Premiums: Employees might need to continue paying their health insurance premiums, which could be a considerable cost during unpaid leave.

💡 Note: In some cases, employees might use vacation or sick time concurrently with FMLA leave to mitigate income loss.

Strategies to Minimize Costs

Here are some practical steps to manage the financial implications of FMLA:

- Plan Ahead: Know the eligibility criteria and start gathering required documents early to avoid last-minute fees or delays.

- Check for Employer-Specific Benefits: Many companies offer additional benefits or programs that could offset some financial burdens.

- Seek Insurance Coverage: Check for disability insurance or supplemental benefits that might cover part of the salary during FMLA leave.

- Consult HR: Speak with your HR department about any financial assistance or programs that could help during leave.

Understanding these costs can help both employers and employees prepare better for an FMLA situation. While the act provides crucial support for personal or family health issues, navigating through the administrative and financial aspects requires foresight and planning.

Can FMLA leave be denied by my employer?

+

Employers can deny FMLA leave if the employee does not meet the eligibility criteria or if the reason for leave does not qualify under FMLA rules. However, they must provide clear reasons for the denial in writing.

What happens if I can't afford health insurance during FMLA leave?

+

Employees are required to pay their health insurance premiums during FMLA leave. If they cannot afford it, they might lose their health coverage. However, some employers might have policies to assist in such scenarios or provide advance payment options.

Are there state-specific FMLA laws that might offer better financial support?

+

Yes, some states have their own family leave programs which can provide more benefits or be more lenient than federal FMLA. For example, states like California, New Jersey, and Rhode Island have paid family leave programs.

How can I appeal an FMLA denial?

+

If your FMLA request is denied, you can appeal the decision. Start by reviewing the reasons given for the denial and consult with HR or seek legal advice to understand your rights and next steps.

In summary, understanding the costs associated with FMLA paperwork is crucial for planning your leave effectively. While there might be direct costs like notary fees or indirect costs like administrative time, knowing how to mitigate these expenses through strategic planning, employer benefits, or insurance can make the process more manageable. By taking these steps, both employers and employees can ensure compliance with the law while minimizing financial strain.