How Long to Keep Audit Paperwork?

Understanding Audit Paperwork and Its Importance

Audit paperwork is the tangible or digital record of all documents, correspondences, and evidence that support the accuracy of an organization’s financial statements. These documents are vital for demonstrating compliance, validating financial transparency, and ensuring accountability in the event of future audits or legal inquiries. This section will delve into why audit paperwork is so crucial.

The Role of Audit Paperwork

- Compliance Verification: Audit documentation serves as proof that an organization adheres to both internal and external financial reporting regulations.

- Historical Records: It provides a paper trail for historical financial activities, which can be reviewed if there are discrepancies or legal disputes.

- Financial Decision Making: Having accurate records aids in making informed business decisions based on verified financial information.

- Risk Management: Proper documentation helps in assessing potential financial risks and implementing necessary controls.

Legal and Regulatory Requirements

From International Financial Reporting Standards (IFRS) to Generally Accepted Accounting Principles (GAAP), various bodies mandate the retention of audit documentation for a specified duration. Understanding these requirements is crucial:

- United States: The IRS requires businesses to keep records that support their tax returns for at least 3 years. However, in cases of fraud or substantial understatements of income, records may need to be retained for up to 6 or 7 years.

- European Union: Countries within the EU have varied regulations, but companies often keep records for 10 years or more to comply with VAT legislation.

- Canada: The Canada Revenue Agency (CRA) stipulates that records must be kept for a minimum of 6 years.

📝 Note: Regulations can change, so it's essential to keep abreast of current requirements specific to your jurisdiction.

How Long Should Audit Paperwork Be Kept?

The question of how long to retain audit paperwork can be complex due to differing regulations, the nature of the business, and potential litigations:

Statutory Retention Periods

- Tax Purposes: Generally, tax documents should be kept for at least 6 years after the tax year.

- Financial Reporting: Companies might need to retain financial records for up to 10 years or longer, especially if they are publicly listed.

- Litigation Risks: In cases where litigation is anticipated or in process, records must be kept for longer, with no definitive time limit.

Industry-Specific Guidelines

Some industries have specific requirements or practices for record retention:

- Construction: Records often need to be kept until the expiration of warranties or potential for construction defect claims, which can extend retention periods significantly.

- Healthcare: Medical records have long retention periods due to potential malpractice or care quality issues, typically up to 10 years after treatment or until the patient turns 25 if they are minors at the time of treatment.

- Insurance: Records related to underwriting or claims can be retained for 7 years after the end of the policy or resolution of the claim.

Company Policies

While statutory requirements are a baseline, companies often establish their own policies:

- Company Size: Larger firms might implement longer retention periods to cover all possible scenarios or align with corporate governance practices.

- Retention Procedures: Companies should have clear policies on record destruction, archival, and electronic storage.

📦 Note: Companies should balance storage costs, privacy concerns, and accessibility when establishing their record retention policy.

Practical Steps for Managing Audit Paperwork

Managing audit documentation effectively is key to complying with retention requirements and facilitating an organization’s operations. Here are steps to ensure your audit paperwork management is up to par:

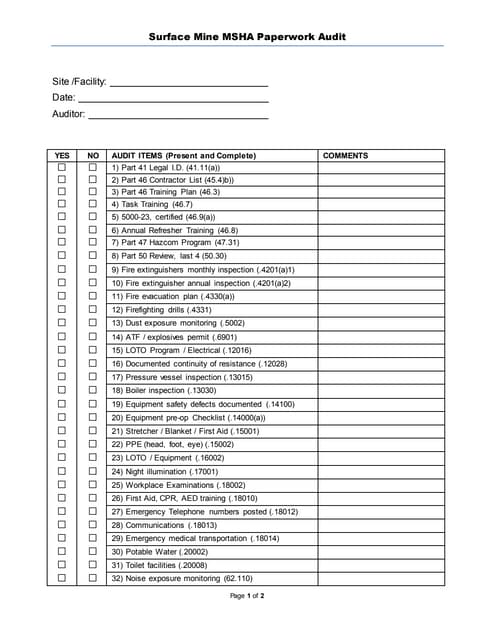

Documenting Audits

- Standardize Procedures: Develop uniform procedures for documenting audit work, including how evidence is collected, recorded, and stored.

- Use Audit Software: Utilize specialized software to streamline documentation, ensure consistency, and reduce errors.

- Quality Assurance: Regularly review the quality of audit documentation to ensure it meets legal, professional, and internal standards.

Storage Solutions

- Physical Storage: Secure, fire-resistant cabinets or off-site storage facilities can be used for paper records.

- Electronic Storage: Digital solutions offer better accessibility, backup options, and cost-efficiency. Ensure encryption and access controls are in place.

- Hybrid Approaches: Combining physical and electronic storage can provide redundancy and flexibility in managing audit records.

Retention and Disposal

- Retention Schedule: Create a retention schedule aligned with legal requirements, company policy, and risk assessment.

- Controlled Disposal: Ensure that obsolete records are disposed of in a way that protects sensitive information, like shredding paper documents or securely erasing electronic data.

- Archive Important Records: Some documents are of long-term value and should be archived rather than disposed of.

💾 Note: When transitioning to electronic storage, verify the integrity of the data and ensure a robust disaster recovery plan is in place.

Wrap-Up: Managing Your Audit Records Responsibly

Navigating the complexities of audit record retention demands a strategic approach that blends compliance with efficient document management. Here are the key takeaways from this discussion:

- Audit paperwork plays a crucial role in demonstrating compliance, ensuring historical accuracy, aiding in financial decision-making, and mitigating risks.

- Understanding legal and regulatory requirements is paramount to prevent non-compliance issues.

- Retention periods vary by jurisdiction, industry, and company policy, requiring a tailored approach to record management.

- Implementing standardized documentation procedures, choosing appropriate storage solutions, and having a clear retention and disposal policy are essential steps in managing audit paperwork.

Organizations must strike a balance between regulatory compliance, operational efficiency, and security when deciding how long to keep audit paperwork. By employing a thoughtful strategy, businesses can maintain the integrity of their financial records, protect themselves from legal scrutiny, and optimize their record management process. The goal is to foster a culture of accountability, transparency, and responsible financial stewardship through effective audit documentation practices.

Can I keep audit documents electronically, or do they need to be physical?

+

You can keep audit documents electronically, provided the storage system meets legal standards for record-keeping, including accessibility, security, and integrity. Many businesses now opt for electronic storage to reduce physical space and enhance efficiency.

What happens if I don’t retain audit documents for the required time?

+

Failing to retain audit documents for the mandated period can result in legal penalties, fines, or sanctions, especially if the records are required during tax audits or legal proceedings. It can also hinder a company’s ability to prove compliance or defend itself in legal disputes.

Do different types of businesses have different record retention requirements?

+Yes, different industries and types of businesses might have specific retention periods due to their unique regulatory environments or operational needs. For example, healthcare providers have different requirements from construction companies due to the nature of their documentation and legal risks involved.